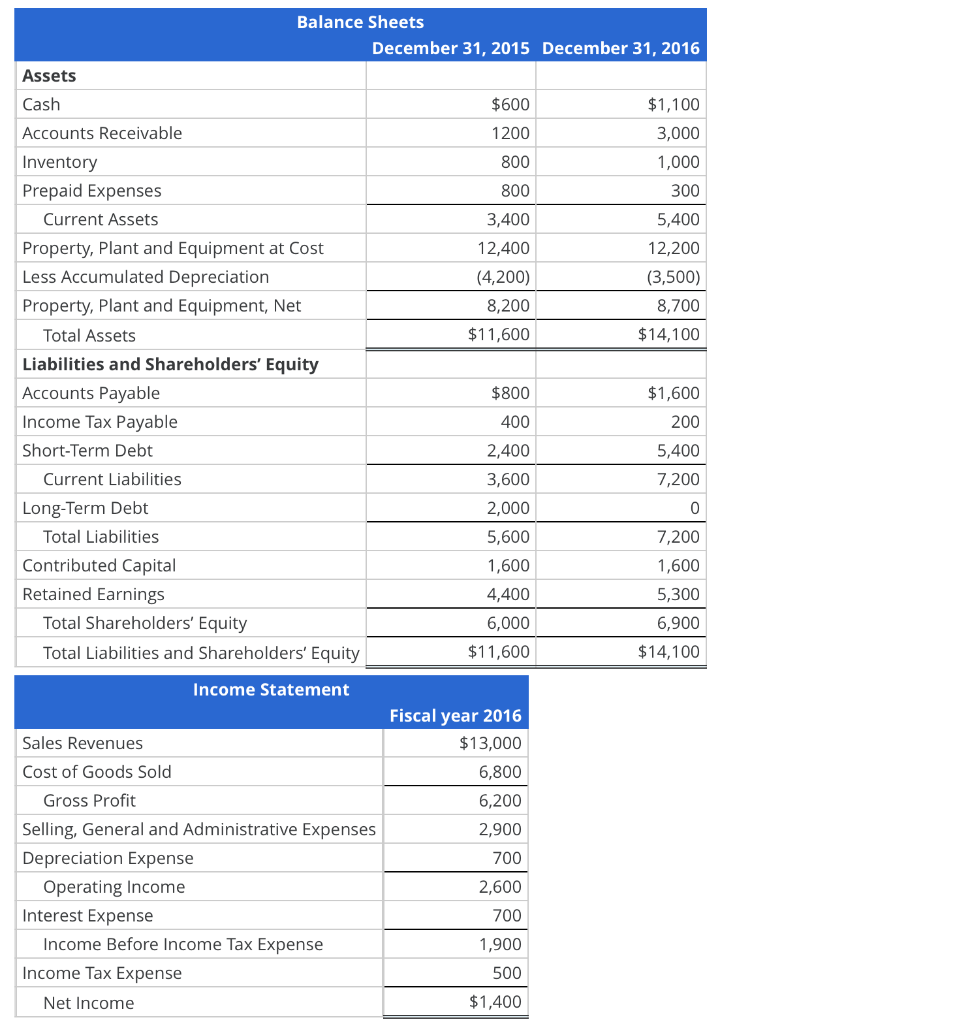

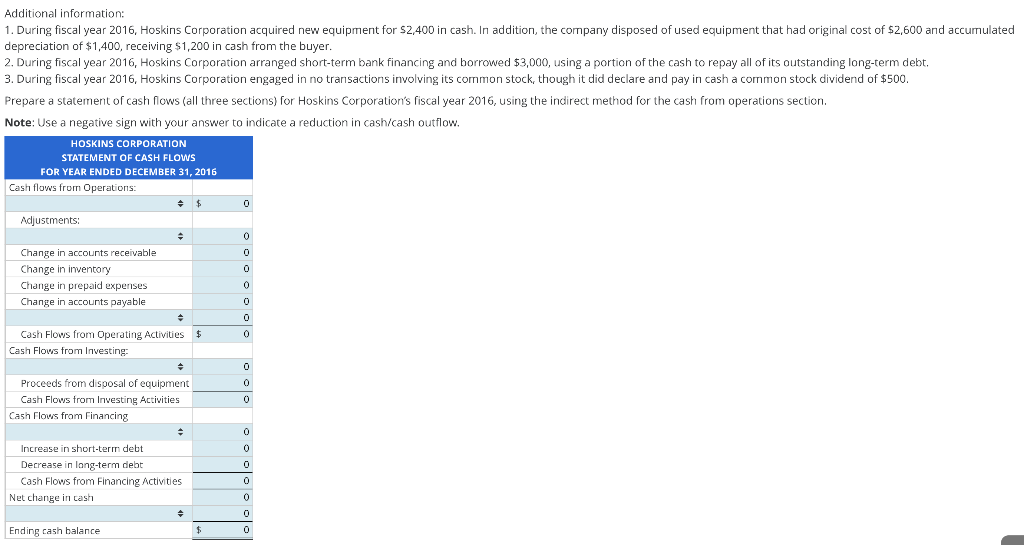

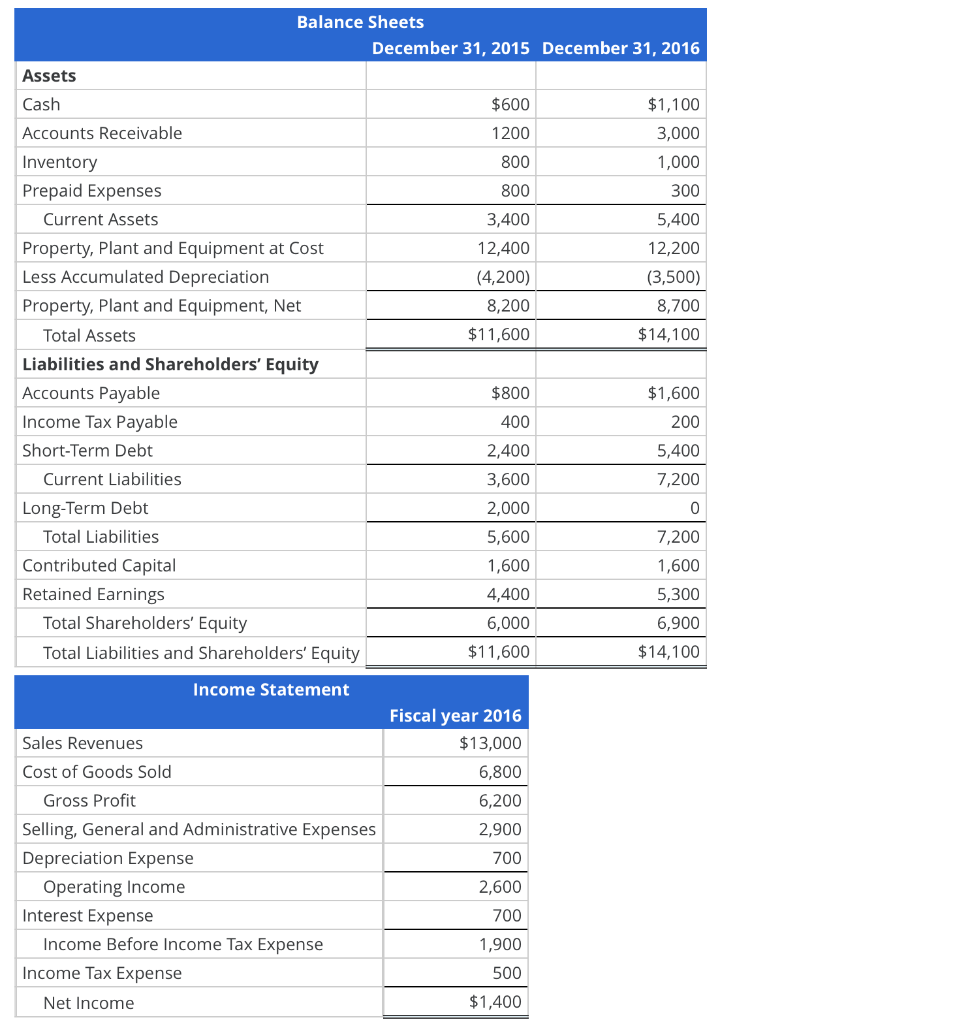

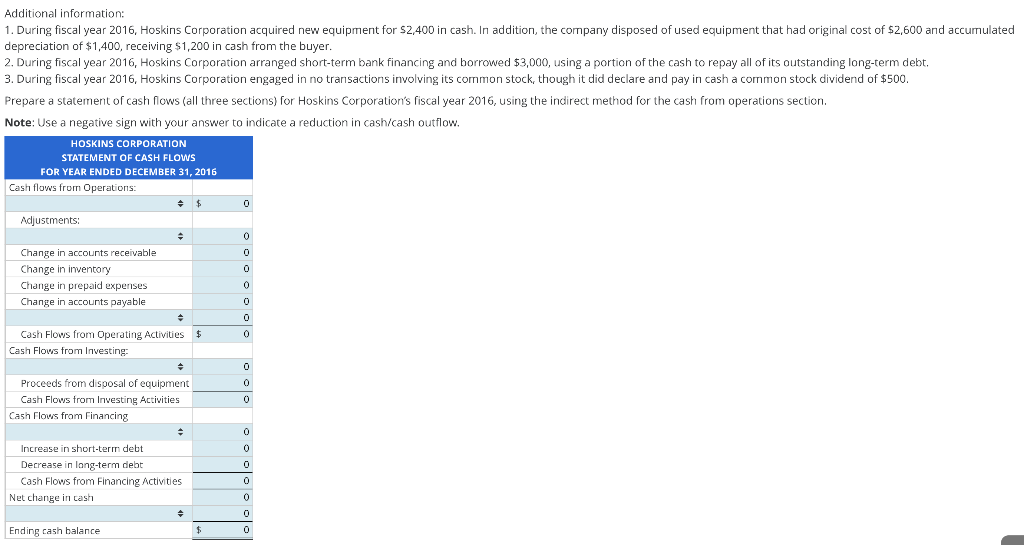

Balance Sheets December 31, 2015 December 31, 2016 Assets Cash $600 $1,100 3,000 Accounts Receivable 1200 800 1,000 300 800 3,400 12,400 (4,200) 8,200 5,400 12,200 (3,500) 8,700 $11,600 $14,100 $800 Inventory Prepaid Expenses Current Assets Property, Plant and Equipment at Cost Less Accumulated Depreciation Property, Plant and Equipment, Net Total Assets Liabilities and Shareholders' Equity Accounts Payable Income Tax Payable Short-Term Debt Current Liabilities Long-Term Debt Total Liabilities Contributed Capital Retained Earnings Total Shareholders' Equity Total Liabilities and Shareholders' Equity $1,600 200 400 5,400 7,200 0 7,200 2,400 3,600 2,000 5,600 1,600 4,400 6,000 $11,600 1,600 5,300 