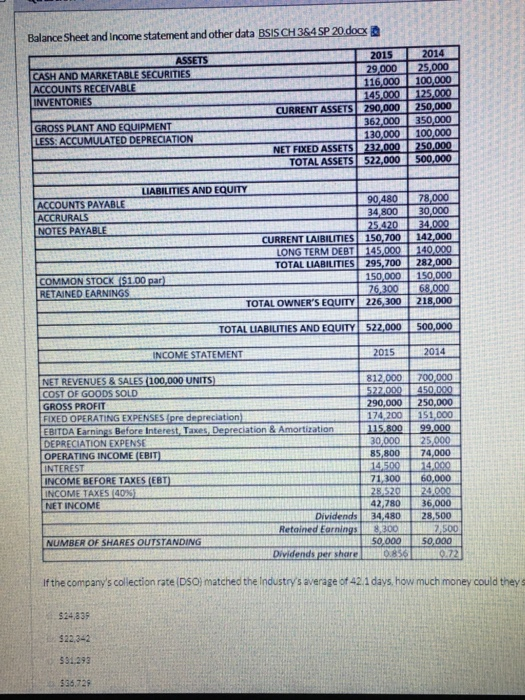

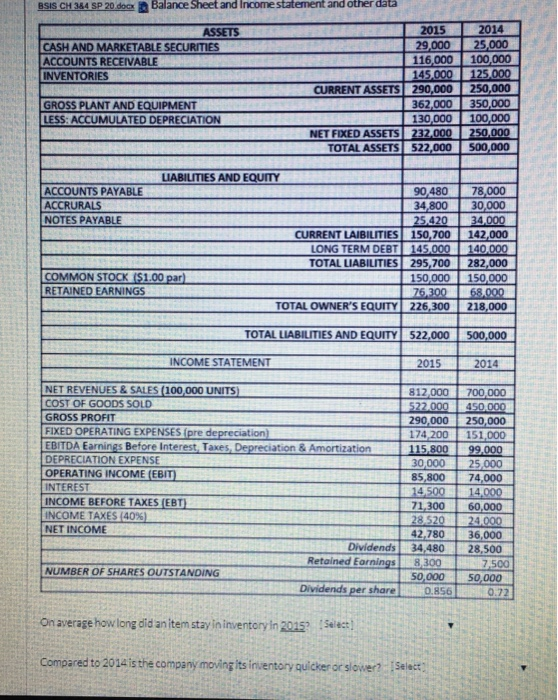

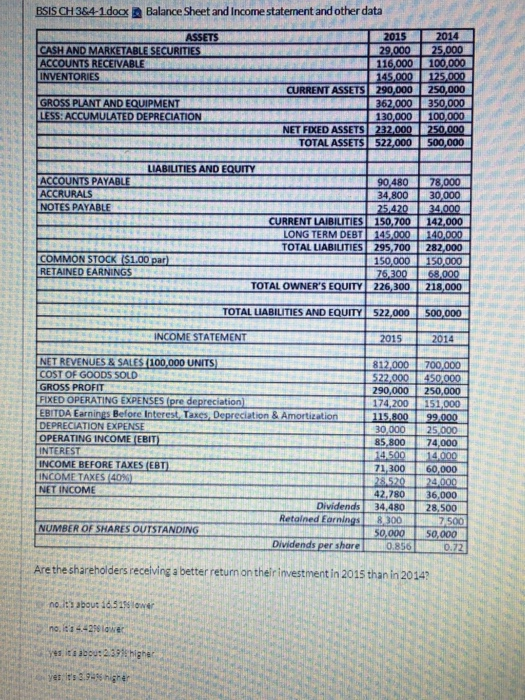

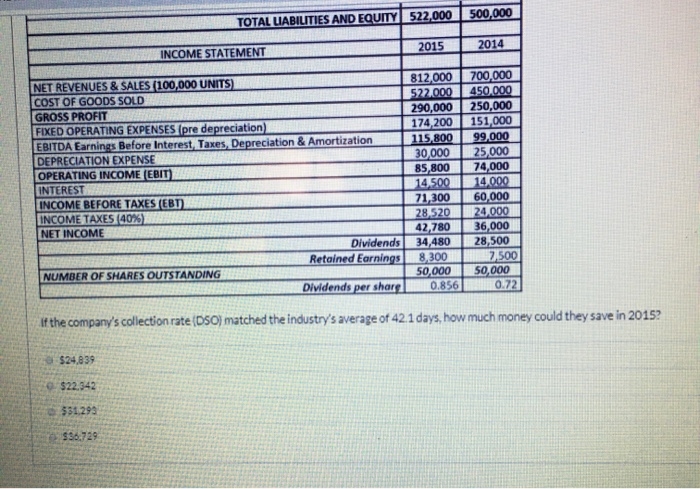

Balance Sheet and income statement and other data BSISCH 364 SP 20 docx 2014 ASSETS CASH AND MARKETABLE SECURITIES INVENTORIES 2015 29,000 116,000 145.000 CURRENT ASSETS 290,000 362,000 130,000 N ET FIXED ASSETS222.000 ELS TOTAL ASSETS 522,000 25000 100 000 125.000 250,000 350 000 100.000 250.000 500.000 GROSS PLANT AND EQUIPMENT LESS: ACCUMULATED DEPRECIATION BE LIABILITIES AND EQUITY ACCOUNTS PAYABLE 90 480 78,000 ACCRURALS 34.800 30.000 NOTES PAYABLE 25.420 34.000 CURRENT LAIBILITIES 150,700 142.000 LONG TERM DEBT 145,000 140.000 TOTAL LIABILITIES 295.700 282.000 COMMON STOCK ($1.00 par) 150.000 150.000 RETAINED EARNINGS 76.300 168.000 TOTAL OWNER'S EQUITY 226,300 218,000 TOTAL LIABILITIES AND EQUITY 22,000 500,000 INCOME STATEMENT 2015 2014 NET REVENUES & SALES (100,000 UNITS 812 000 COST OF GOODS SOLD . 522.000 GROSS PROFIT 290,000 FIXED OPERATING EXPENSES (pre depreciation) 174.200 EBITDA Earnings Before Interest. Taxes. Depreciation 115.000 DEPRECIATION EXPENSE 130.000 OPERATING INCOME (EBIT) 85,800 INTEREST 114.500 INCOME BEFORE TAXES (EBT) 71,300 INCOME TAXES (40%) 28.520 NET INCOME 42.780 Dividends 34.480 Retained Earnings 3.300 NUMBER OF SHARES OUTSTANDING 150.000 Dividends per share 0.856 200 000 450.000 250,000 151 000 99,000 25.000 74,000 14.000 60,000 20.000 36,000 28.500 2.500 50,000 0.22 If the company's collection rate D50j matched the industry's average of 2.1 days, how much money could they $24837 SSISCHE SP 20 door Balance Sheet and income statement and other data 2015 2014 ASSETS CASH AND MARKETARLE SECURITIES ACCOUNTS RECEIVABLE INVENTORIES GROSS PLANT AND EQUIPMENT LESS: ACCUMULATED