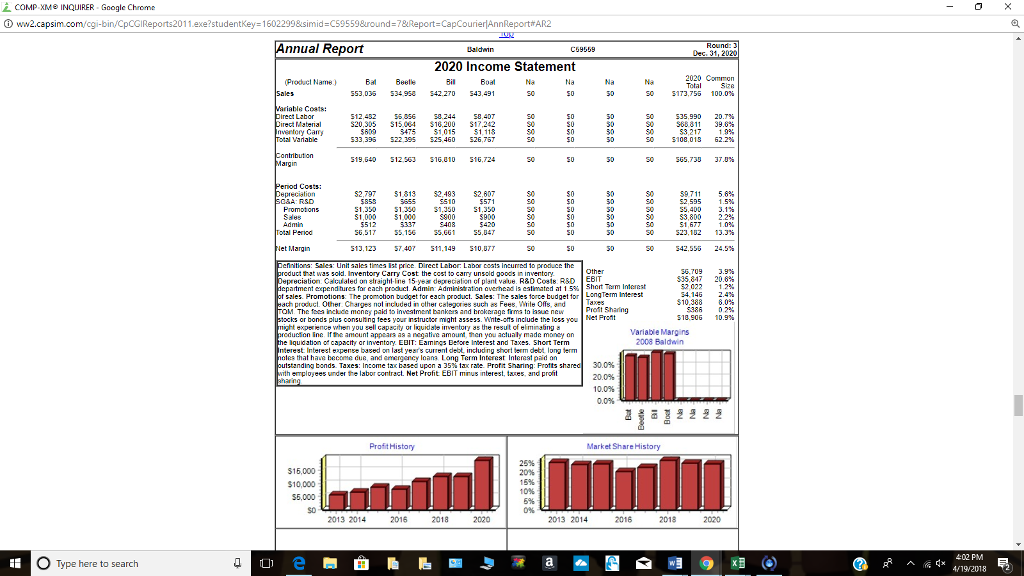

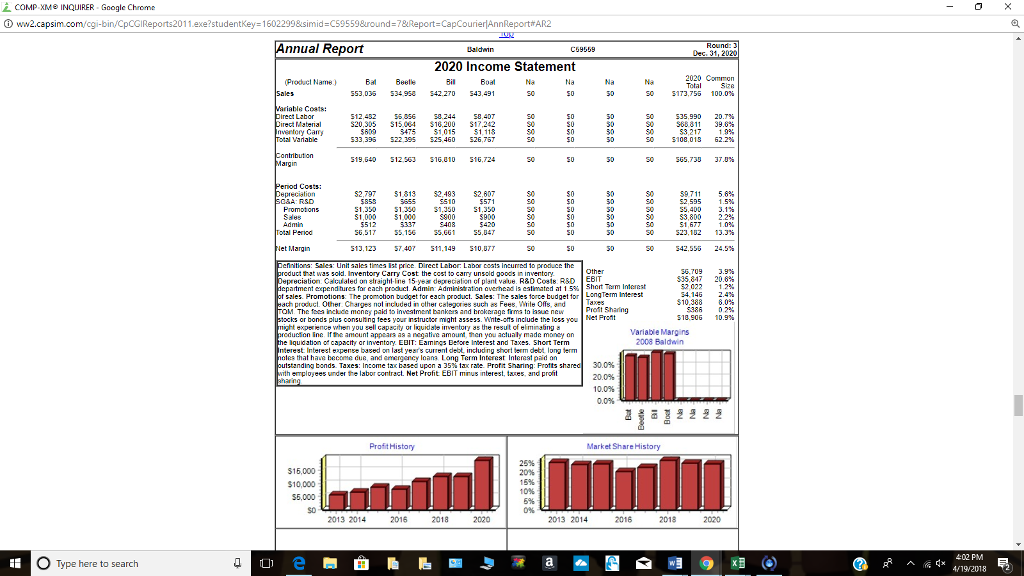

Baldwin has negotiated a new labor contract for the next round that will affect the cost for their product Bat. Labor costs will go from $7.91 to $8.41 per unit. In addition, their material costs have fallen from $13.66 to $12.66. Assume all period costs as reported on Baldwin's Income Statement remain the same. If Baldwin were to pass on half the new costs of labor and half the savings in materials to customers by adjusting the price of their product, how many units of product Bat would need to be sold next round to break even on the product?

