Answered step by step

Verified Expert Solution

Question

1 Approved Answer

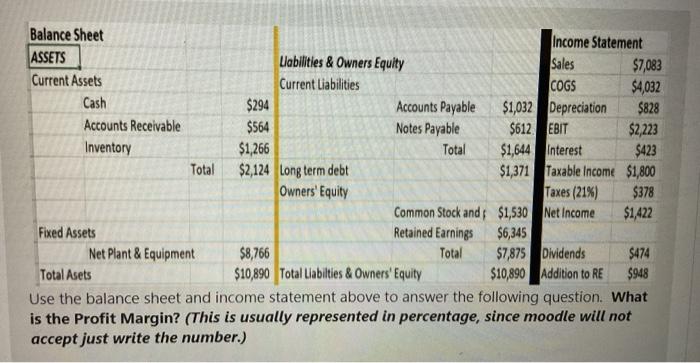

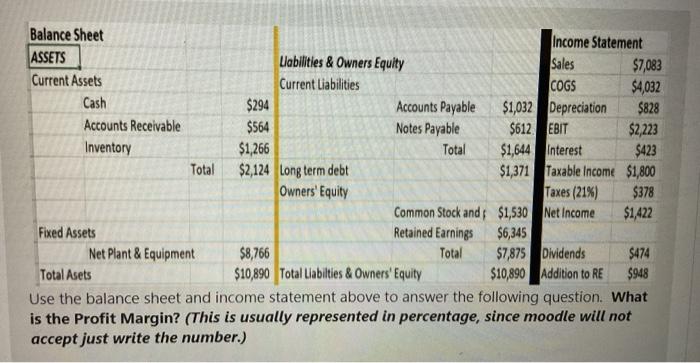

Balance Sheet Income Statement ASSETS Liabilities & Owners Equity Sales $7,083 Current Assets Current Liabilities COGS $4,032 Cash $294 Accounts Payable $1,032 Depreciation $828 Accounts

Balance Sheet Income Statement ASSETS Liabilities & Owners Equity Sales $7,083 Current Assets Current Liabilities COGS $4,032 Cash $294 Accounts Payable $1,032 Depreciation $828 Accounts Receivable $564 Notes Payable $612 EBIT $2,223 Inventory $1,266 Total $1,644 Interest $423 Total $2,124 Long term debt $1,371 Taxable income $1,800 Owners' Equity Taxes (21%) Common Stock and $1,530 Net Income $1,422 Fixed Assets Retained Earnings $6,345 Net Plant & Equipment $8,766 Total $7,875 Dividends $474 Total Asets $10,890 Total Liabilities & Owners' Equity $10,890 Addition to RE $948 Use the balance sheet and income statement above to answer the following question. What is the Profit Margin? (This is usually represented in percentage, since moodle will not accept just write the number.) $378

Balance Sheet Income Statement ASSETS Liabilities & Owners Equity Sales $7,083 Current Assets Current Liabilities COGS $4,032 Cash $294 Accounts Payable $1,032 Depreciation $828 Accounts Receivable $564 Notes Payable $612 EBIT $2,223 Inventory $1,266 Total $1,644 Interest $423 Total $2,124 Long term debt $1,371 Taxable income $1,800 Owners' Equity Taxes (21%) Common Stock and $1,530 Net Income $1,422 Fixed Assets Retained Earnings $6,345 Net Plant & Equipment $8,766 Total $7,875 Dividends $474 Total Asets $10,890 Total Liabilities & Owners' Equity $10,890 Addition to RE $948 Use the balance sheet and income statement above to answer the following question. What is the Profit Margin? (This is usually represented in percentage, since moodle will not accept just write the number.) $378

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started