Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cash Accounts receivable Inventory Balance Sheet December 31, 20X6 (with comparative figures for 20X5) Long term investments Property, plant, & equipment Less: accumulated depreciation

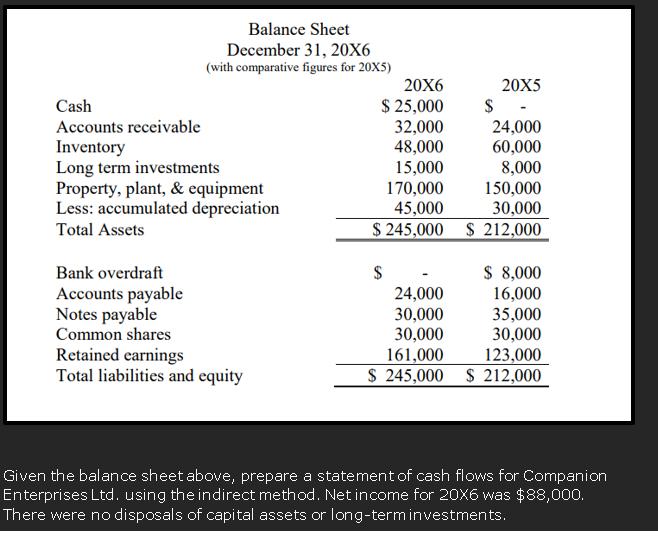

Cash Accounts receivable Inventory Balance Sheet December 31, 20X6 (with comparative figures for 20X5) Long term investments Property, plant, & equipment Less: accumulated depreciation Total Assets Bank overdraft Accounts payable Notes payable Common shares Retained earnings Total liabilities and equity 20X6 $ 25,000 32,000 48,000 15,000 170,000 45,000 $ 20X5 24,000 30,000 30,000 161,000 $ 245,000 $ - 150,000 30,000 $245,000 $ 212,000 24,000 60,000 8,000 $ 8,000 16,000 35,000 30,000 123,000 $212,000 Given the balance sheet above, prepare a statement of cash flows for Companion Enterprises Ltd. using the indirect method. Net income for 20X6 was $88,000. There were no disposals of capital assets or long-term investments.

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER STEP 1 STEP 2 In the indirect method of cashflow stateme...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started