Question

Balance sheet and income statement are given Current Assets: Cash Short-term Investments Accounts Receivables, Net Merchandise Inventory Prepaid Expenses Total Current Assets Total Assets Total

Balance sheet and income statement are given

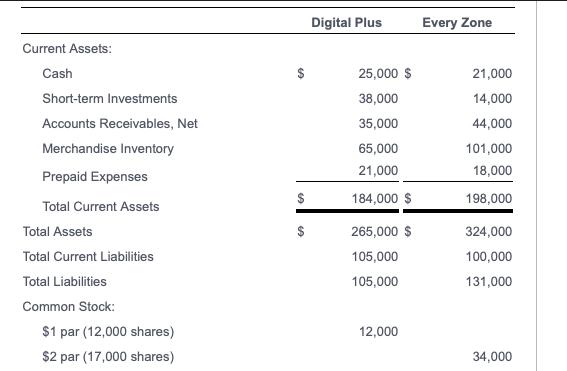

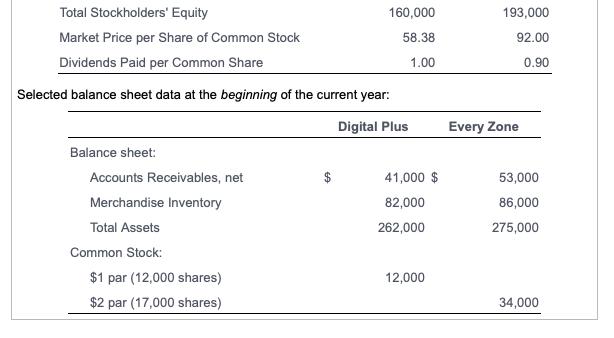

Current Assets: Cash Short-term Investments Accounts Receivables, Net Merchandise Inventory Prepaid Expenses Total Current Assets Total Assets Total Current Liabilities Total Liabilities Common Stock: $1 par (12,000 shares) $2 par (17,000 shares) $ GA Digital Plus 25,000 $ 38,000 35,000 65,000 21,000 184,000 $ 265,000 $ 105,000 105,000 12,000 Every Zone 21,000 14,000 44,000 101,000 18,000 198,000 324,000 100,000 131,000 34,000

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

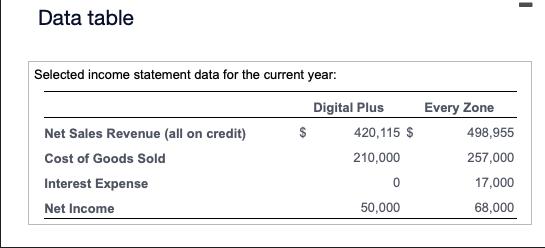

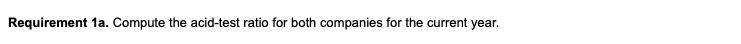

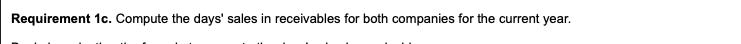

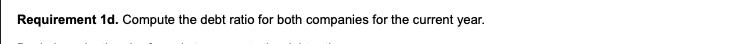

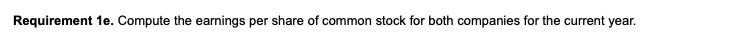

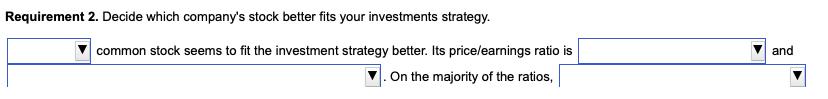

To calculate the required financial ratios lets use the given information Requirement 1a Compute the acidtest ratio for both companies for the current year The acidtest ratio also known as the quick r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting and Analysis

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer

7th edition

1259722651, 978-1259722653

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App