Answered step by step

Verified Expert Solution

Question

1 Approved Answer

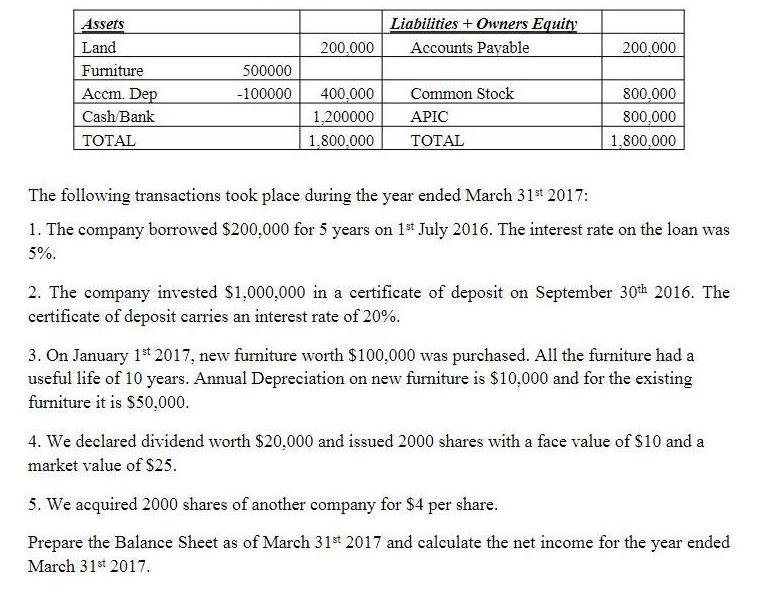

Balance Sheet as of March 31st 2016 is given below Assets Land Furniture Accm. Dep Cash Bank TOTAL 500000 -100000 200,000 400,000 1,200000 1,800,000 Liabilities

Balance Sheet as of March 31st 2016 is given below

Assets Land Furniture Accm. Dep Cash Bank TOTAL 500000 -100000 200,000 400,000 1,200000 1,800,000 Liabilities + Owners Equity Accounts Payable Common Stock APIC TOTAL 200,000 800,000 800,000 1,800,000 The following transactions took place during the year ended March 31st 2017: 1. The company borrowed $200,000 for 5 years on 1st July 2016. The interest rate on the loan was 5%. 2. The company invested $1,000,000 in a certificate of deposit on September 30th 2016. The certificate of deposit carries an interest rate of 20%. 3. On January 1st 2017, new furniture worth $100,000 was purchased. All the furniture had a useful life of 10 years. Annual Depreciation on new furniture is $10,000 and for the existing furniture it is $50,000. 4. We declared dividend worth $20,000 and issued 2000 shares with a face value of $10 and a market value of $25. 5. We acquired 2000 shares of another company for $4 per share. Prepare the Balance Sheet as of March 31st 2017 and calculate the net income for the year ended March 31st 2017.

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Balance Sheet as of March 31st 2017 Assets Land 200000 Furniture Existing 500000 Initial 50000 Depre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started