Answered step by step

Verified Expert Solution

Question

1 Approved Answer

balance sheet, income statement, cashflow Chemalite, Inc. In late 1974, Mr. Bennett Alexander, a consulting chemical engineer, applied for and was successful in receiving a

balance sheet, income statement, cashflow

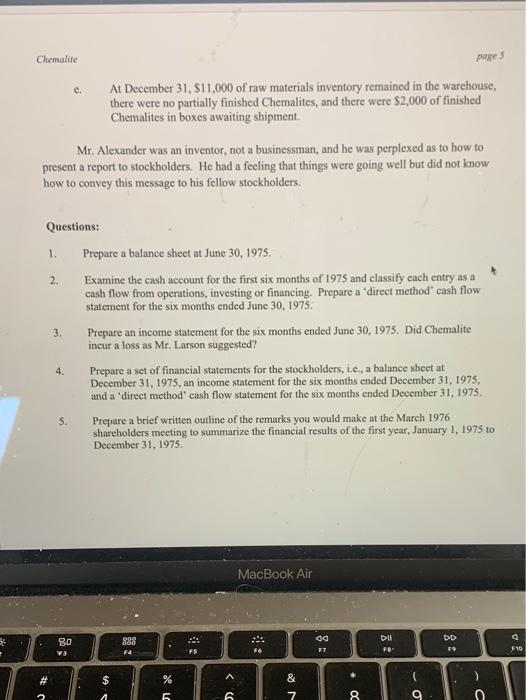

Chemalite, Inc. In late 1974, Mr. Bennett Alexander, a consulting chemical engineer, applied for and was successful in receiving a patent for one of his inventions, a "Chemalite." A small fragile, glass via of one chemical was inserted into a plastic, translucent cylinder, which was then filled with a seco chemical and scaled. By bending the cylinder the glass vial inside broke releasing the first chemical. When combined, the two chemicals gave off a bright yellow/green glow. Mr. Alexander anticipated a substantial market for the Chemalite. It had the appeal of being available readily in case of emergencies but yet did not require any form of ignition. He anticipated a considerable demand from the Armed Forces and manufacturers of flares and similar safety equipment. The Start-up Period: January 2 through June 30, 1975 On January 2, 1975, Mr. Alexander together with a number of relatives and friends established Chemalite, Inc. One hundred thousand shares were sold to the investors at $1 per share. 1. During the period January 2, 1975 through June 30, 1975, Chemalite, Inc. made the following expenditures. January 3, 1975 Purchased the patent on the "Chemalite" from Mr. Alexander for $25,000 cash. 2. January 15, 1975 Paid $1,600 in cash for legal fees to incorporate. 3. June 1975 Spent $12,500 cash to acquire and test machinery, which would ultimately be used to produce the first commercial models of the Chemalite. June 24, 1975 Purchased $15,000 worth of raw materials (plastics and chemicals) with cash for use in the production of commercial "Cheralites." 4. MacBook Air Dil DD 80 V3 . aa F7 F4 FS F6 FB- 9 # $ % A & Towards the end of June, Mr. Alexander, who had assumed a very active role in the management of Chemalite, Inc. up to that point, met with the rest of the stockholders to present a "state of the corporation report and to discuss strategies for the future marketing of the Chemalites. He expressed the hope that the company would be producing Cheralites by the end of August. Susan Peterson, a friend of Mr. Alexander, who had invested a substantial sum in the company, indicated at the meeting that she had received inquiries from an auto parts distributor about the availability of Chemalites and the expected price. The distributor had indicated a desire to acquire a substantial number of the lights as part of a highway safety package promotion and they were interested perhaps in pursuing the possibility of private branding At this point on the meeting, Mr. Larson, one of the stockholders, but a man with very little business experience and even less understanding of financial statements, interjected, "All this discussion of what we are going to do is well and good, but all I can see is that six months ago we had $100,000 and now we have less than $46,000. By my reckoning, we've managed to lose $54,000 in six months and have not much to show for it." Some of the stockholders concurred with Larson. It was a fact that between January and June the company's bank balance had fallen from $100,000 to 545,900. One shareholder, however, Ms. D'Cruz, suggested that as Chemalite, Inc.'s operations were not in full swing yet, these pre-operating outlays should probably be considered more as "investments in the business by the business" rather than losses. After considerable discussion by all the stockholders, it was agreed that they would reconvene in early January 1976 to again study the "state of the corporation." It was generally felt that by then the company would be in full operation and that the problems that developed during the pre-operating period (which Ms. D'Cruz noted) would be overcome by year-end The First Six Months of Operations: July 1 through December 31, 1975 During the last half of 1975, Chemalite, Inc, did indeed get into full operation. At the meeting in early January 1976, Mr. Bill Murray, a bookkeeper whom Mr. Alexander had recently hired, produced the following data: In early July 1975, an outside consulting engineer delivered the prototypes of the Chemalite for which the Company paid him a total of $4,750 cash. The consultant S. MacBook Air So vu 888 F4 1 FE 00 F7 Dll F DD F F2 FS FY %2 $ % & 7 * 00 3 5 6 9 0 5. In early July 1975, an outside consulting engineer delivered the prototypes of the Chemalite for which the Company paid him a total of $4,750 cash. The consultant provided all materials and labor used in building the prototypes. During the six months from July to December 1975, Chemalite sold S150,900 of their product. The largest single purchaser, the auto parts distributor with whom Susan Peterson had negotiated, still owed Chemalite 543,900. All other customers' accounts were paid in full by year-end. 6. Chemalite page 7. 