6,900 $14,100 Income Statement Sales Revenues Cost of Goods Sold Gross Profit Selling, General and Administrative Expenses Depreciation Expense Operating Income Interest Expense Income Before Income Tax Expense Income Tax Expense Net Income Fiscal year 2016 $13,000 6,800 6,200 2,900 700 2,600 700 1,900 500 $1,400 Additional information: 1. During fiscal year 2016, Hoskins Corporation acquired new equipment for 52,400 in cash. In addition, the company disposed of used equipment that had original cost of $2,600 and accumulated depreciation of $1,400, receiving $1,200 in cash from the buyer. 2. During fiscal year 2016, Hoskins Corporation arranged short-term bank financing and borrowed $3,000, using a portion of the cash to repay all of its outstanding long-term debt, During fiscal year 2016, Hoskins Corporation engaged in no transactions involving its common stock, though it did declare and pay in cash a common stock dividend of $500. Prepare a statement of cash flows (all three sections) for Hoskins Corporation's fiscal year 2016, using the indirect method for the cash from operations section. Note: Use a negative sign with your answer to indicate a reduction in cash/cash outflow, HOSKINS CORPORATION STATEMENT OF CASH FLOWS FOR YEAR ENDED DECEMBER 31, 2016 Cash flows from Operations Adjustments: 0 0 0 Change in accounts receivable Change in inventory Change in prepaid expenses Change in accounts payable 0 0 0 0 Cash Flows from Operating Activities $ Cash Flows from Investing Proceeds from disposal of equipment Cash Flows from Investing Activities Cash Flows from Financing 0 0 0 0 0 Increase in short-term debt Decrease in long-term debt Cash Flows from Financing Activities Net change in tash 0 0 0 Ending cash balance 0