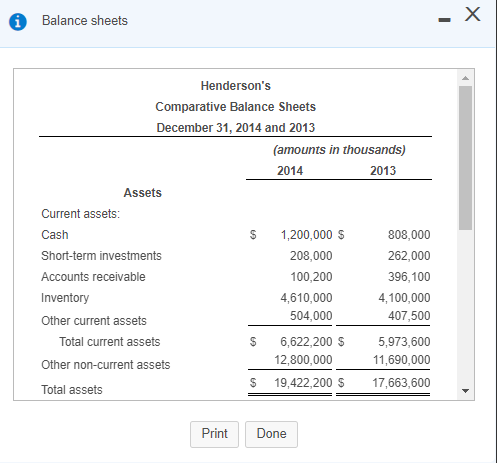

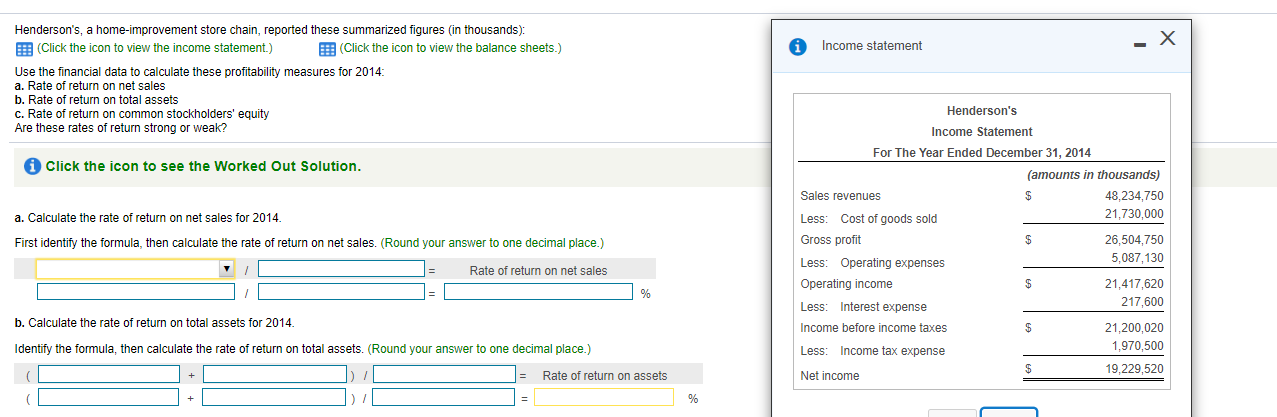

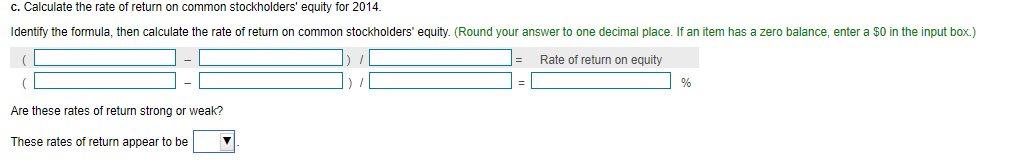

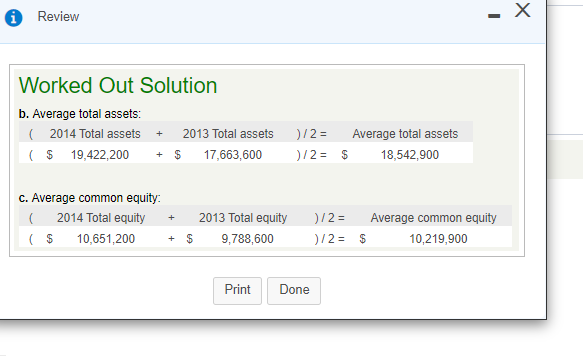

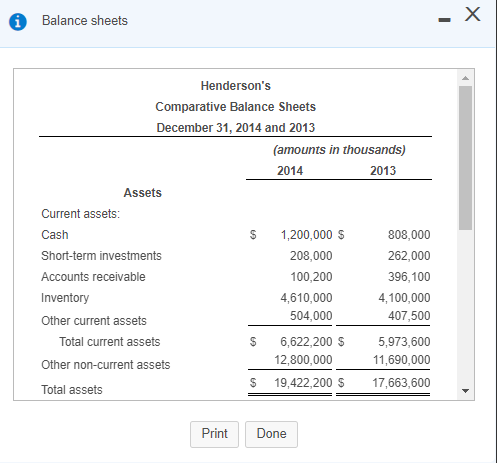

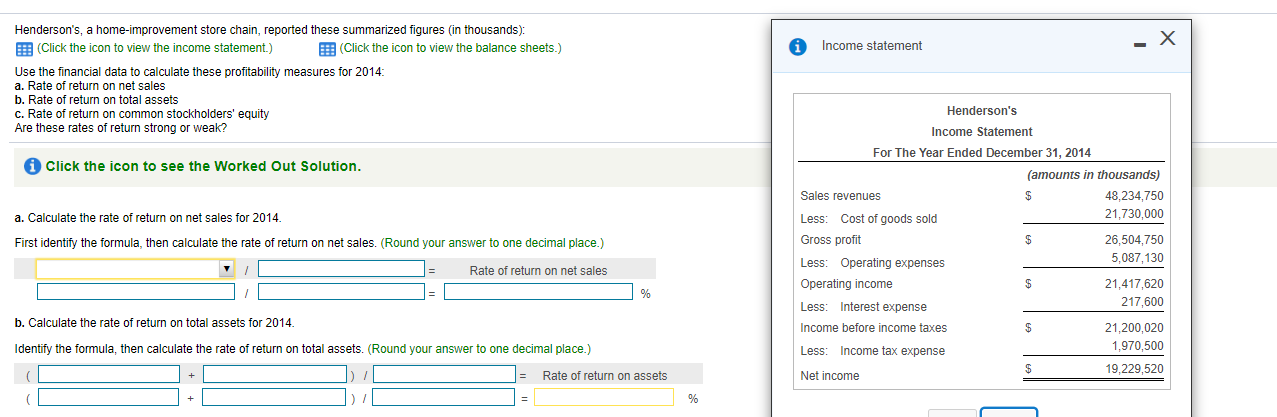

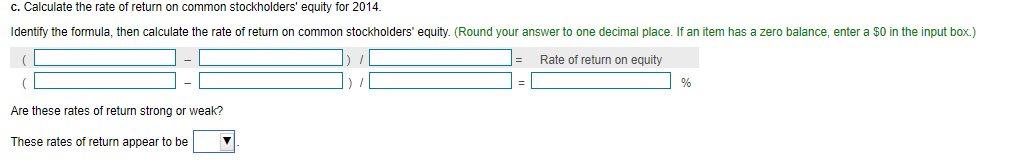

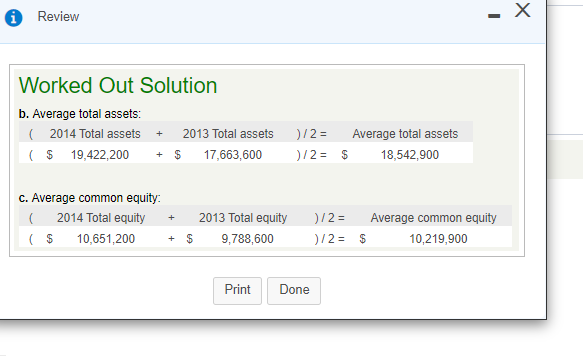

Balance sheets - X Henderson's Comparative Balance Sheets December 31, 2014 and 2013 (amounts in thousands) 2014 2013 Assets Current assets: Cash $ 1,200,000 $ 808,000 Short-term investments 208,000 262,000 Accounts receivable 100,200 396,100 Inventory 4,610,000 4,100,000 Other current assets 504,000 407,500 Total current assets $ 6,622,200 $ 5,973,600 Other non-current assets 12,800,000 11,690,000 Total assets $ 19,422,200 $ 17,663,600 Print Done Income statement Henderson's, a home-improvement store chain, reported these summarized figures in thousands): (Click the icon to view the income statement.) (Click the icon to view the balance sheets.) Use the financial data to calculate these profitability measures for 2014: a. Rate of return on net sales b. Rate of return on total assets c. Rate of return on common stockholders' equity Are these rates of return strong or weak? Click the icon to see the worked Out Solution. a. Calculate the rate of return on net sales for 2014. First identify the formula, then calculate