Answered step by step

Verified Expert Solution

Question

1 Approved Answer

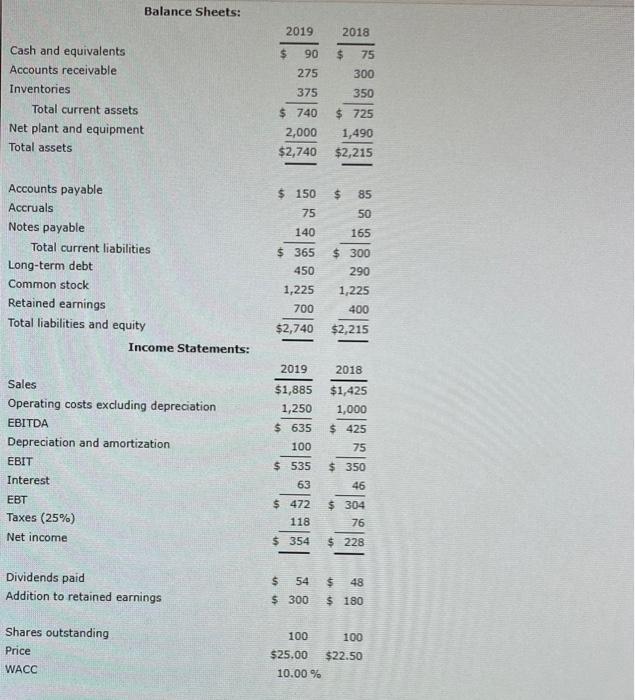

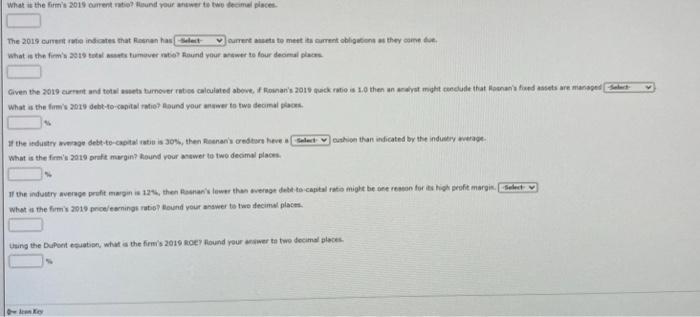

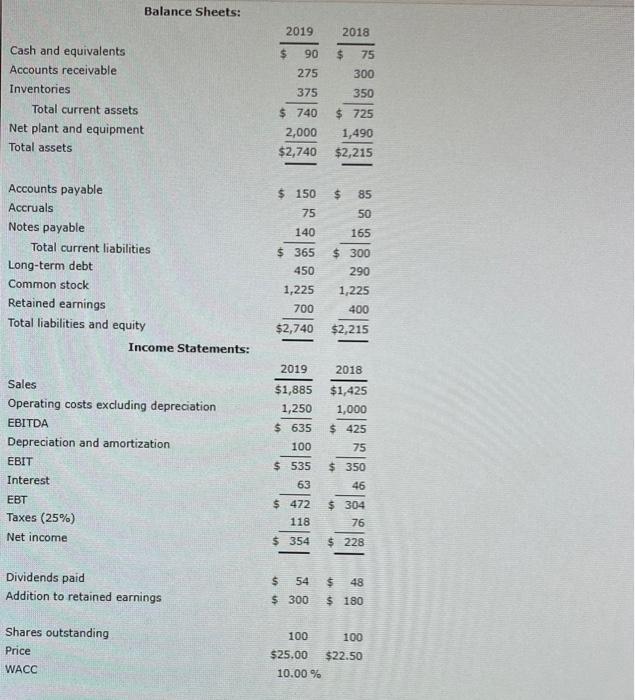

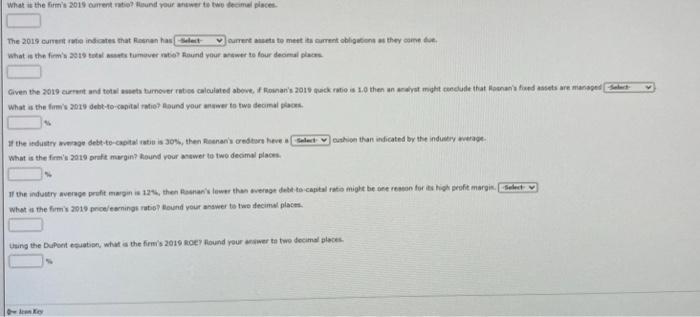

Balance Sheets: The 2019 currert rabe insicates that fissnan has surrert ausete to mett its cament obligecions of they come lue. What is the finmis

