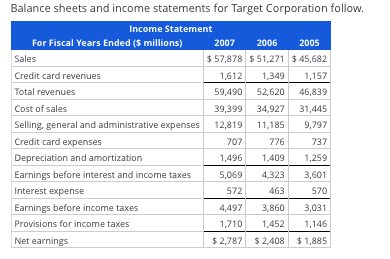

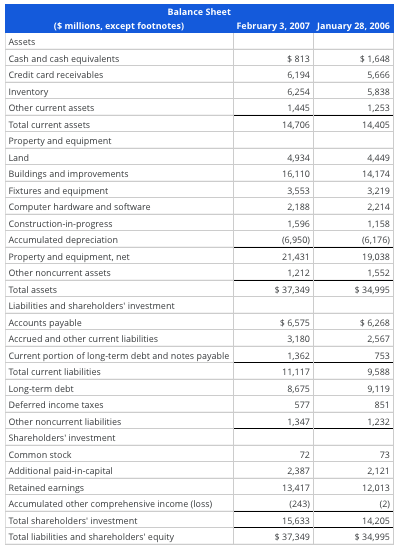

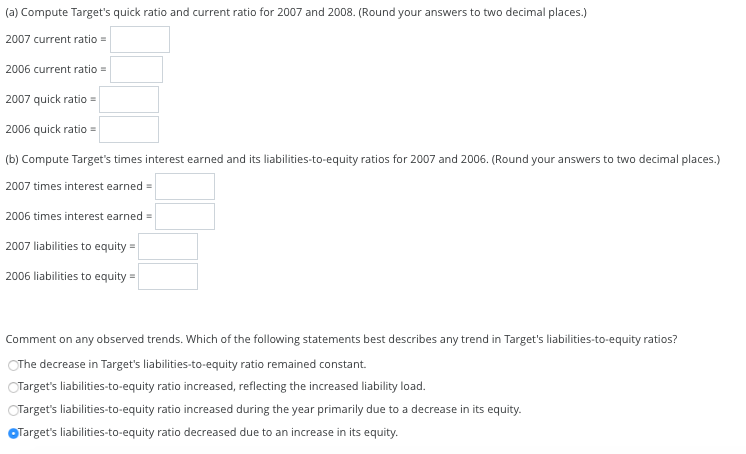

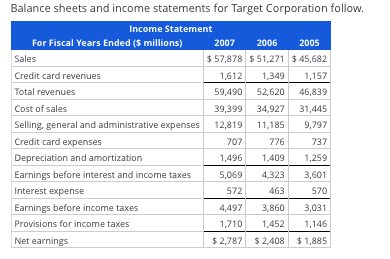

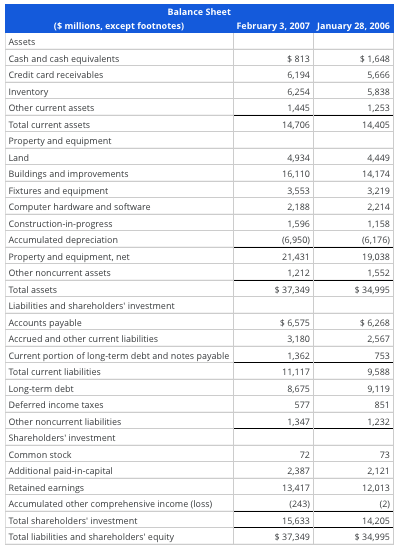

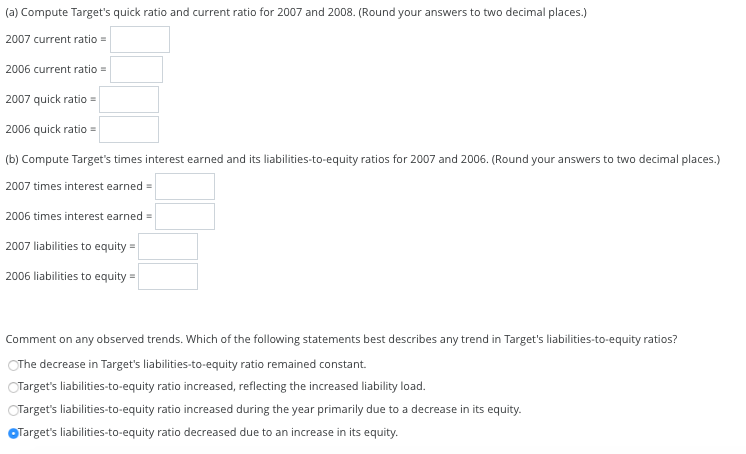

Balance sheets and income statements for Target Corporation follow. Income Statement For Fiscal Years Ended (5 millions) 2007 2006 2005 Sales $57,878 $ 51,271 $ 45,682 Credit card revenues 1,612 1,349 1,157 Total revenues 59,490 52,620 46,839 Cost of sales 39,399 34,927 31,445 Selling, general and administrative expenses 12,819 11,185 9,797 Credit card expenses 707 776 737 Depreciation and amortization 1,496 1,409 1,259 Earnings before interest and income taxes 5,069 4,323 3,601 Interest expense 572 463 570 Earnings before income taxes 4,497 3,860 3,031 Provisions for income taxes 1,710 1,452 1,146 Net earnings $ 2,787 $2,408 $1,885 February 3, 2007 January 28, 2006 $ 813 6,194 6,254 1,445 14,706 $1,648 5,666 5.838 1,253 14,405 Balance Sheet (5 millions, except footnotes) Assets Cash and cash equivalents Credit card receivables Inventory Other current assets Total current assets Property and equipment Land Buildings and improvements Fixtures and equipment Computer hardware and software Construction-in-progress Accumulated depreciation Property and equipment, net Other noncurrent assets Total assets Liabilities and shareholders' investment Accounts payable Accrued and other current liabilities Current portion of long-term debt and notes payable Total current liabilities Long-term debt Deferred income taxes Other noncurrent liabilities Shareholders investment Common stock Additional paid-in-capital 4,934 16,110 3.553 2,188 1,596 (6,950) 21,431 1,212 $ 37,349 4,449 14.174 3.219 2.214 1.158 (6,176) 19,038 1,552 $ 34,995 $ 6,575 3,180 1,362 11.117 8,675 $ 6,268 2.567 753 9,588 9.119 577 851 1,347 1.232 2.121 Retained earnings 12.013 22 2,387 13,417 (243) 15,633 $ 37,349 Accumulated other comprehensive income (loss) Total shareholders investment Total liabilities and shareholders' equity 14.205 $ 34,995 (a) Compute Target's quick ratio and current ratio for 2007 and 2008. (Round your answers to two decimal places.) 2007 current ratio = 2006 current ratio = 2007 quick ratio = 2006 quick ratio = (b) Compute Target's times interest earned and its liabilities-to-equity ratios for 2007 and 2006. (Round your answers to two decimal places.) 2007 times interest earned = 2006 times interest earned = 2007 liabilities to equity = 2006 liabilities to equity = Comment on any observed trends. Which of the following statements best describes any trend in Target's liabilities-to-equity ratios? The decrease in Target's liabilities-to-equity ratio remained constant. Target's liabilities-to-equity ratio increased, reflecting the increased liability load. Target's liabilities-to-equity ratio increased during the year primarily due to a decrease in its equity. Target's liabilities-to-equity ratio decreased due to an increase in its equity