BALANCE SHEET -

PLEASE LOOK AT THE WORKSHEET ABOVE FOR THE FOLLOWING QUESTIONS:

A -

B -

C-

D -

E -

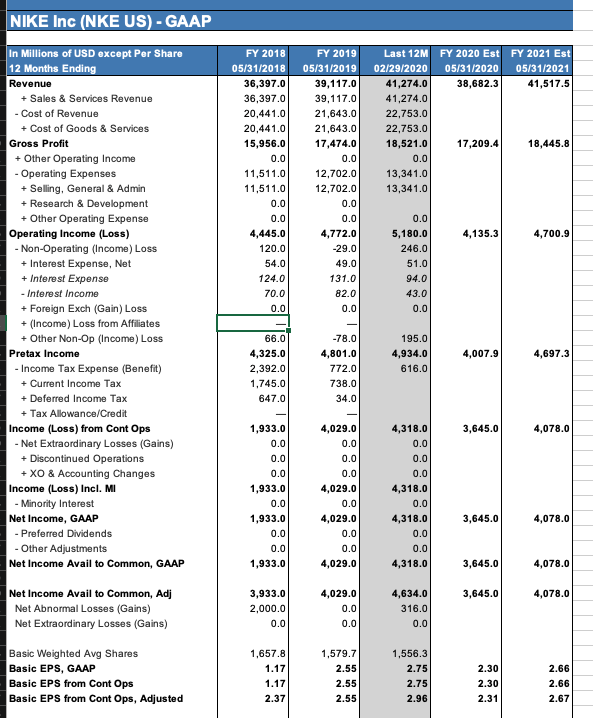

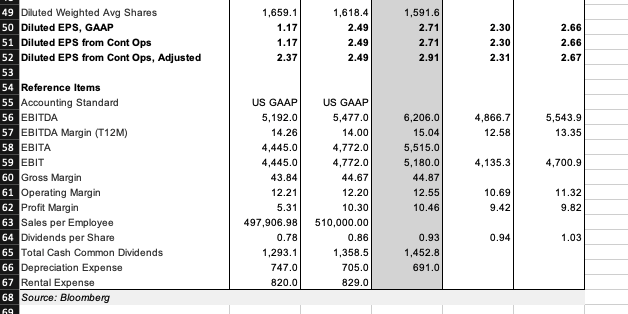

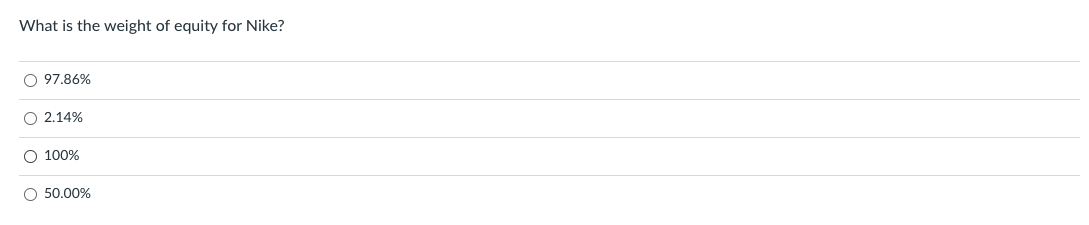

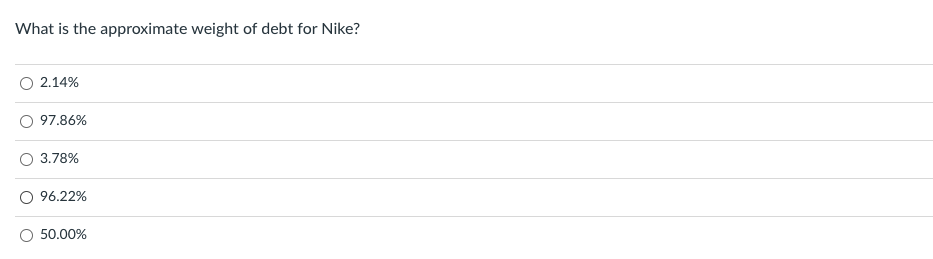

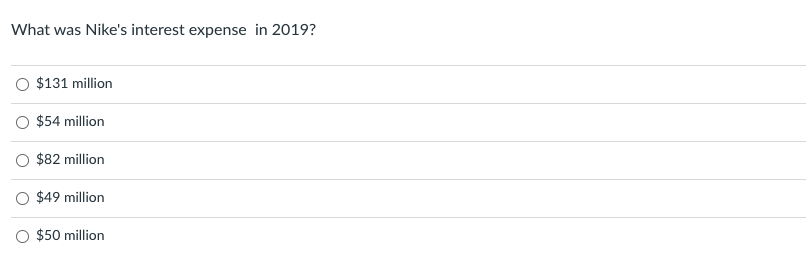

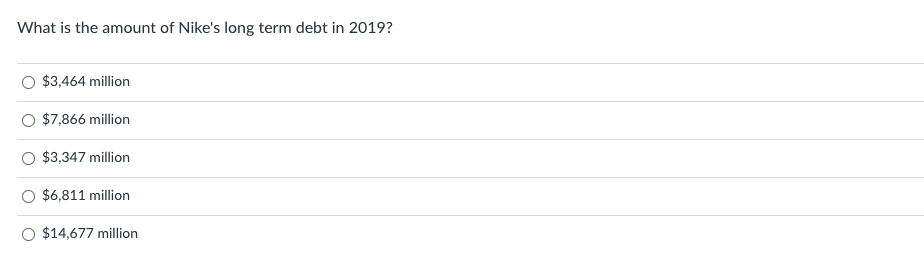

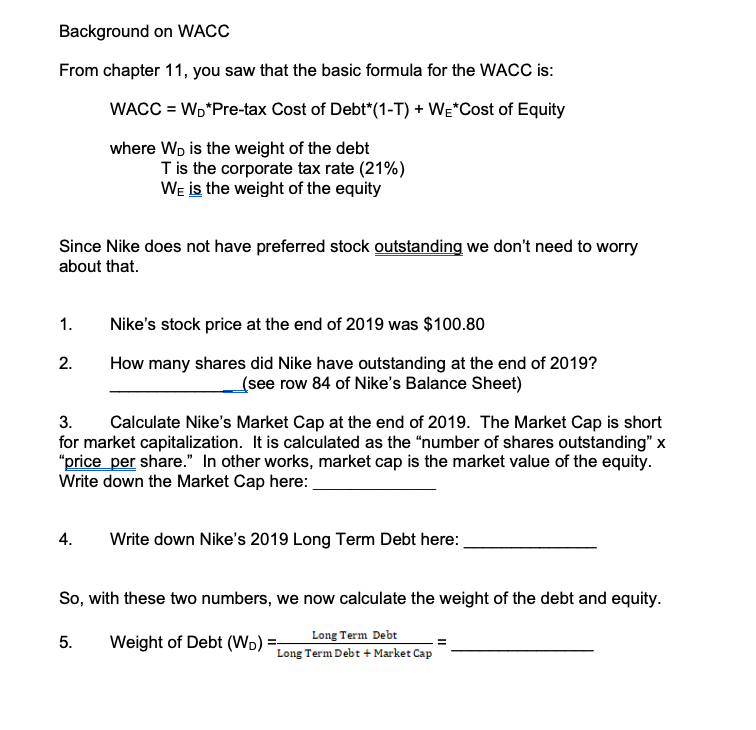

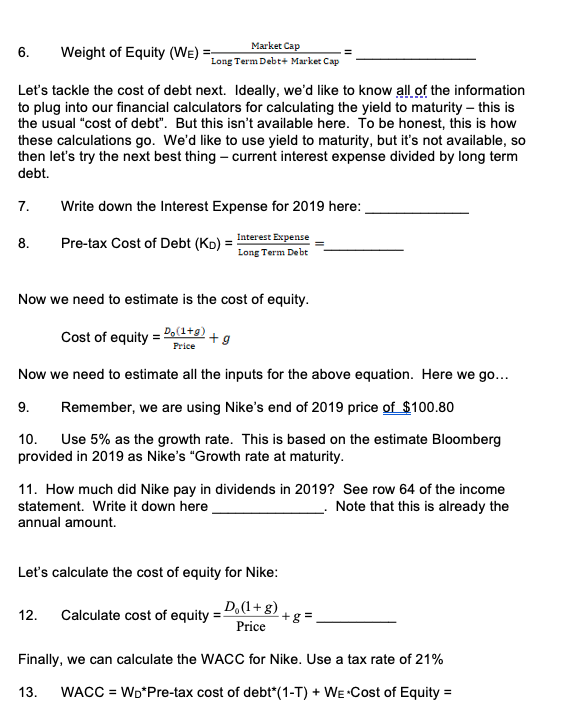

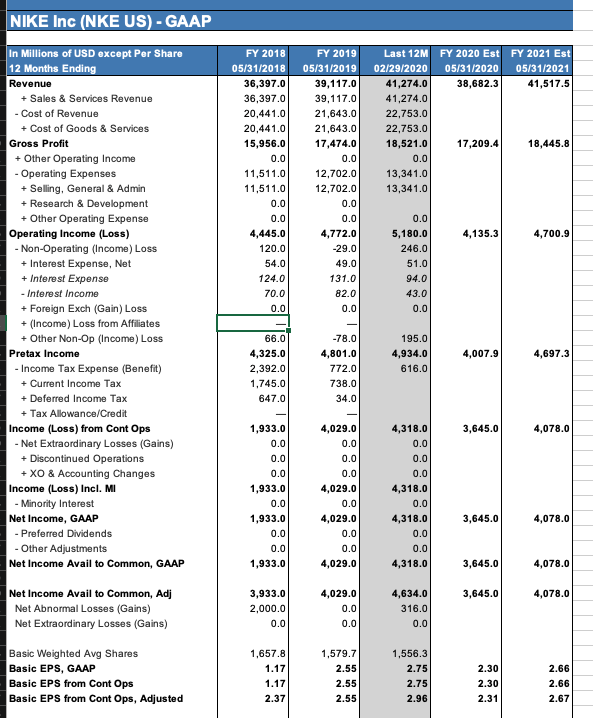

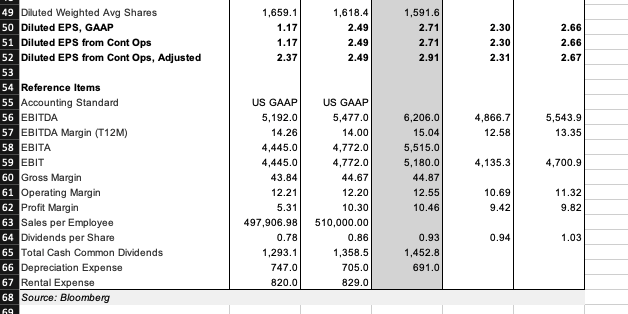

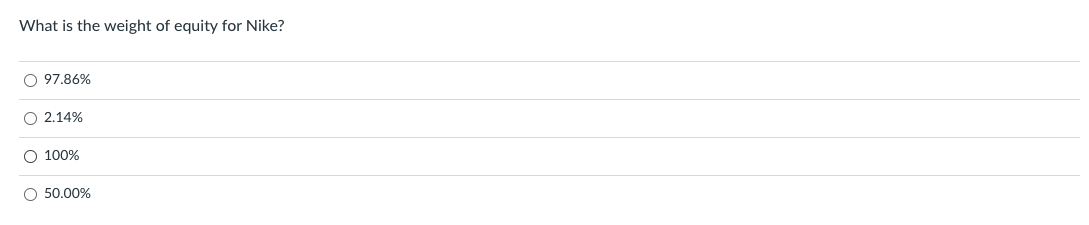

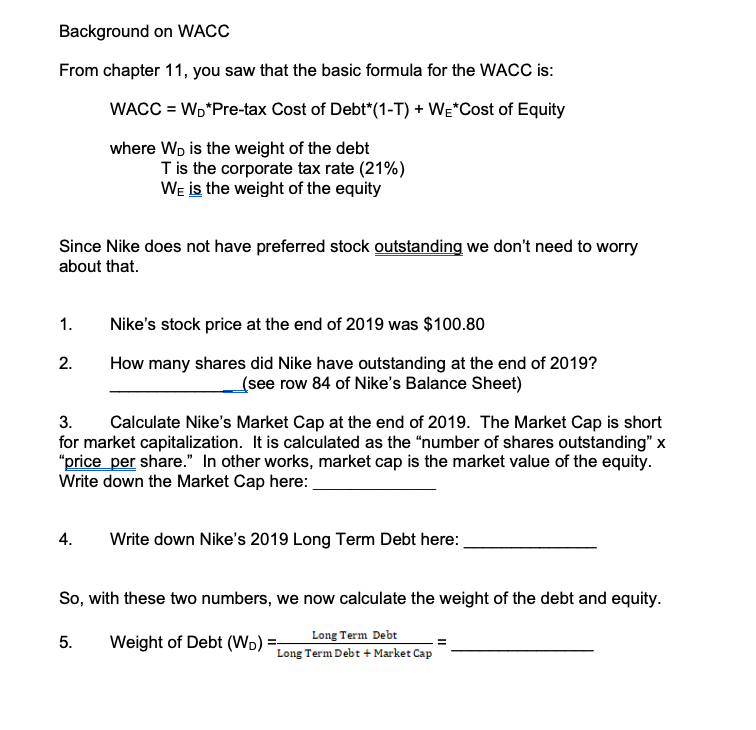

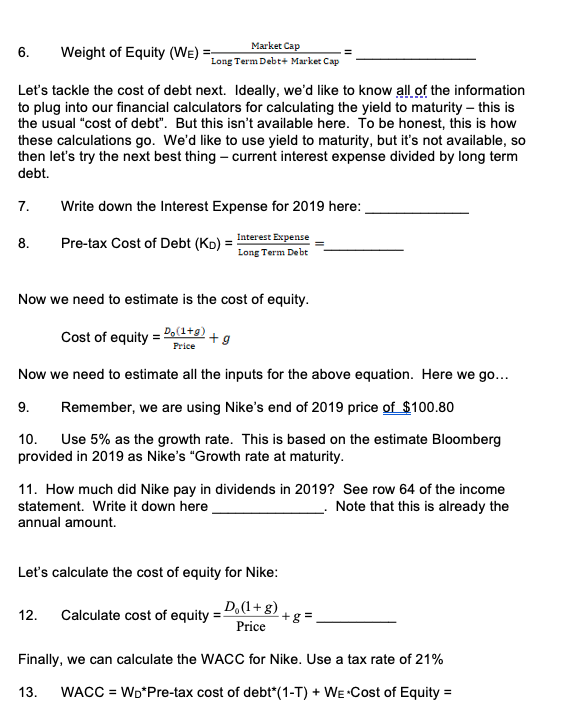

FY 2018 05/31/2018 36,397.0 36,397.0 20,441.0 20,441.0 15,956.0 0.0 11,511.01 11,511.0 0.0 0.0 4,445.0 120.0 54.0 124.0 70.0 0.0 FY 2019 05/31/2019 39,117.0 39,117.0 21,643.0 21,643.0 17,474.0 0.0 12,702.0 12,702.0 0.0 0.0 4,772.0 -29.0 49.0 131.0 82.0 0.0 Last 12M FY 2020 Est FY 2021 Est 02/29/2020 05/31/2020 05/31/2021 41,274.0 38,682.3 41,517.5 41,274.0 22,753.0 22,753.0 18,521.0 17,209.4 18,445.8 0.0 13,341.0 13,341.0 NIKE Inc (NKE US) - GAAP In Millions of USD except Per Share 12 Months Ending Revenue + Sales & Services Revenue - Cost of Revenue + Cost of Goods & Services Gross Profit + Other Operating Income - Operating Expenses + Selling, General & Admin + Research & Development + Other Operating Expense Operating Income (Loss) - Non-Operating (Income) Loss + Interest Expense, Net + Interest Expense - Interest Income + Foreign Exch (Gain) Loss + (Income) Loss from Affiliates + Other Non-Op (Income) Loss Pretax Income - Income Tax Expense (Benefit) + Current Income Tax + Deferred Income Tax + Tax Allowance/Credit Income (Loss) from