Answered step by step

Verified Expert Solution

Question

1 Approved Answer

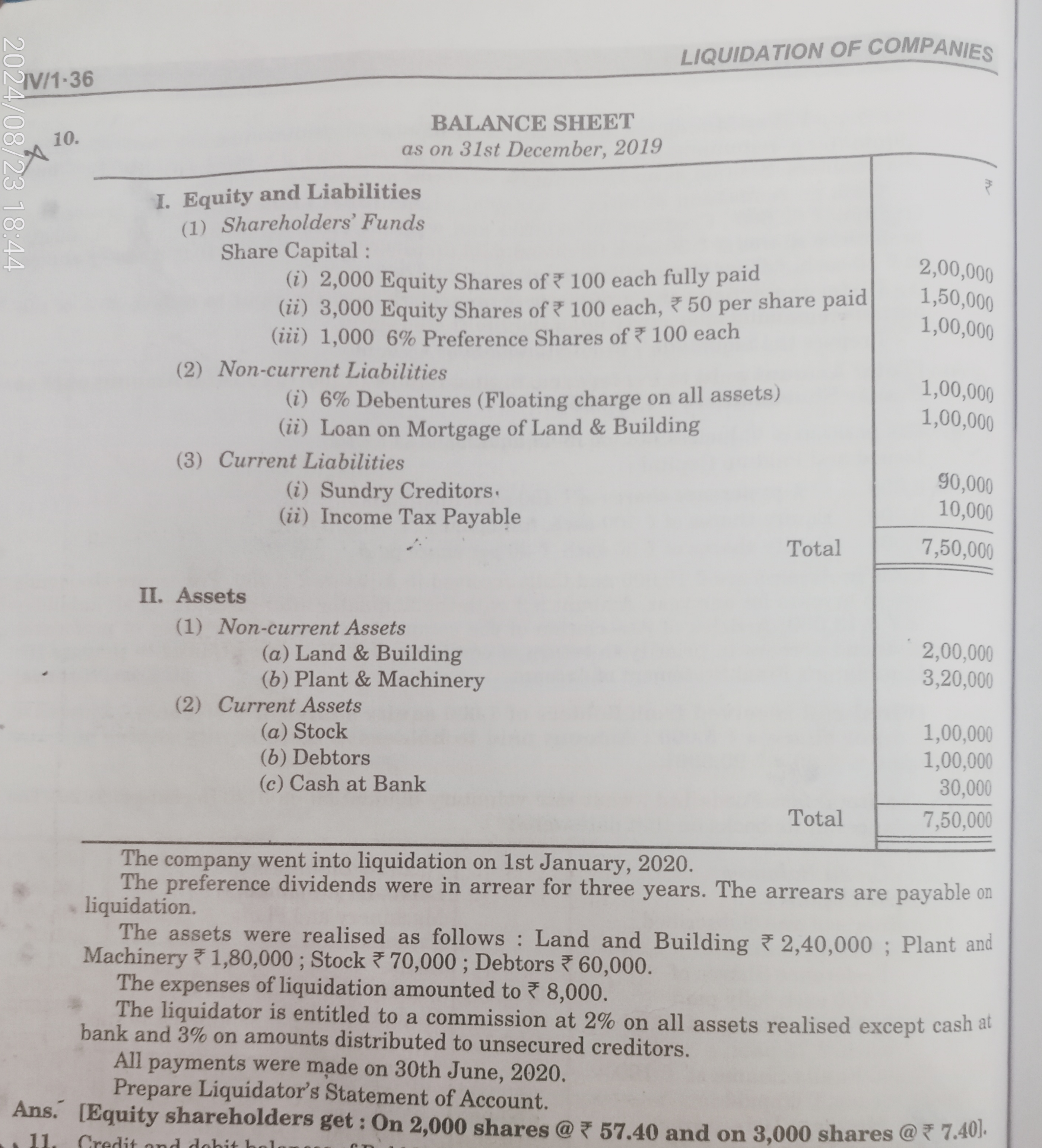

BALANCE SHEET as on 3 1 st December, 2 0 1 9 I. Equity and Liabilities ( 1 ) Shareholders' Funds Share Capital : (

BALANCE SHEET

as on st December,

I. Equity and Liabilities

Shareholders' Funds

Share Capital :

i Equity Shares of each fully paid

ii Equity Shares of each, per share paid

iii Preference Shares of each

Noncurrent Liabilities

i Debentures Floating charge on all assets

ii Loan on Mortgage of Land & Building

Current Liabilities

i Sundry Creditors.

ii Income Tax Payable

II Assets

Noncurrent Assets

a Land & Building

b Plant & Machinery

Current Assets

a Stock

b Debtors

c Cash at Bank

The company went into liquidation on st January,

The preference dividends were in arrear for three years. The arrears are payable on

liquidation.

The assets were realised as follows : Land and Building ; Plant and

Machinery ; Stock ; Debtors

The expenses of liquidation amounted to

The liquidator is entitled to a commission at on all assets realised except cash at

bank and on amounts distributed to unsecured creditors.

All payments were made on th June,

Prepare Liquidator's Statement of Account.

Ans.Equity shareholders get : On shares @ and on shares @

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started