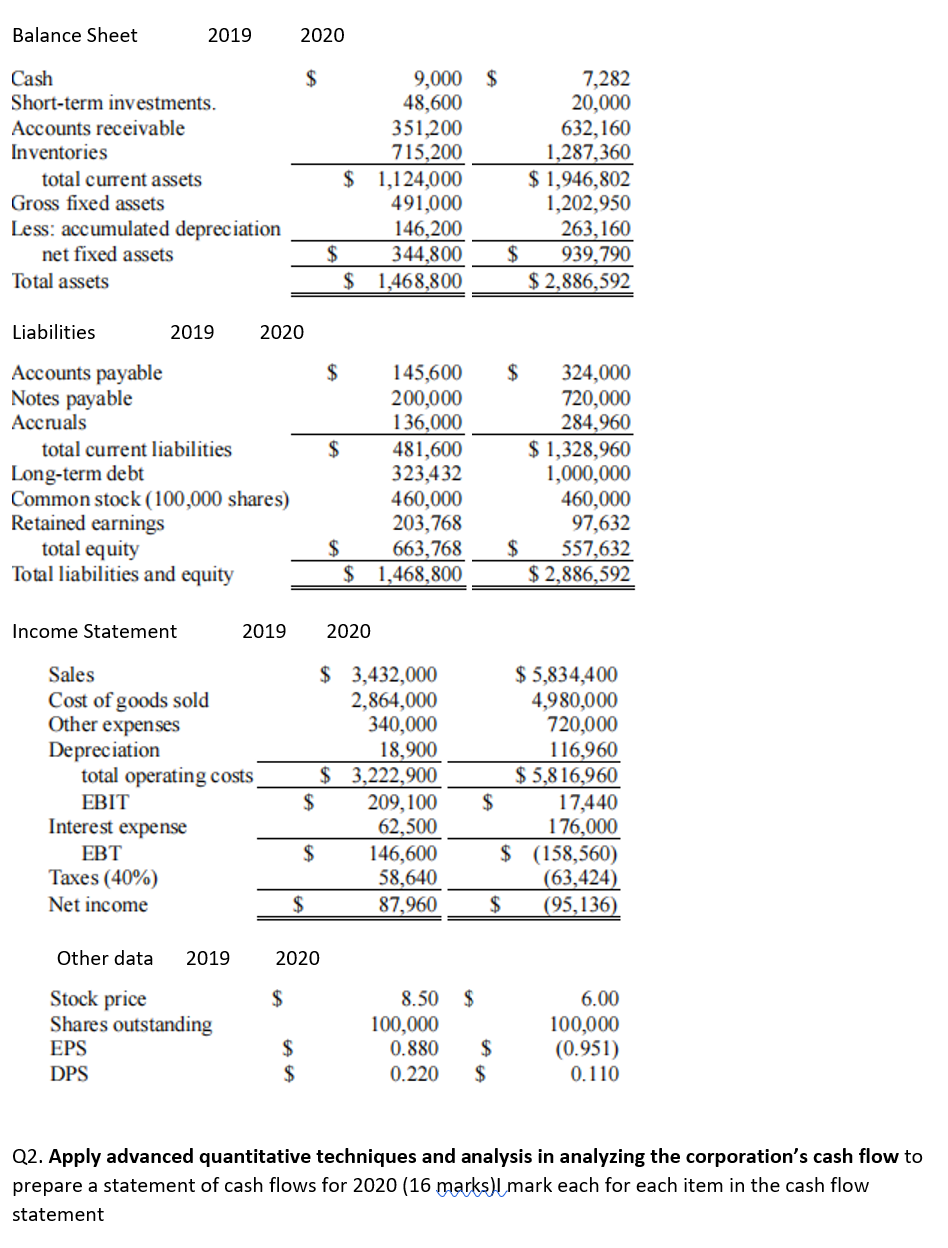

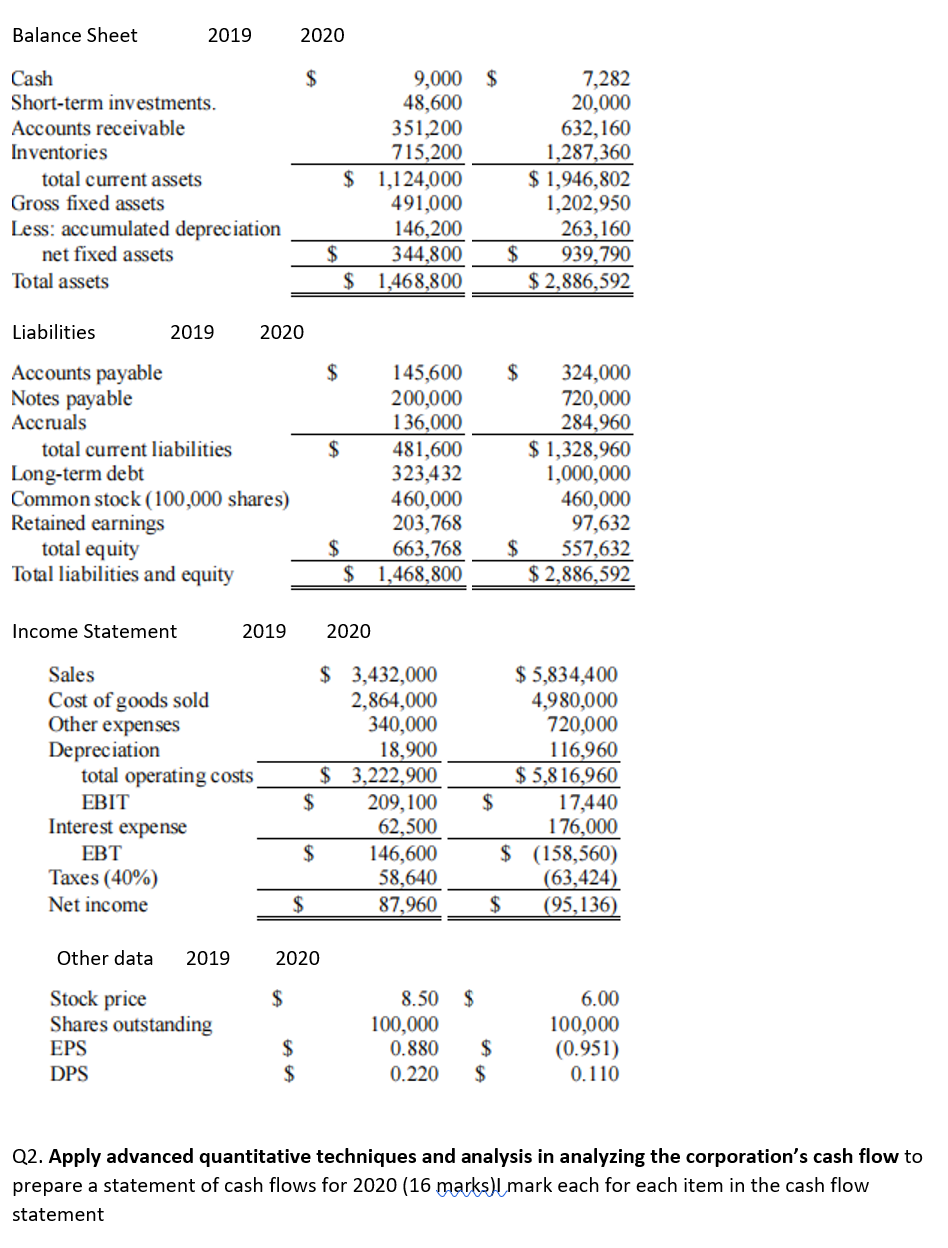

Balance Sheet 2019 2020 $ Cash Short-term investments. Accounts receivable Inventories total current assets Gross fixed assets Less: accumulated depreciation net fixed assets Total assets 9,000 $ 48,600 351,200 715,200 $ 1,124,000 491,000 146,200 $ 344,800 $ $ 1,468,800 7,282 20,000 632,160 1,287,360 $ 1,946,802 1,202,950 263,160 939,790 $ 2,886,592 Liabilities 2019 2020 $ Accounts payable Notes payable Accruals total current liabilities Long-term debt Common stock (100,000 shares) Retained earnings total equity Total liabilities and equity $ 145,600 200,000 136,000 $ 481,600 323,432 460,000 203,768 $ 663,768 $ 1,468,800 324,000 720,000 284,960 $ 1,328,960 1,000,000 460,000 97,632 557,632 $ 2,886,592 $ Income Statement 2019 2020 Sales Cost of goods sold Other expenses Depreciation total operating costs EBIT Interest expense $ 3,432,000 2,864,000 340,000 18,900 $ 3,222,900 $ 209,100 62,500 $ 146,600 58,640 $ 87,960 $ 5,834,400 4,980,000 720,000 116,960 $ 5,816,960 $ 17,440 176,000 $ (158,560) (63,424) $ (95,136) Taxes (40%) Net income Other data 2019 2020 $ $ Stock price Shares outstanding EPS DPS 8.50 100,000 0.880 0.220 6.00 100,000 (0.951) 0.110 $ $ $ Q2. Apply advanced quantitative techniques and analysis in analyzing the corporation's cash flow to prepare a statement of cash flows for 2020 (16 marks)l mark each