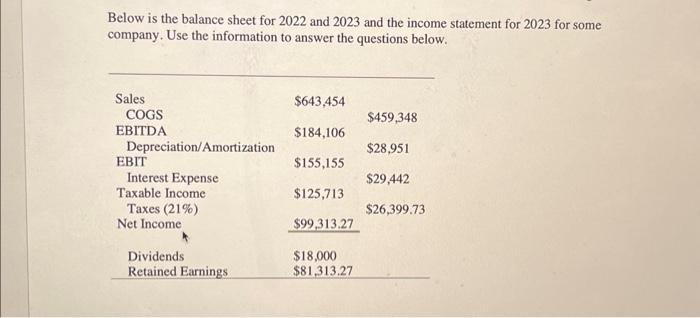

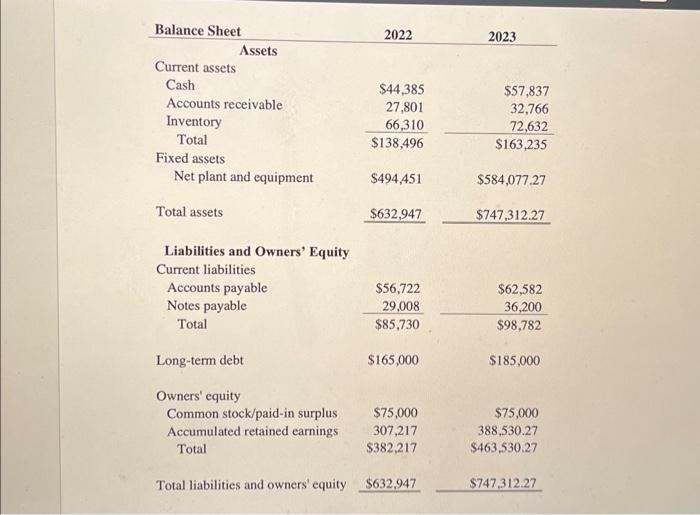

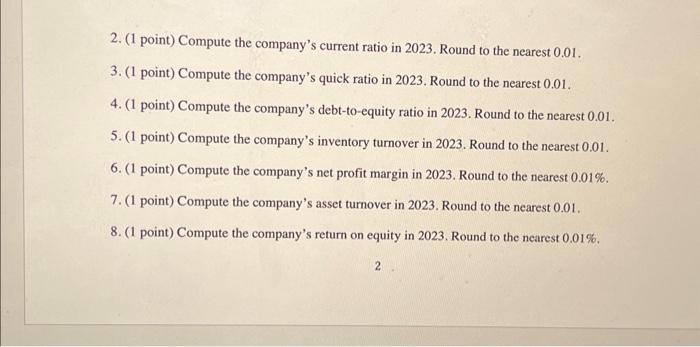

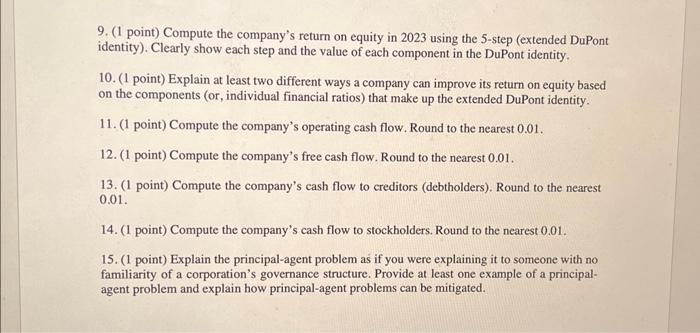

Balance Sheet 2022 2023 Assets Current assets Cash Accounts receivable Inventory Total Fixed assets Net plant and equipment Total assets \begin{tabular}{rr} $44,385 & $57,837 \\ 27,801 & 32,766 \\ 66,310 & 72,632 \\ \hline$138,496 & $163,235 \end{tabular} $494,451 $584,077.27 $632,947 $747,312.27 Liabilities and Owners' Equity Current liabilities Accounts payable Notes payable Total Long-term debt $165,000 $185,000 Owners' equity Common stock/paid-in surplus Accumulated retained earnings Total $75,000 $75,000 307,217 388,530.27 $382,217 $463,530.27 Total liabilities and owners' equity \$632,947 $747,312.27 9. (1 point) Compute the company's return on equity in 2023 using the 5 -step (extended DuPont identity). Clearly show each step and the value of each component in the DuPont identity. 10. (1 point) Explain at least two different ways a company can improve its return on equity based on the components (or, individual financial ratios) that make up the extended DuPont identity. 11. (1 point) Compute the company's operating cash flow. Round to the nearest 0.01 . 12. (1 point) Compute the company's free cash flow. Round to the nearest 0.01 . 13. (1 point) Compute the company's cash flow to creditors (debtholders). Round to the nearest 0.01 . 14. (1 point) Compute the company's cash flow to stockholders. Round to the nearest 0.01 . 15. (1 point) Explain the principal-agent problem as if you were explaining it to someone with no familiarity of a corporation's governance structure. Provide at least one example of a principalagent problem and explain how principal-agent problems can be mitigated. Below is the balance sheet for 2022 and 2023 and the income statement for 2023 for some company. Use the information to answer the questions below. 2. (1 point) Compute the company's current ratio in 2023. Round to the nearest 0.01 . 3. ( 1 point) Compute the company's quick ratio in 2023. Round to the nearest 0.01 . 4. ( 1 point) Compute the company's debt-to-equity ratio in 2023. Round to the nearest 0.01 . 5. (1 point) Compute the company's inventory turnover in 2023. Round to the nearest 0.01 . 6. (1 point) Compute the company's net profit margin in 2023. Round to the nearest 0.01%. 7. (1 point) Compute the company's asset turnover in 2023. Round to the nearest 0.01 . 8. (1 point) Compute the company's return on equity in 2023. Round to the nearest 0.01%. 2