Answered step by step

Verified Expert Solution

Question

1 Approved Answer

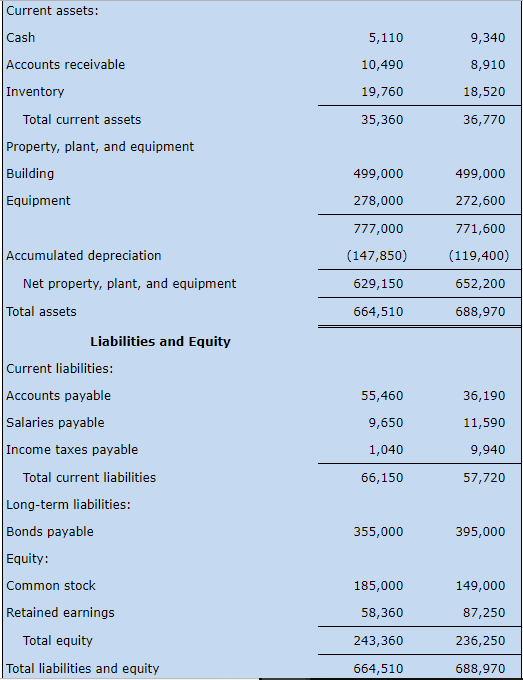

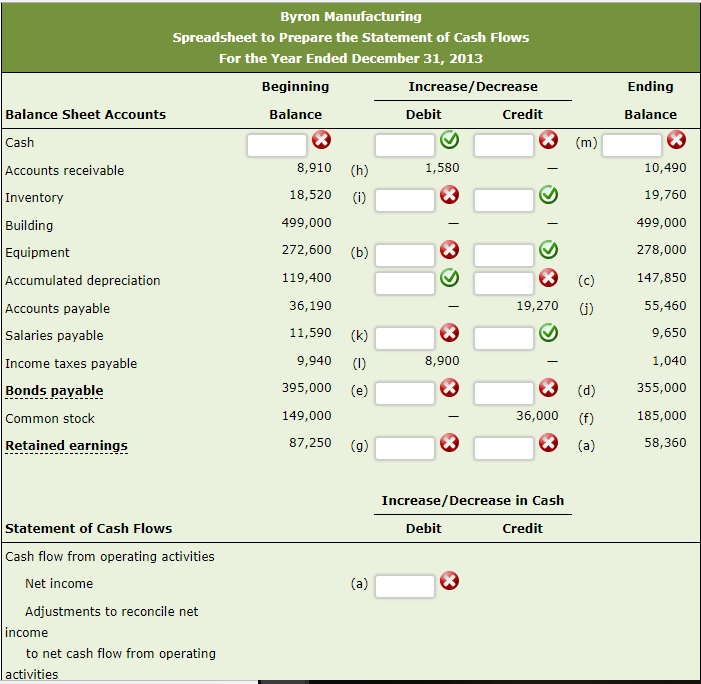

Balance sheet is shown below Additional Information needed to prepare the Statement of Cash Flows: Net income was $2,820 Byron paid $31,710 in cash dividends

Balance sheet is shown below

Additional Information needed to prepare the Statement of Cash Flows:

- Net income was $2,820

- Byron paid $31,710 in cash dividends

- Byron issued $49,240 in bonds payable for cash

- Byron retired $89,240 in bonds with cash

- No fixed assets were sold or disposed of during the period

Fill in the blanks below to fill out the statement of cash flows

Now you can prepare the Statement of Cash Flows using the indirect method. Fill in the Statement based on the spreadsheet. Select Increase or Decrease and enter the amounts.

