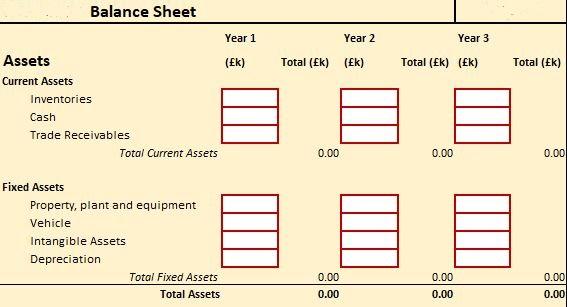

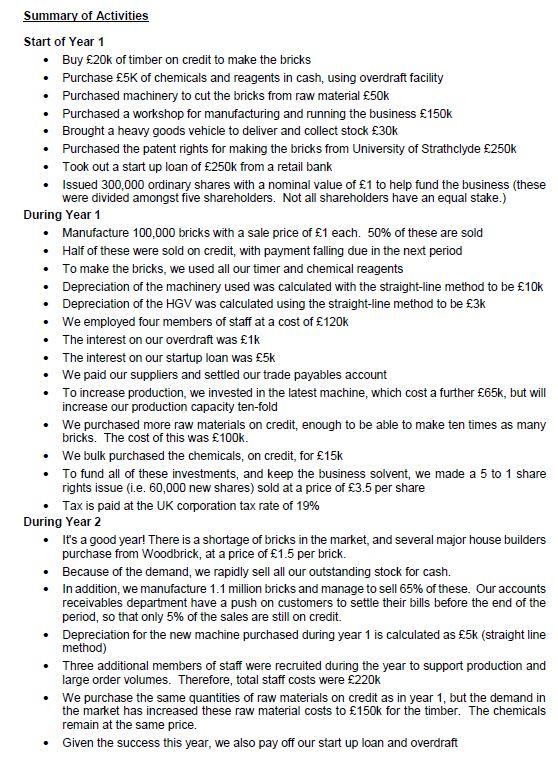

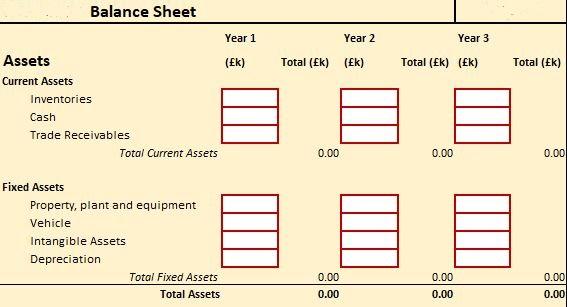

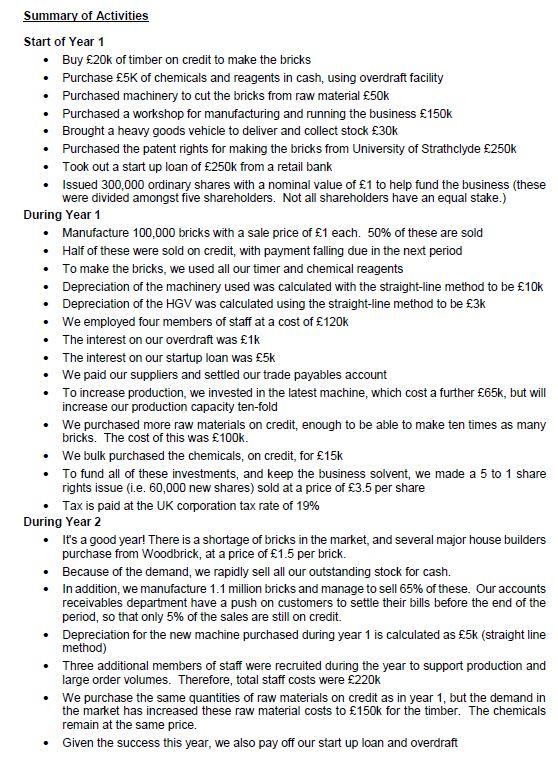

Balance Sheet Year 1 Year 2 Year 3 () Total (k) (EK) Total (k) (k) Total (Ek) Assets Current Assets Inventories Cash Trade Receivables Total Current Assets 0.00 0.00 0.00 Fixed Assets Property, plant and equipment Vehicle Intangible Assets Depreciation Total Fixed Assets Total Assets 0.00 0.00 0.00 0.00 0.00 0.00 Summary of Activities Start of Year 1 Buy 20k of timber on credit to make the bricks Purchase 5K of chemicals and reagents in cash, using overdraft facility Purchased machinery to cut the bricks from raw material 50k Purchased a workshop for manufacturing and running the business 150k Brought a heavy goods vehicle to deliver and collect stock 30k Purchased the patent rights for making the bricks from University of Strathclyde 250k Took out a start up loan of 250k from a retail bank Issued 300,000 ordinary shares with a nominal value of 1 to help fund the business (these were divided amongst five shareholders. Not all shareholders have an equal stake.) During Year 1 Manufacture 100,000 bricks with a sale price of 1 each. 50% of these are sold Half of these were sold on credit, with payment falling due in the next period To make the bricks, we used all our timer and chemical reagents Depreciation of the machinery used was calculated with the straight-line method to be 10k Depreciation of the HGV was calculated using the straight-line method to be 3k We employed four members of staff at a cost of 120k The interest on our overdraft was 1k The interest on our startup loan was 5k We paid our suppliers and settled our trade payables account To increase production, we invested in the latest machine, which cost a further 65k, but will increase our production capacity ten-fold We purchased more raw materials on credit, enough to be able to make ten times as many bricks. The cost of this was 100k. We bulk purchased the chemicals, on credit for 15k To fund all of these investments, and keep the business solvent, we made a 5 to 1 share rights issue (i.e. 60,000 new shares) sold at a price of 3.5 per share Tax is paid at the UK corporation tax rate of 19% During Year 2 It's a good year! There is a shortage of bricks in the market, and several major house builders purchase from Woodbrick, at a price of 1.5 per brick. Because of the demand, we rapidly sell all our outstanding stock for cash. In addition, we manufacture 1.1 million bricks and manage to sell 65% of these. Our accounts receivables department have a push on customers to settle their bills before the end of the period, so that only 5% of the sales are still on credit Depreciation for the new machine purchased during year 1 is calculated as 5k (straight line method) Three additional members of staff were recruited during the year to support production and large order volumes. Therefore, total staff costs were 220k We purchase the same quantities of raw materials on credit as in year 1, but the demand in the market has increased these raw material costs to 150k for the timber. The chemicals remain at the same