Question

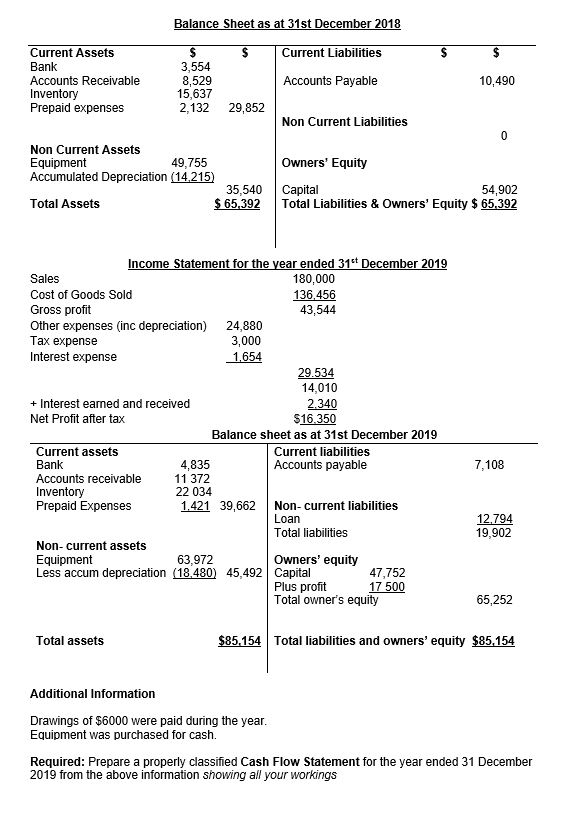

Balance Sheet as at 31st December 2018 Current Assets $ $ Current Liabilities $ $ Bank 3,554 Accounts Receivable 8,529 Accounts Payable 10,490 Inventory 15,637

Balance Sheet as at 31st December 2018

Current Assets $ $ Current Liabilities $ $

Bank 3,554

Accounts Receivable 8,529 Accounts Payable 10,490

Inventory 15,637

Prepaid expenses 2,132 29,852

Non Current Liabilities

0

Non Current Assets

Equipment 49,755 Owners Equity

Accumulated Depreciation (14,215)

35,540 Capital 54,902

Total Assets $ 65,392 Total Liabilities & Owners Equity $ 65,392

Income Statement for the year ended 31st December 2019

Sales 180,000

Cost of Goods Sold 136,456

Gross profit 43,544

Other expenses (inc depreciation) 24,880

Tax expense 3,000

Interest expense 1,654

29.534

14,010

+ Interest earned and received 2,340

Net Profit after tax $16,350

Balance sheet as at 31st December 2019

| Current assets Bank 4,835 Accounts receivable 11 372 Inventory 22 034 Prepaid Expenses 1,421 39,662

Non- current assets Equipment 63,972 Less accum depreciation (18,480) 45,492

Total assets $85,154

| Current liabilities Accounts payable 7,108

Non- current liabilities Loan 12,794 Total liabilities 19,902

Owners equity Capital 47,752 Plus profit 17 500 Total owners equity 65,252

Total liabilities and owners equity $85,154 |

Additional Information

Drawings of $6000 were paid during the year.

Equipment was purchased for cash.

Required: Prepare a properly classified Cash Flow Statement for the year ended 31 December 2019 from the above information showing all your workings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started