for each item in the cash flow statement Balance Sheet 2019 2020 $ Cash Short-term investments. Accounts receivable Inventories total current assets Gross fixed assets Less: accumulated depreciation net fixed assets Total assets 9,000 $ 48,600 351,200 715,200 $ 1,124,000 491,000 146,200 $ 344,800 $ $ 1,468,800 7,282 20,000 632,160 1,287,360 $ 1,946,802 1,202,950 263,160 939,790 $ 2,886,592 Liabilities 2019 2020 $ Accounts payable Notes payable Accruals total current liabilities Long-term debt Common stock (100,000 shares) Retained earnings total equity Total liabilities and equity $ 145,600 200,000 136,000 $ 481,600 323,432 460,000 203,768 $ 663,768 $ 1,468,800 324,000 720,000 284,960 $ 1,328,960 1,000,000 460,000 97,632 557,632 $ 2,886,592 $ Income Statement 2019 2020 Sales Cost of goods sold Other expenses Depreciation total operating costs EBIT Interest expense $ 3,432,000 2,864,000 340,000 18,900 $ 3,222,900 $ 209,100 62,500 $ 146,600 58,640 $ 87,960 $ 5,834,400 4,980,000 720,000 116,960 $ 5,816,960 $ 17,440 176,000 $ (158,560) (63,424) $ (95,136) Taxes (40%) Net income Other data 2019 2020 $ $ Stock price Shares outstanding EPS DPS 8.50 100,000 0.880 0.220 6.00 100,000 (0.951) 0.110 $ $ $ Q2. Apply advanced quantitative techniques and analysis in analyzing the corporation's cash flow to prepare a statement of cash flows for 2020 (16 marks)l mark each for each item in the cash flow statement