Cont Ops - Net Extraordinary Losses (Gains) + Discontinued Operations + XO & Accounting Changes Income (Loss) Incl. MI - Minority Interest Net Income, GAAP - Preferred Dividends Other Adjustments Net Income Avail to Common, GAAP 4,135.3 4,700.9 0.0 5,180.0 246.0 51.0 94.0 43.0 0.0 4,007.91 66.0 4,325.0 2,392.0 1,745.0 647.0 195.0 4,934.0 616.0 4,697.3 -78.0 4,801.0 772.0 738.0 34.0 3,645.0 4,078.0 1,933.0 0.0 0.0 0.0 1,933.0 0.0 1,933.0 0.0 0.0 1,933.0 4,029.0 0.0 0.0 0.0 4,029.0 0.0 4,029.0 0.0 0.0 4,029.0 4,318.0 0.0 0.0 0.0 4,318.0 0.0 4,318.0 0.0 0.0 4,318.0 3,645.0 4,078.0 3,645.0 4,078.0 3,645.0 4,078.0 Net Income Avail to Common, Adj Net Abnormal Losses (Gains) Net Extraordinary Losses (Gains) 3,933.0 2,000.0 0.0 4,029.0 0.0 0.0 4,634.0 316.0 0.0 Basic Weighted Avg Shares Basic EPS, GAAP Basic EPS from Cont Ops Basic EPS from Cont Ops, Adjusted 1,657.8 1.17 1.17 2.37 1,579.7 2.55 2.55 2.55 1,556.3 2.75 2.75 2.96 2.30 2.30 2.31 2.66 2.66 2.67 49 Diluted Weighted Avg Shares 50 Diluted EPS, GAAP 51 Diluted EPS from Cont Ops 52 Diluted EPS from Cont Ops, Adjusted 1.659.1 1.17 1.17 2.37 1,618.4 2.49 2.49 2.49 1,591.6 2.71 2.71 2.91 2.30 2.30 2.31 2.66 2.66 2.67 53 4,866.7 12.58 5,543.9 13.35 4,135.3 54 Reference Items 55 Accounting Standard 56 EBITDA 57 EBITDA Margin (T12M) 58 EBITA 59 EBIT 60 Gross Margin 61 Operating Margin 62 Profit Margin 63 Sales per Employee 64 Dividends per Share 65 Total Cash Common Dividends 66 Depreciation Expense 67 Rental Expense 68 Source: Bloomberg 4,700.9 US GAAP 5,192.0 14.26 4,445.0 4,445.0 43.84 12.21 5.31 497,906.98 0.78 1,293.1 747.0 820.0 6,206.0 15.04 5,515.0 5,180.0 44.87 12.55 10.46 US GAAP 5,477.0 14.00 4,772.0 4,772.0 44.67 