the rate of return on net sales. (Round your answer to one decimal place.) Henderson's Income Statement For The Year Ended December 31, 2014 (amounts in thousands) Sales revenues $ 48,234,750 Less Cost of goods sold 21,730,000 Gross profit $ 26,504,750 Less: Operating expenses 5,087,130 Operating income $ 21,417,620 Less: Interest expense 217,600 Income before income taxes $ 21,200,020 Less: Income tax expense Net income $ 19,229,520 Rate of return on net sales b. Calculate the rate of return on total assets for 2014. Identify the formula, then calculate the rate of return on total assets. (Round your answer to one decimal place.) 1,970,500 Rate of return on assets C. Calculate the rate of return on common stockholders' equity for 2014. Identify the formula, then calculate the rate of return on common stockholders' equity. (Round your answer to one decimal place. If an item has a zero balance, enter a $0 in the input box.) Rate of return on equity % Are these rates of return strong or weak? These rates of return appear to be 1 Review - Worked Out Solution b. Average total assets: (2014 Total assets 2013 Total assets ( $ 19,422,200 + $ 17,663,600 )/2 = Average total assets 1/2 = $ 18,542,900 C. Average common equity: ( 2014 Total equity ($ 10,651,200 + $ + 2013 Total equity 9,788,600 1/2 = Average common equity )/2 = $ 10,219,900 Print Done