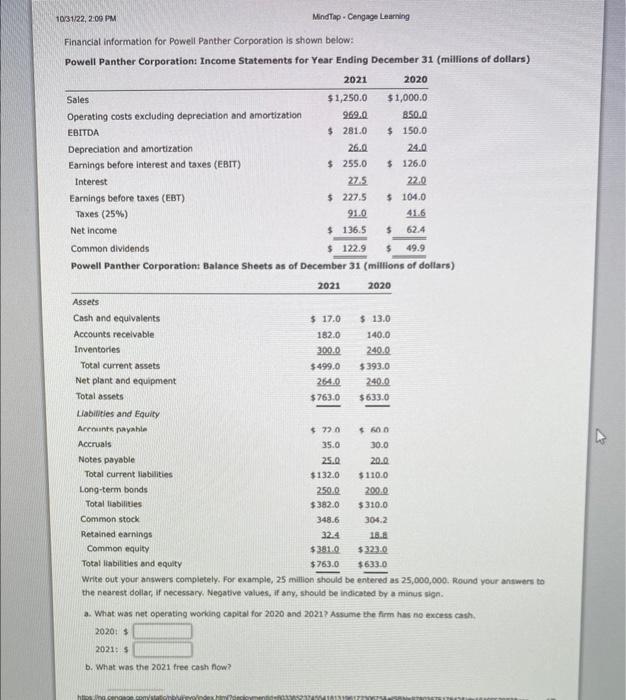

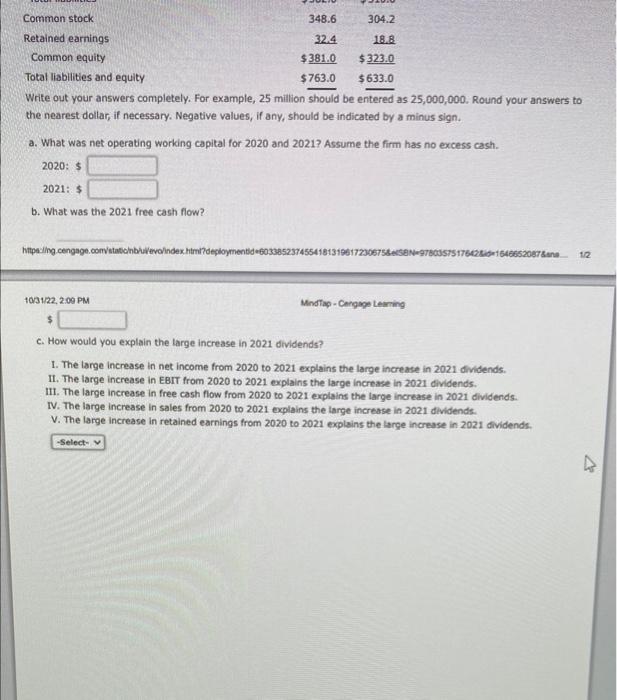

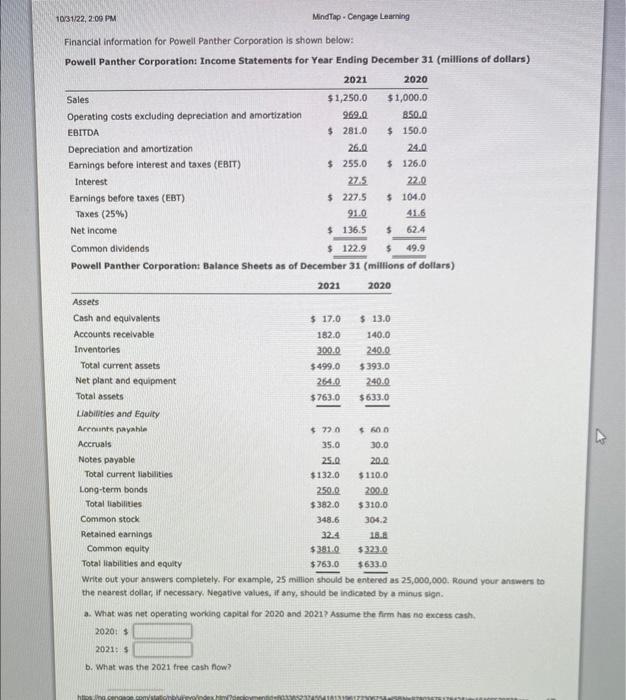

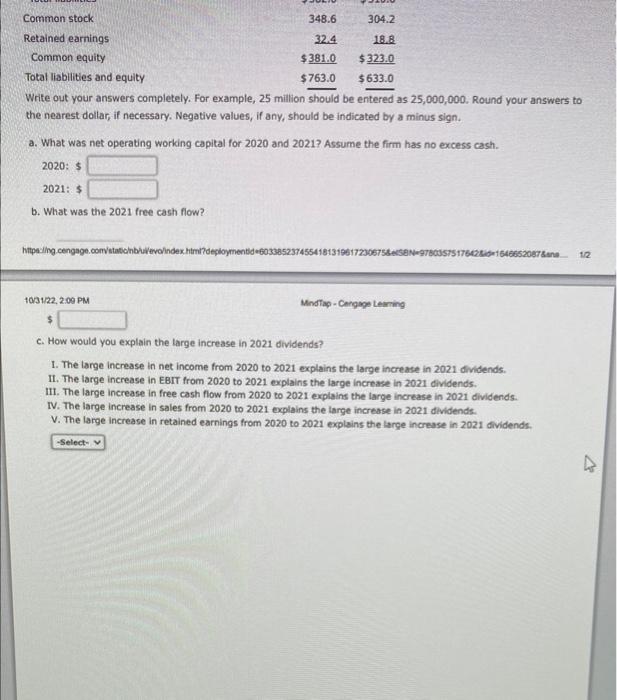

Balance Sheets: The 2019 currert rabe insicates that fissnan has surrert ausete to mett its cament obligecions of they come lue. What is the finmis 2010 debt-to-capital rahe? Alound your andwer to twe decimal placks. Eathion than inficated by the induery werageWhat is the firmis 2019 procieeninge ratist Eound yout arswer to twe fecimal placen. 1031/22,2.00fM Mindtap - Cengage Learning Financial information for Poweil Panther Corporation is shown below: Powell Panther Corporation: Income Statements for Year Ending December 31 (millions of dollars) Write out your answers completely. For example, 25 million should be entered as 25,000,000. Round your antwers to the nearest dollar, if necessary. Negative values, if any, should be indicated by a minus sign. a. What was net operating working captal for 2020 and 2021? Assume the firm has ne excess cash. 2020:3 2021:5 b. What was the 2021 free cash fow? Write out your answers completely. For example, 25 million should be entered as 25,000,000, Round your answers to the nearest dollar, if necessary. Negative values, if any, should be indicated by a minus sign. a. What was net operating working capital for 2020 and 2021 ? Assume the firm has no excess cash. 2020:$2021:$ b. What was the 2021 free cash flow? 1031/22,2.09PM Mndtap - Corgige Lesing c. How would you explain the large increase in 2021 dividends? 1. The large increase in net income from 2020 to 2021 explains the large increase in 2021 dividends. II. The large increase in EBIT from 2020 to 2021 explains the large increase in 2021 dividends. III. The large increase in free cash flow from 2020 to 2021 explains the large increase in 2021 dividends. IV. The large increase in sales from 2020 to 2021 explains the large increase in 2021 dividends. V. The large increase in