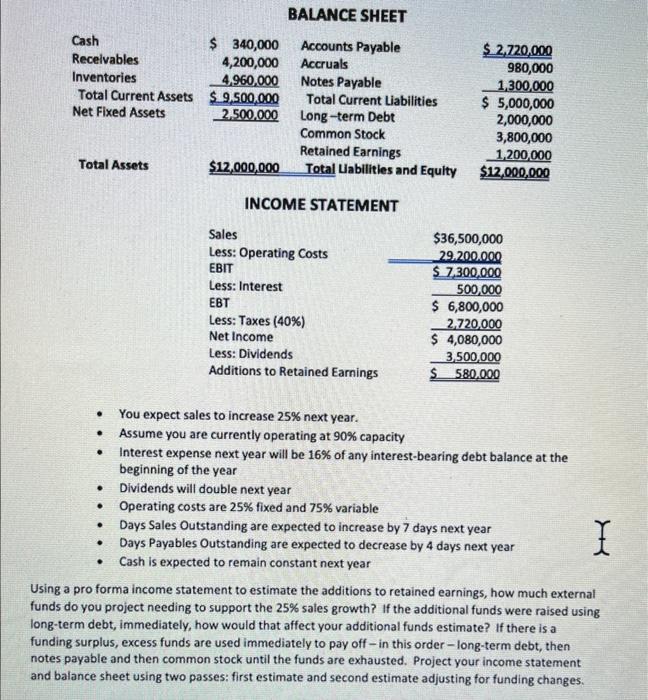

BALANCE SHEET INCOME STATEMENT - You expect sales to increase 25% next year. - Assume you are currently operating at 90% capacity - Interest expense next year will be 16% of any interest-bearing debt balance at the beginning of the year - Dividends will double next year - Operating costs are 25% fixed and 75% variable - Days Sales Outstanding are expected to increase by 7 days next year - Days Payables Outstanding are expected to decrease by 4 days next year - Cash is expected to remain constant next year Using a pro forma income statement to estimate the additions to retained earnings, how much external funds do you project needing to support the 25% sales growth? If the additional funds were raised using long-term debt, immediately, how would that affect your additional funds estimate? If there is a funding surplus, excess funds are used immediately to pay off - in this order-long-term debt, then notes payable and then common stock until the funds are exhausted. Project your income statement and balance sheet using two passes: first estimate and second estimate adjusting for funding changes. BALANCE SHEET INCOME STATEMENT - You expect sales to increase 25% next year. - Assume you are currently operating at 90% capacity - Interest expense next year will be 16% of any interest-bearing debt balance at the beginning of the year - Dividends will double next year - Operating costs are 25% fixed and 75% variable - Days Sales Outstanding are expected to increase by 7 days next year - Days Payables Outstanding are expected to decrease by 4 days next year - Cash is expected to remain constant next year Using a pro forma income statement to estimate the additions to retained earnings, how much external funds do you project needing to support the 25% sales growth? If the additional funds were raised using long-term debt, immediately, how would that affect your additional funds estimate? If there is a funding surplus, excess funds are used immediately to pay off - in this order-long-term debt, then notes payable and then common stock until the funds are exhausted. Project your income statement and balance sheet using two passes: first estimate and second estimate adjusting for funding changes