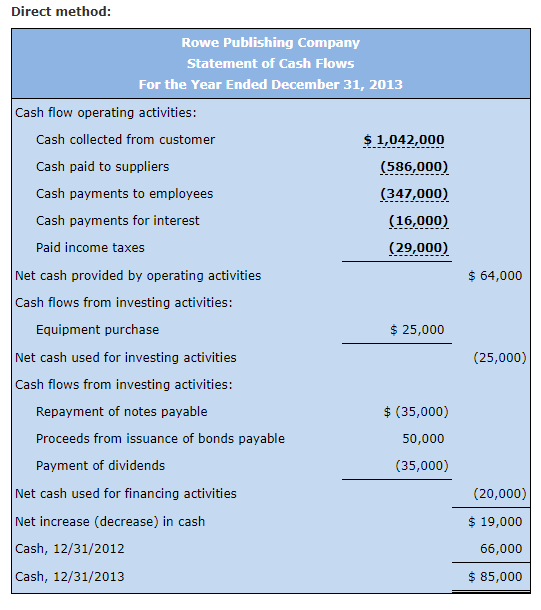

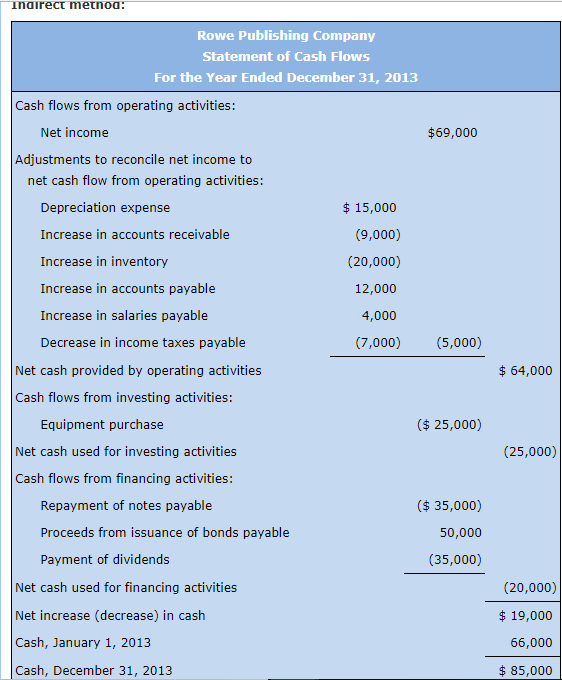

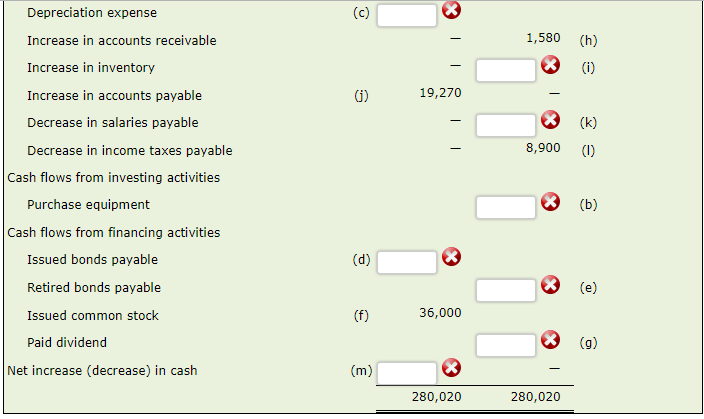

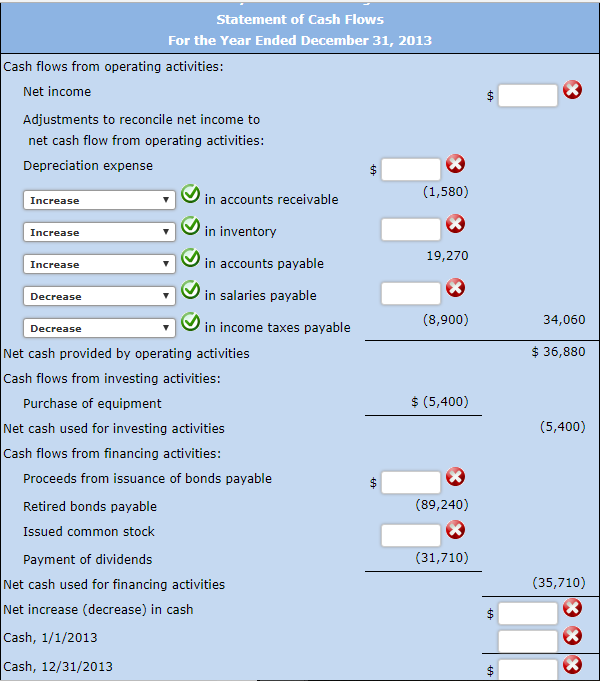

Direct method: Rowe Publishing Company Statement of Cash Flows For the Year Ended December 31, 2013 Cash flow operating activities: Cash collected from customer Cash paid to suppliers Cash payments to employees Cash payments for interest Paid income taxes $1,042,000 (586,000) (347,000) (16,000) (29,000) Net cash provided by operating activities $64,000 Cash flows from investing activities: Equipment purchase Net cash used for investing activities Cash flows from investing activities: $ 25,000 (25,000) Repayment of notes payable $ (35,000) 50,000 (35,000) Proceeds from issuance of bonds payable Payment of dividends Net cash used for financing activities Net increase (decrease) in cash Cash, 12/31/2012 Cash, 12/31/2013 (20,000) $ 19,000 66,000 $85,000 Rowe Publishing Company Statement of Cash Flows For the Year Ended December 31, 2013 Cash flows from operating activities: Net income $69,000 Adjustments to reconcile net income to net cash flow from operating activities: Depreciation expense Increase in accounts receivable Increase in inventory Increase in accounts payable Increase in salaries payable Decrease in income taxes payable $15,000 (9,000) (20,000) 12,000 4,000 (7,000) (5,000) Net cash provided by operating activities $64,000 Cash flows from investing activities: Equipment purchase ($ 25,000) Net cash used for investing activities (25,000) Cash flows from financing activities ($ 35,000) 50,000 (35,000) Repayment of notes payable Proceeds from issuance of bonds payable Payment of dividends Net cash used for financing activities Net increase (decrease) in cash Cash, January 1, 2013 Cash, December 31, 2013 (20,000) $19,000 66,000 $85,000 Current assets: Cash Accounts receivable Inventory 5,110 10,490 19,760 35,360 9,340 8,910 18,520 36,770 Total current assets Property, plant, and equipment Building Equipment 499,000 278,000 777,000 (147,850) 629,150 664,510 499,000 272,600 771,600 (119,400) 652,200 688,970 Accumulated depreciation Net property, plant, and equipment Total assets Liabilities and Equity Current liabilities: Accounts payable Salaries payable Income taxes payable 55,460 9,650 1,040 