DEPRECIATION 116,000 1 45.000 CURRENT ASSETS 290,000 362.000 130 000 ET FIXED ASSETS 232.000 TOTAL ASSETS 522.000 100.000 125.000 250,000 350.000 100 000 250.000 500.000 LIABILITIES AND EQUITY ACCOUNTS PAYABLE 90, 480 78,000 ACCRURALS 34,800 30,000 NOTES PAYABLES 25,420 34.000 CURRENT LAIBILITIES 150,700 142,000 L ONG TERM DEBT 145.000 140.000 TOTAL LIABILITIES 295,700 282,000 COMMON STOCK ($1.00 par 1 50,000 150,000 RETAINED EARNINGS 76 30068,000 T OTAL OWNER'S EQUITY 226,300 218,000 TOTAL LIABILITIES AND EQUITY 522,000 500,000 INCOME STATEMENT 2015 2014 700,000 812,000 522.000 290,000 174 200 250,000 151,000 NET REVENUES & SALES (100,000 UNITS) COST OF GOODS SOLDE GROSS PROFIT FIXED OPERATING EXPENSES (pre depreciation) EBITDA Earnings Before Interest, Taxes, Depreciation & Amortization DEPRECIATION EXPENSE OPERATING INCOME (EBIT) INTEREST INCOME BEFORE TAXES (EBT) INCOME TAXES (40%) NET INCOME Dividends Retained Earnings NUMBER OF SHARES OUTSTANDING Dividends per share 30 000 85,800 14 500 71,300 28.520 42.780 34,480 8300 50.000 0.856 25 000 74,000 14.000 60,000 24.000 36,000 28,500 7,500 50,000 On average how long did an item stay in inventory in 2015 Select) Compared to 2014 is the company moving its inventory quicker or slower? PSIS CH 384-1.docx Balance Sheet and Income statement and other data C ID A SSETS CASH AND MARKETABLE SECURITIES ACCOUNTS RECEIVABLE INVENTORIES NA R GROSS PLANT AND EQUIPMENT LESS: ACCUMULATED DEPRECIATION E 2015 2 9.000 116,000 1 45.000 CURRENT ASSETS 290,000 362.000 130,000 NET FOXED ASSETS232.000 TOTAL ASSETS 522,000 2014 25.000 100.000 125.000 250,000 350.000 100.000 250.000 500,000 AND EQUITY ELIABIL ACCOUNTS PAYABLE ACCRURALS I NOTES PAYABLE ULTI 18 TULI 1911 LLLLLLLL LIIT SIT al III 90 480 78,000 34,800 30 000 25,420 34.000 