12.20 10.30 510,000.00 0.86 1,358.5 705.0 829.0 10.69 9.42 11.32 9.82 0.94 1.03 0.93 1,452.8 691.0 69 What is the weight of equity for Nike? O 97.86% 0 2.14% O 100% 0 50.00% What is your approximate estimate of Nike's WACC based on the worksheet? O 5.83% O 5.90% 05.0% 0 3.78% 09.68% What is the approximate weight of debt for Nike? 2.14% 97.86% 3.78% 096.22% 50.00% What was Nike's interest expense in 2019? O $131 million O $54 million $82 million O $49 million $50 million What is the amount of Nike's long term debt in 2019? $3,464 million $7,866 million O $3,347 million $6,811 million $14,677 million Background on WACC From chapter 11, you saw that the basic formula for the WACC is: WACC = W. *Pre-tax Cost of Debt*(1-T) + WE*Cost of Equity where Wo is the weight of the debt T is the corporate tax rate (21%) We is the weight of the equity Since Nike does not have preferred stock outstanding we don't need to worry about that. 1. Nike's stock price at the end of 2019 was $100.80 2. How many shares did Nike have outstanding at the end of 2019? (see row 84 of Nike's Balance Sheet) 3. Calculate Nike's Market Cap at the end of 2019. The Market Cap is short for market capitalization. It is calculated as the "number of shares outstanding" X "price per share." In other works, market cap is the market value of the equity. Write down the Market Cap here: 4. Write down Nike's 2019 Long Term Debt here: So, with these two numbers, we now calculate the weight of the debt and equity. 