Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Balance Sheet Total Assets = Total Liabilities + Total Equity $ 40,000 (2,000) June 1 Jenna Davis invested $40,000 cash to start the business.

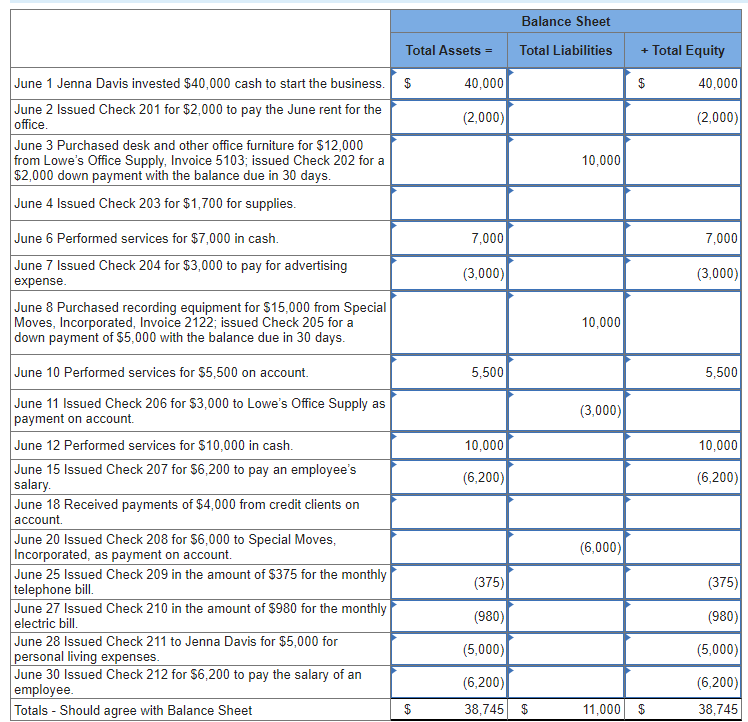

Balance Sheet Total Assets = Total Liabilities + Total Equity $ 40,000 (2,000) June 1 Jenna Davis invested $40,000 cash to start the business. $ June 2 Issued Check 201 for $2,000 to pay the June rent for the office. June 3 Purchased desk and other office furniture for $12,000 from Lowe's Office Supply, Invoice 5103; issued Check 202 for a $2,000 down payment with the balance due in 30 days. June 4 Issued Check 203 for $1,700 for supplies. 40,000 (2,000) 10,000 June 6 Performed services for $7,000 in cash. 7,000 7,000 June 7 Issued Check 204 for $3,000 to pay for advertising (3,000) (3,000) expense. June 8 Purchased recording equipment for $15,000 from Special Moves, Incorporated, Invoice 2122; issued Check 205 for a down payment of $5,000 with the balance due in 30 days. 10,000 June 10 Performed services for $5,500 on account. 5,500 5,500 June 11 Issued Check 206 for $3,000 to Lowe's Office Supply as payment on account. (3,000) June 12 Performed services for $10,000 in cash. 10,000 10,000 June 15 Issued Check 207 for $6,200 to pay an employee's salary. (6,200) (6,200) June 18 Received payments of $4,000 from credit clients on account. June 20 Issued Check 208 for $6,000 to Special Moves, Incorporated, as payment on account. (6,000) June 25 Issued Check 209 in the amount of $375 for the monthly telephone bill. (375) (375) June 27 Issued Check 210 in the amount of $980 for the monthly electric bill. (980) (980) June 28 Issued Check 211 to Jenna Davis for $5,000 for personal living expenses. (5,000) (5,000) June 30 Issued Check 212 for $6,200 to pay the salary of an employee. (6,200) Totals - Should agree with Balance Sheet $ 38,745 $ 11,000 69 (6,200) 38,745

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started