66,150 36,190 11,590 9,940 57,720 Total current liabilities Long-term liabilities: Bonds payable Equity: Common stock Retained earnings 395,000 355,000 149,000 87,250 236,250 688,970 185,000 58,360 243,360 664,510 Total equity Total liabilities and equity Byron Manufacturing Spreadsheet to Prepare the Statement of Cash Flows For the Year Ended December 31, 2013 Ending Beginning Increase/Decrease Balance Sheet Accounts Cash Accounts receivable Inventory Building Equipment Accumulated depreciation Accounts payable Salaries payable Income taxes payable Bonds pavable Common stock Retained earnings Balance Debit Balance Credit 8,910 (h) 10,490 19,760 499,000 278,000 147,850 55,460 9,650 1,040 355,000 185,000 58,360 1,580 18,520 (i) 499,000 272,600 (b) 119,400 19,270 i) 36,190 11,590 (k) 9,940 (I) 395,000 (e) 8,900 36,000 (f) 149,000 87,250 (g) Increase/Decrease in Cash Statement of Cash Flows Debit Credit Cash flow from operating activities Net income Adjustments to reconcile net to net cash flow from operating income activities Depreciation expense Increase in accounts receivable Increase in inventory Increase in accounts payable Decrease in salaries payable Decrease in income taxes payable 1,580 (h) 19,270 G) 8,900 (I) Cash flows from investing activities Purchase equipment Cash flows from financing activities Issued bonds payable Retired bonds payable Issued common stock Paid dividend 36,000 Net increase (decrease) in cash 280,020 280,020 Statement of Cash Flows For the Year Ended December 31, 2013 Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash flow from operating activities: Depreciation expense (1,580) in accounts receivable in inventory in accounts payable in salaries payable in income taxes payable Increase Increase 19,270 Increase Decrease (8,900) 34,060 Decrease $36,880 Net cash provided by operating activities Cash flows from investing activities: $ (5,400) Purchase of equipment Net cash used for investing activities Cash flows from financing activities (5,400) Proceeds from issuance of bonds payable Retired bonds payable Issued common stock Payment of dividends (89,240) (31,710) (35,710) Net cash used for financing activities Net increase (decrease) in cash Cash, 1/1/2013 Cash, 12/31/2013

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started