Question

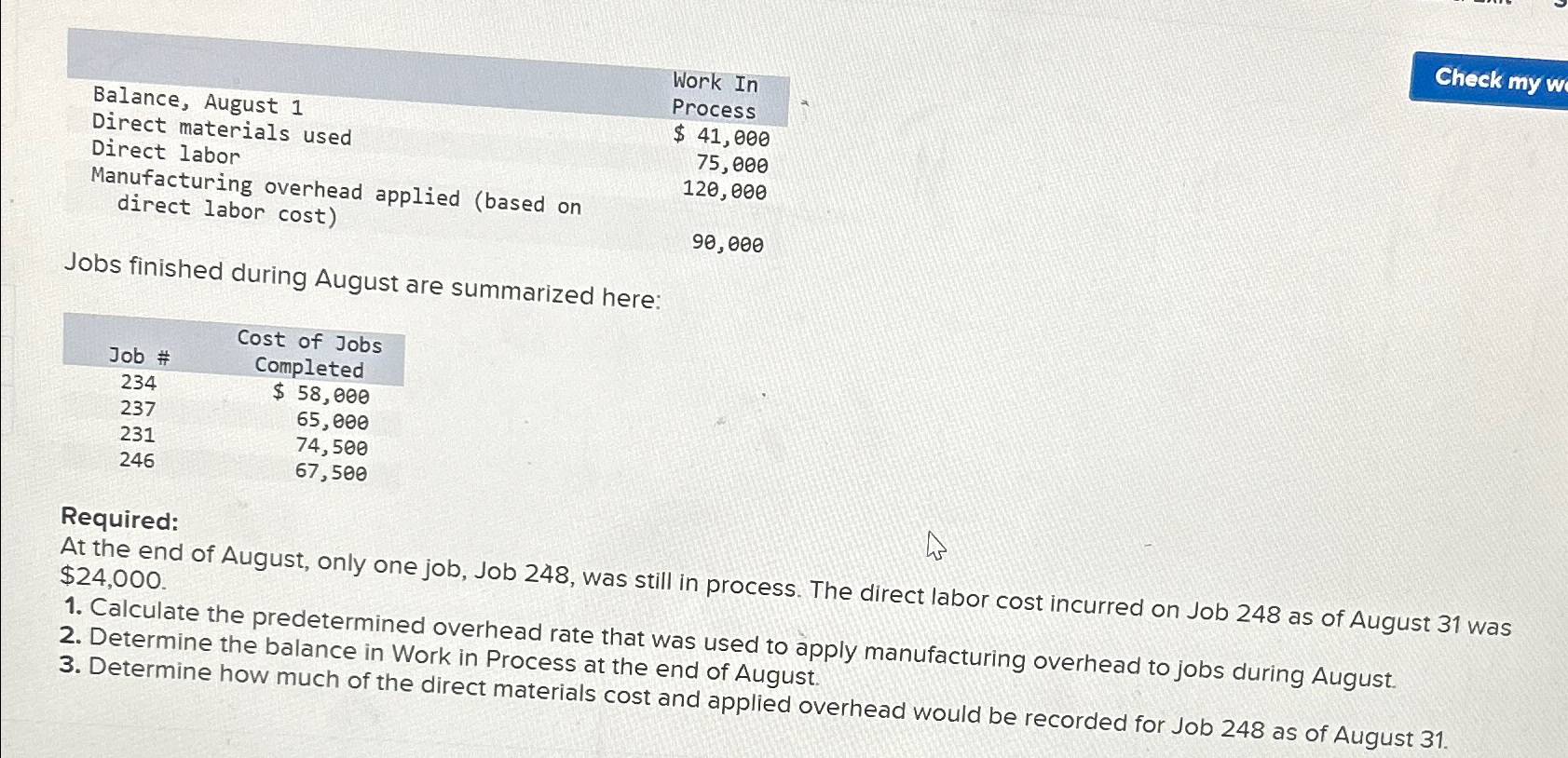

Balance, August 1 Direct materials used Direct labor Manufacturing overhead applied (based on direct labor cost) Jobs finished during August are summarized here: Cost

Balance, August 1 Direct materials used Direct labor Manufacturing overhead applied (based on direct labor cost) Jobs finished during August are summarized here: Cost of Jobs Completed Work In Process $ 41,000 75,000 120,000 90,000 Job # 234 237 231 246 $ 58,000 65,000 74,500 67,500 Check my w Required: At the end of August, only one job, Job 248, was still in process. The direct labor cost incurred on Job 248 as of August 31 was $24,000. 1. Calculate the predetermined overhead rate that was used to apply manufacturing overhead to jobs during August. 2. Determine the balance in Work in Process at the end of August. 3. Determine how much of the direct materials cost and applied overhead would be recorded for Job 248 as of August 31.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial and Managerial Accounting

Authors: Carl S. Warren, James M. Reeve, Jonathan Duchac

13th edition

1285866304, 978-1285866307

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App