CURRENT LAIBILITIES 150.700 142.000 LONG TERM DEBT 145.000 140,000 TOTAL LIABILITIES 295.700282.000 COMMON STOCK ($1.00 RETAINED EARNINGS 76300 226,300 TOTAL OWNER'S EQUITY 68.000 218,000 TOTAL LIABILITIES AND EQUITY 522,000 500,000 INCOME STATEMENT 2015 2014 1 DI Il 185.800 25.000 1 NET REVENUES & SALES 100,000 UNITS 812.000 700,000 COST OF GOODS SOLD 522.000 450.000 GROSS PROFIT 290,000 250.000 FIXED OPERATING EXPENSES (pre depreciation) 174.200 151.000 EBITDA Earnings Before Interest Taxes Depreciation & Amortiz 115.800 99.000 DEPRECIATION EXPENSE 30.000 25.000 OPERATING INCOME (EBIT) INTEREST 14.500 14.000 INCOME BEFORE TAXES (EBT) 71 300 60,000 INCOME TAXES (40%) 28.520 24,000 NET INCOME 42.780 136,000 Dividends 34,480 28.500 Retained Earnings AB 300 500 NUMBER OF SHARES OUTSTANDING 50.000 50,000 Dividends per share 0.856 0 .72 Are the shareholders receiving a better return on their investment in 2015 than in 2014? not about 16.519 no. 1 - 25 One yetu boshi yet Its 31989 higher _ TOTAL LIABILITIES AND EQUITY 522,000 500,000 INCOME STATEMENT 2015 2014 NET REVENUES & SALES (100,000 UNITS 812 000 COST OF GOODS SOLD 522.000 GROSS PROFIT 290,000 FIXED OPERATING EXPENSES (pre depreciation) 174,200 EBITDA Earnings Before Interest, Taxes, Depreciation & Amortization 115.800 DEPRECIATION EXPENSE 30,000 OPERATING INCOME (EBIT) 85,800 INTEREST 14.500 INCOME BEFORE TAXES (EBT) 71,300 INCOME TAXES (40%) 28.520 NET INCOME 42,780 Dividends 34,480 Retoined Earnings 8,300 NUMBER OF SHARES OUTSTANDING 50,000 Dividends per sharel 0.856 700,000 450.000 250,000 151,000 99.000 25,000 74,000 14.000 60.000 24,000 36,000 28,500 2500 50,000 . 0.72 If the company's collection rate (DSOmatched the industry's average of 42. 1 days, how much money could they save in 2015? $24.839 0 $22,342 551.299