price. Given the success this year, we also pay off our start up loan and overdraft Balance Sheet Year 1 Year 2 Year 3 () Total (k) (EK) Total (k) (k) Total (Ek) Assets Current Assets Inventories Cash Trade Receivables Total Current Assets 0.00 0.00 0.00 Fixed Assets Property, plant and equipment Vehicle Intangible Assets Depreciation Total Fixed Assets Total Assets 0.00 0.00 0.00 0.00 0.00 0.00 Summary of Activities Start of Year 1 Buy 20k of timber on credit to make the bricks Purchase 5K of chemicals and reagents in cash, using overdraft facility Purchased machinery to cut the bricks from raw material 50k Purchased a workshop for manufacturing and running the business 150k Brought a heavy goods vehicle to deliver and collect stock 30k Purchased the patent rights for making the bricks from University of Strathclyde 250k Took out a start up loan of 250k from a retail bank Issued 300,000 ordinary shares with a nominal value of 1 to help fund the business (these were divided amongst five shareholders. Not all shareholders have an equal stake.) During Year 1 Manufacture 100,000 bricks with a sale price of 1 each. 50% of these are sold Half of these were sold on credit, with payment falling due in the next period To make the bricks, we used all our timer and chemical reagents Depreciation of the machinery used was calculated with the straight-line method to be 10k Depreciation of the HGV was calculated using the straight-line method to be 3k We employed four members of staff at a cost of 120k The interest on our overdraft was 1k The interest on our startup loan was 5k We paid our suppliers and settled our trade payables account To increase production, we invested in the latest machine, which cost a further 65k, but will increase our production capacity ten-fold We purchased more raw materials on credit, enough to be able to make ten times as many bricks. The cost of this was 100k. We bulk purchased the chemicals, on credit for 15k To fund all of these investments, and keep the business solvent, we made a 5 to 1 share rights issue (i.e. 60,000 new shares) sold at a price of 3.5 per share Tax is paid at the UK corporation tax rate of 19% During Year 2 It's a good year! There is a shortage of bricks in the market, and several major house builders purchase from Woodbrick, at a price of 1.5 per brick. Because of the demand, we rapidly sell all our outstanding stock for cash. In addition, we manufacture 1.1 million bricks and manage to sell 65% of these. Our accounts receivables department have a push on customers to settle their bills before the end of the period, so that only 5% of the sales are still on credit Depreciation for the new machine purchased during year 1 is calculated as 5k (straight line method) Three additional members of staff were recruited during the year to support production and large order volumes. Therefore, total staff costs were 220k We purchase the same quantities of raw materials on credit as in year 1, but the demand in the market has increased these raw material costs to 150k for the timber. The chemicals remain at the same price. Given the success this year, we also pay off our start up loan and overdraft