8 9. Additional chemicals and plastics were purchased at a cost of $35,000. All purchases were for cash. To promote its product, Chemalite spent $4,500 in cash on television and trade joumal advertising. All ads were released by the end of 1975. During the six months ended December 31, 1975, the company spent $86,000 on Tabor and electricity of this amount, $8,600 relates to administration and marketing functions. The remainder was directly related to the manufacturing of Chemalites. In early July, an additional $30,000 was spent on machinery to be used in the production of the Chemalites. Early in the period the company borrowed 510,000. Although the principal remained 10. 11. MacBook Air BO 888 da F7 DII F3 DD F9 FVO 3 F4 Page > of 5 11. Early in the period the company borrowed 10,000. Although the principal remained outstanding, interest on the loan amounting to $150 was paid at year-end. In preparing his "state of the corporation" report, Mr. Alexander noted with some considerable anxiety that the Company bank balance had fallen a further S43.400 from the $45,900 in June to only $2,500 now. It bothered him because he felt the company was really doing well and he failed to understand why the bank account did not appear to reflect this condition a. In surveying the cash outflows incurred by Chemalite, Inc. over the entire year, he also noted the following: Management expects the machinery used in the production of the Chemalites to last 10 years, of which six months had already been consumed. b. While the Chemalite patent had a legal life of 17 years, Mr. Alexander expected that competitors would soon develop equivalent products and that the unique benefit enjoyed by Chemalite due to holding the patent would last only about 5 years (from 6/30/75 through 6/30/80). Mr. Alexander was really confused about the worth of the prototypes. By year- end they were older than they had been in July. On the other hand, they had resulted directly in the development of the product the Company was presently selling so perhaps their value had actually increased over the last six months of 1975. The Comite d'Organisation des Jeux Olympiques had placed a firm order with Chemalite for 30,000 Chemalites at a price of S.55 each. It was their intention to give a Chemalite to cach person at the closing ceremonies for the 1976 Olympics and have athletes and funs all light their Chemalites, symbolic of the Olympic flame. c MacBook Air Chemolite pes B. At December 31, $11,000 of raw materials inventory remained in the warehouse, there were no partially finished Cheralites, and there were $2,000 of finished Chemalites in boxes awaiting shipment. Mr. Alexander was an inventor, not a businessman, and he was perplexed as to how to present a report to stockholders. He had a feeling that things were going well but did not know how to convey this message to his fellow stockholders, 2. Questions: 1. Prepare a balance sheet at June 30, 1975. Examine the cash account for the first six months of 1975 and classify each entry as a cash flow from operations, investing or financing. Prepare a direct method' cash flow statement for the six months ended June 30, 1975. 3. Prepare an income statement for the six months ended June 30, 1975. Did Chemalite incur a loss as Mr. Larson suggested? Prepare a set of financial statements for the stockholders, i.e., a balance sheet at December 31, 1975, an income statement for the six months ended December 31, 1975, and a 'direct method' cash flow statement for the six months ended December 31, 1975, Prepare a brief written outline of the remarks you would make at the March 1976 shareholders meeting to summarize the financial results of the first year, January 1, 1975 to December 31, 1975 4. 5. MacBook Air 80 DD 888 F4 oa F7 DII F . 510 VI - FS # $ % & Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started