5. Weight of Debt (WD) Long Term Debt Long Term Debt + Market Cap 6. Weight of Equity (WE) Market Cap Long Term Debt+ Market Cap Let's tackle the cost of debt next. Ideally, we'd like to know all of the information to plug into our financial calculators for calculating the yield to maturity - this is the usual "cost of debt". But this isn't available here. To be honest, this is how these calculations go. We'd like to use yield to maturity, but it's not available, so then let's try the next best thing - current interest expense divided by long term debt. 7. Write down the Interest Expense for 2019 here: 8. Pre-tax Cost of Debt (ko) = Interest Expense Long Term Debt Now we need to estimate is the cost of equity. Cost of equity = Do(1+0)+g Price Now we need to estimate all the inputs for the above equation. Here we go... 9. Remember, we are using Nike's end of 2019 price of $100.80 10. Use 5% as the growth rate. This is based on the estimate Bloomberg provided in 2019 as Nike's "Growth rate at maturity. 11. How much did Nike pay in dividends in 2019? See row 64 of the income statement. Write it down here Note that this is already the annual amount Let's calculate the cost of equity for Nike: 12. Calculate cost of equity = D. (1+g) + g = Price Finally, we can calculate the WACC for Nike. Use a tax rate of 21% 13. WACC = Wo*Pre-tax cost of debt*(1-T) + We Cost of Equity = FY 2018 05/31/2018 36,397.0 36,397.0 20,441.0 20,441.0 15,956.0 0.0 11,511.01 11,511.0 0.0 0.0 4,445.0 120.0 54.0 124.0 70.0 0.0 FY 2019 05/31/2019 39,117.0 39,117.0 21,643.0 21,643.0 17,474.0 0.0 12,702.0 12,702.0 0.0 0.0 4,772.0 -29.0 49.0 131.0 82.0 0.0 Last 12M FY 2020 Est FY 2021 Est 02/29/2020 05/31/2020 05/31/2021 41,274.0 38,682.3 41,517.5 41,274.0 22,753.0 22,753.0 18,521.0 17,209.4 18,445.8 0.0 13,341.0 13,341.0 NIKE Inc (NKE US) - GAAP In Millions of USD except Per Share 12 Months Ending Revenue + Sales & Services Revenue - Cost of Revenue + Cost of Goods & Services Gross Profit + Other Operating Income - Operating Expenses + Selling, General & Admin + Research & Development + Other Operating Expense Operating Income (Loss) - Non-Operating (Income) Loss + Interest Expense, Net + Interest Expense - Interest Income + Foreign Exch (Gain) Loss + (Income) Loss from Affiliates + Other Non-Op (Income) Loss Pretax Income - Income Tax Expense (Benefit) + Current Income Tax + Deferred Income Tax + Tax Allowance/Credit Income (Loss) from Cont Ops - Net Extraordinary Losses (Gains) + Discontinued Operations + XO & Accounting Changes Income (Loss) Incl. MI - Minority Interest Net Income, GAAP - Preferred Dividends Other Adjustments Net Income Avail to Common, GAAP 4,135.3 4,700.9 0.0 5,180.0 246.0 51.0 94.0 43.0 0.0 4,007.91 66.0 4,325.0 2,392.0 1,745.0 647.0 195.0 4,934.0 616.0 4,697.3 -78.0 4,801.0 772.0 738.0 34.0 3,645.0 4,078.0 1,933.0 0.0 0.0 0.0 1,933.0 0.0 1,933.0 0.0 0.0 1,933.0 4,029.0 0.0 0.0 0.0 4,029.0 0.0 4,029.0 0.0 0.0 4,029.0 4,318.0 0.0 0.0 0.0 4,318.0 0.0 4,318.0 0.0 0.0 4,318.0 3,645.0 4,078.0 3,645.0 4,078.0 3,645.0 4,078.0 Net Income Avail to Common, Adj Net Abnormal Losses (Gains) Net Extraordinary Losses (Gains) 3,933.0 2,000.0 0.0 4,029.0 0.0 0.0 4,634.0 316.0 0.0 Basic Weighted Avg Shares Basic EPS, GAAP Basic EPS from Cont Ops Basic EPS from Cont Ops, Adjusted 1,657.8 1.17 1.17 2.37 1,579.7 2.55 2.55 2.55 1,556.3 2.75 2.75 2.96 2.30 2.30 2.31 2.66 2.66 2.67 49 Diluted Weighted Avg Shares 50 Diluted EPS, GAAP 51 Diluted EPS from Cont Ops 52 Diluted EPS from Cont Ops, Adjusted 1.659.1 1.17 1.17 2.37 1,618.4 2.49 2.49 2.49 1,591.6 2.71 2.71 2.91 2.30 2.30 2.31 2.66 