COMP XM INQUIRER Google Chrome ? ww2.capsim.com cgi-bin/CpCGIReports2011 exe?studentKey=1602299&simid=CS9559&round=7&Report-CapCourier AnnReportrAR2 nnual Report Dec. 31, 2020 2020 Income Statement 2020 Comson Product Name) 553,035 534 9 42 270 543,491 50 50 S173.755 100.0% 12.452 55856 244 58,40 S20,305 1504 18,200 17,242 39.6% rect Matenal nventory Cany S0 5600 3475 1,015 1,118 $3,217 533,39 522 395 S 460 526,757 19,640 12 1 316,010 516,724 S2,797 1813 2493 $2,607 30 59 711 56% 1,3 5.330 31,350 51,350 S5.400 $3.800 3.1% 2.2% 900 S1,000 1000 S6,517 55156 5661 55,047 13,123 5740 1,149 510,UTT let Margn 542.556 24.5% coats incun uct that was sold. Inventory Carry Cost the cest to cary unsold goods in inventory EBIT $35,847 20.6% eciation. Caculaled an straighl-ine 15 year degreciation of plant vaue. R&0 Cost R&O EE epartmentexpendtures fr each prodel Admin Administratonoverheadis estimated at 1 5% hort Trm Interest s. Promotions The promobon budget for each product. Sales: The sales torte tudget tor LongTerm Inerest ach product Other Charges nol roluded in clhe' elogor es such ?8 Fee8. Vitite 0??, and $10.388 8.0% The fos incluce money paid to inveatment bankars and brokorage frms to aue new cks orbonds plus consuling fees your instructor might 35555. Wnte-ts include the loss you Nei Pron might experience when you sell capscity or liquidale inventory as the result cfelmnating ? cducion inc Ithe amcunt appears as anegati amount, then you actualy made money on quidabon of capacity ar inventory EBIT: Eamings Before Interest and Taxes. Short Term VariableMargins 2008 Baldwin nterest Interest expense based on last years current debt includ ng short term debt long term oles that have become due, and emengoncy loana Long Term Intereat Interast paid on bonds Taxes: Income tac based upon a 35% tax rate Profit Sharin Protts ith emplogees under the labor contract. Net Profit EBIT minus interest, taxes, and pront 20.0% 10.0% 0.0% ProfitHistory Market Share History 25% 16,000 $10,000 S5,000 16% 10% 5% 2013 2014 2016 018 2013 2014 2018 2020 402 PM O Type here to search COMP XM INQUIRER Google Chrome ? ww2.capsim.com cgi-bin/CpCGIReports2011 exe?studentKey=1602299&simid=CS9559&round=7&Report-CapCourier AnnReportrAR2 nnual Report Dec. 31, 2020 2020 Income Statement 2020 Comson Product Name) 553,035 534 9 42 270 543,491 50 50 S173.755 100.0% 12.452 55856 244 58,40 S20,305 1504 18,200 17,242 39.6% rect Matenal nventory Cany S0 5600 3475 1,015 1,118 $3,217 533,39 522 395 S 460 526,757 19,640 12 1 316,010 516,724 S2,797 1813 2493 $2,607 30 59 711 56% 1,3 5.330 31,350 51,350 S5.400 $3.800 3.1% 2.2% 900 S1,000 1000 S6,517 55156 5661 55,047 13,123 5740 1,149 510,UTT let Margn 542.556 24.5% coats incun uct that was sold. Inventory Carry Cost the cest to cary unsold goods in inventory EBIT $35,847 20.6% eciation. Caculaled an straighl-ine 15 year degreciation of plant vaue. R&0 Cost R&O EE epartmentexpendtures fr each prodel Admin Administratonoverheadis estimated at 1 5% hort Trm Interest s. Promotions The promobon budget for each product. Sales: The sales torte tudget tor LongTerm Inerest ach product Other Charges nol roluded in clhe' elogor es such ?8 Fee8. Vitite 0??, and $10.388 8.0% The fos incluce money paid to inveatment bankars and brokorage frms to aue new cks orbonds plus consuling fees your instructor might 35555. Wnte-ts include the loss you Nei Pron might experience when you sell capscity or liquidale inventory as the result cfelmnating ? cducion inc Ithe amcunt appears as anegati amount, then you actualy made money on quidabon of capacity ar inventory EBIT: Eamings Before Interest and Taxes. Short Term VariableMargins 2008 Baldwin nterest Interest expense based on last years current debt includ ng short term debt long term oles that have become due, and emengoncy loana Long Term Intereat Interast paid on bonds Taxes: Income tac based upon a 35% tax rate Profit Sharin Protts ith emplogees under the labor contract. Net Profit EBIT minus interest, taxes, and pront 20.0% 10.0% 0.0% ProfitHistory Market Share History 25% 16,000 $10,000 S5,000 16% 10% 5% 2013 2014 2016 018 2013 2014 2018 2020 402 PM O Type here to search