retained earnings from 2020 to 2021 explains the large increase in 2021 dividends. Balance Sheets: The 2019 currert rabe insicates that fissnan has surrert ausete to mett its cament obligecions of they come lue. What is the finmis 2010 debt-to-capital rahe? Alound your andwer to twe decimal placks. Eathion than inficated by the induery werageWhat is the firmis 2019 procieeninge ratist Eound yout arswer to twe fecimal placen. 1031/22,2.00fM Mindtap - Cengage Learning Financial information for Poweil Panther Corporation is shown below: Powell Panther Corporation: Income Statements for Year Ending December 31 (millions of dollars) Write out your answers completely. For example, 25 million should be entered as 25,000,000. Round your antwers to the nearest dollar, if necessary. Negative values, if any, should be indicated by a minus sign. a. What was net operating working captal for 2020 and 2021? Assume the firm has ne excess cash. 2020:3 2021:5 b. What was the 2021 free cash fow? Write out your answers completely. For example, 25 million should be entered as 25,000,000, Round your answers to the nearest dollar, if necessary. Negative values, if any, should be indicated by a minus sign. a. What was net operating working capital for 2020 and 2021 ? Assume the firm has no excess cash. 2020:$2021:$ b. What was the 2021 free cash flow? 1031/22,2.09PM Mndtap - Corgige Lesing c. How would you explain the large increase in 2021 dividends? 1. The large increase in net income from 2020 to 2021 explains the large increase in 2021 dividends. II. The large increase in EBIT from 2020 to 2021 explains the large increase in 2021 dividends. III. The large increase in free cash flow from 2020 to 2021 explains the large increase in 2021 dividends. IV. The large increase in sales from 2020 to 2021 explains the large increase in 2021 dividends. V. The large increase in retained earnings from 2020 to 2021 explains the large increase in 2021 dividends