2.66 2.67 53 4,866.7 12.58 5,543.9 13.35 4,135.3 54 Reference Items 55 Accounting Standard 56 EBITDA 57 EBITDA Margin (T12M) 58 EBITA 59 EBIT 60 Gross Margin 61 Operating Margin 62 Profit Margin 63 Sales per Employee 64 Dividends per Share 65 Total Cash Common Dividends 66 Depreciation Expense 67 Rental Expense 68 Source: Bloomberg 4,700.9 US GAAP 5,192.0 14.26 4,445.0 4,445.0 43.84 12.21 5.31 497,906.98 0.78 1,293.1 747.0 820.0 6,206.0 15.04 5,515.0 5,180.0 44.87 12.55 10.46 US GAAP 5,477.0 14.00 4,772.0 4,772.0 44.67 12.20 10.30 510,000.00 0.86 1,358.5 705.0 829.0 10.69 9.42 11.32 9.82 0.94 1.03 0.93 1,452.8 691.0 69 What is the weight of equity for Nike? O 97.86% 0 2.14% O 100% 0 50.00% What is your approximate estimate of Nike's WACC based on the worksheet? O 5.83% O 5.90% 05.0% 0 3.78% 09.68% What is the approximate weight of debt for Nike? 2.14% 97.86% 3.78% 096.22% 50.00% What was Nike's interest expense in 2019? O $131 million O $54 million $82 million O $49 million $50 million What is the amount of Nike's long term debt in 2019? $3,464 million $7,866 million O $3,347 million $6,811 million $14,677 million Background on WACC From chapter 11, you saw that the basic formula for the WACC is: WACC = W. *Pre-tax Cost of Debt*(1-T) + WE*Cost of Equity where Wo is the weight of the debt T is the corporate tax rate (21%) We is the weight of the equity Since Nike does not have preferred stock outstanding we don't need to worry about that. 1. Nike's stock price at the end of 2019 was $100.80 2. How many shares did Nike have outstanding at the end of 2019? (see row 84 of Nike's Balance Sheet) 3. Calculate Nike's Market Cap at the end of 2019. The Market Cap is short for market capitalization. It is calculated as the "number of shares outstanding" X "price per share." In other works, market cap is the market value of the equity. Write down the Market Cap here: 4. Write down Nike's 2019 Long Term Debt here: So, with these two numbers, we now calculate the weight of the debt and equity. 5. Weight of Debt (WD) Long Term Debt Long Term Debt + Market Cap 6. Weight of Equity (WE) Market Cap Long Term Debt+ Market Cap Let's tackle the cost of debt next. Ideally, we'd like to know all of the information to plug into our financial calculators for calculating the yield to maturity - this is the usual "cost of debt". But this isn't available here. To be honest, this is how these calculations go. We'd like to use yield to maturity, but it's not available, so then let's try the next best thing - current interest expense divided by long term debt. 7. Write down the Interest Expense for 2019 here: 8. Pre-tax Cost of Debt (ko) = Interest Expense Long Term Debt Now we need to estimate is the cost of equity. Cost of equity = Do(1+0)+g Price Now we need to estimate all the inputs for the above equation. Here we go... 9. Remember, we are using Nike's end of 2019 price of $100.80 10. Use 5% as the growth rate. This is based on the estimate Bloomberg provided in 2019 as Nike's "Growth rate at maturity. 11. How much did Nike pay in dividends in 2019? See row 64 of the income statement. Write it down here Note that this is already the annual amount Let's calculate the cost of equity for Nike: 12. Calculate cost of equity = D. (1+g) + g = Price Finally, we can calculate the WACC for Nike. Use a tax rate of 21% 13. WACC = Wo*Pre-tax cost of debt*(1-T) + We Cost of Equity =