Balance Sheets: The 2019 currert rabe insicates that fissnan has surrert ausete to mett its cament obligecions of they come lue. What is the finmis 2010 debt-to-capital rahe? Alound your andwer to twe decimal placks. Eathion than inficated by the induery werageWhat is the firmis 2019 procieeninge ratist Eound yout arswer to twe fecimal placen. 1031/22,2.00fM Mindtap - Cengage Learning Financial information for Poweil Panther Corporation is shown below: Powell Panther Corporation: Income Statements for Year Ending December 31 (millions of dollars) Write out your answers completely. For example, 25 million should be entered as 25,000,000. Round your antwers to the nearest dollar, if necessary. Negative values, if any, should be indicated by a minus sign. a. What was net operating working captal for 2020 and 2021? Assume the firm has ne excess cash. 2020:3 2021:5 b. What was the 2021 free cash fow? Write out your answers completely. For example, 25 million should be entered as 25,000,000, Round your answers to the nearest dollar, if necessary. Negative values, if any, should be indicated by a minus sign. a. What was net operating working capital for 2020 and 2021 ? Assume the firm has no excess cash. 2020:$2021:$ b. What was the 2021 free cash flow? 1031/22,2.09PM Mndtap - Corgige Lesing c. How would you explain the large increase in 2021 dividends? 1. The large increase in net income from 2020 to 2021 explains the large increase in 2021 dividends. II. The large increase in EBIT from 2020 to 2021 explains the large increase in 2021 dividends. III. The large increase in free cash flow from 2020 to 2021 explains the large increase in 2021 dividends. IV. The large increase in sales from 2020 to 2021 explains the large increase in 2021 dividends. V. The large increase in retained earnings from 2020 to 2021 explains the large increase in 2021 dividends. Balance Sheets: The 2019 currert rabe insicates that fissnan has surrert ausete to mett its cament obligecions of they come lue. What is the finmis 2010 debt-to-capital rahe? Alound your andwer to twe decimal placks. Eathion than inficated by the induery werageWhat is the firmis 2019 procieeninge ratist Eound yout arswer to twe fecimal placen. 1031/22,2.00fM Mindtap - Cengage Learning Financial information for Poweil Panther Corporation is shown below: Powell Panther Corporation: Income Statements for Year Ending December 31 (millions of dollars) Write out your answers completely. For example, 25 million should be entered as 25,000,000. Round your antwers to the nearest dollar, if necessary. Negative values, if any, should be indicated by a minus sign. a. What was net operating working captal for 2020 and 2021? Assume the firm has ne excess cash. 2020:3 2021:5 b. What was the 2021 free cash fow? Write out your answers completely. For example, 25 million should be entered as 25,000,000, Round your answers to the nearest dollar, if necessary. Negative values, if any, should be indicated by a minus sign. a. What was net operating working capital for 2020 and 2021 ? Assume the firm has no excess cash. 2020:$2021:$ b. What was the 2021 free cash flow? 1031/22,2.09PM Mndtap - Corgige Lesing c. How would you explain the large increase in 2021 dividends? 1. The large increase in net income from 2020 to 2021 explains the large increase in 2021 dividends. II. The large increase in EBIT from 2020 to 2021 explains the large increase in 2021 dividends. III. The large increase in free cash flow from 2020 to 2021 explains the large increase in 2021 dividends. IV. The large increase in sales from 2020 to 2021 explains the large increase in 2021 dividends. V. The large increase in retained earnings from 2020 to 2021 explains the large increase in 2021 dividends

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started