Answered step by step

Verified Expert Solution

Question

1 Approved Answer

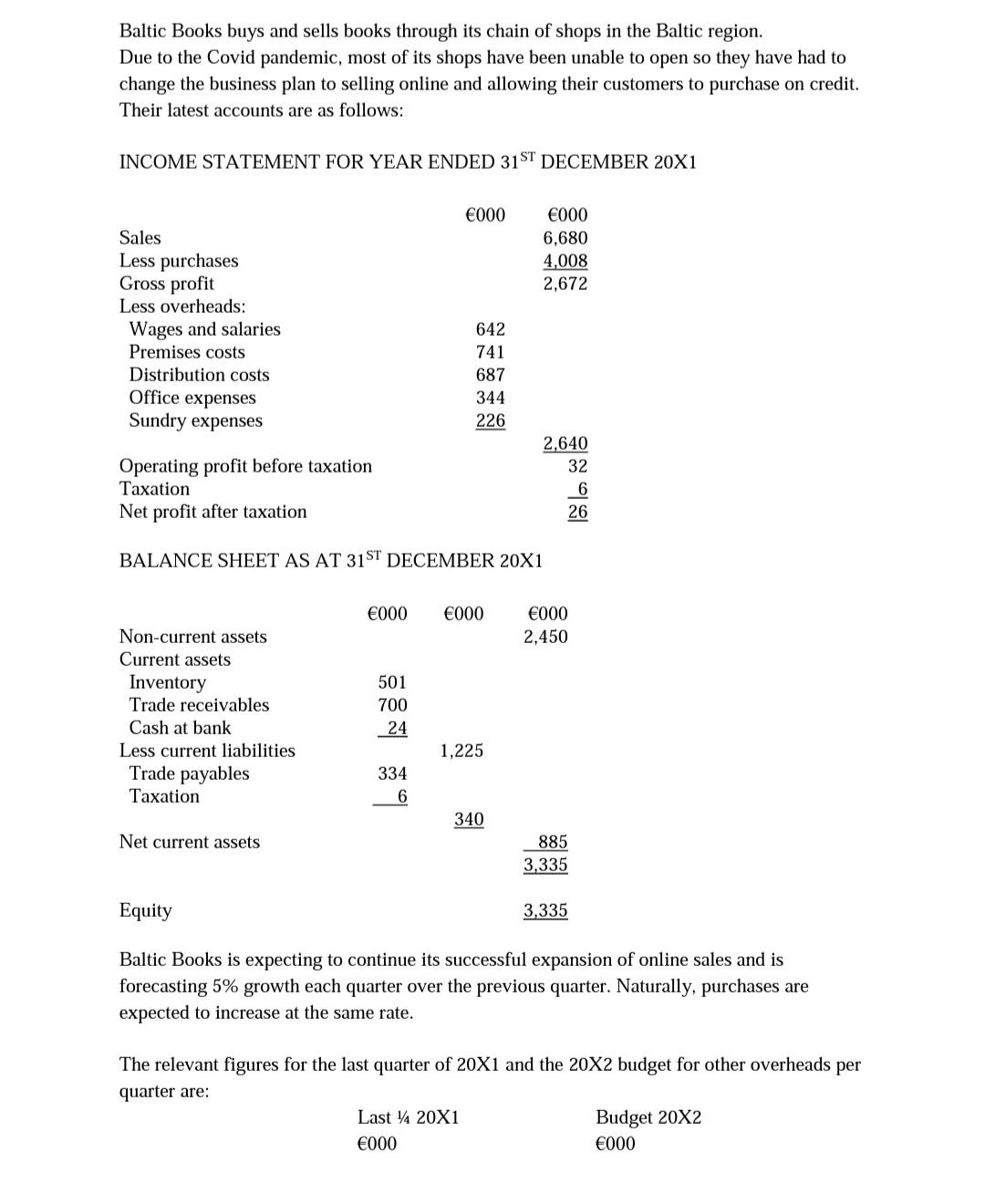

Baltic Books buys and sells books through its chain of shops in the Baltic region. Due to the Covid pandemic, most of its shops

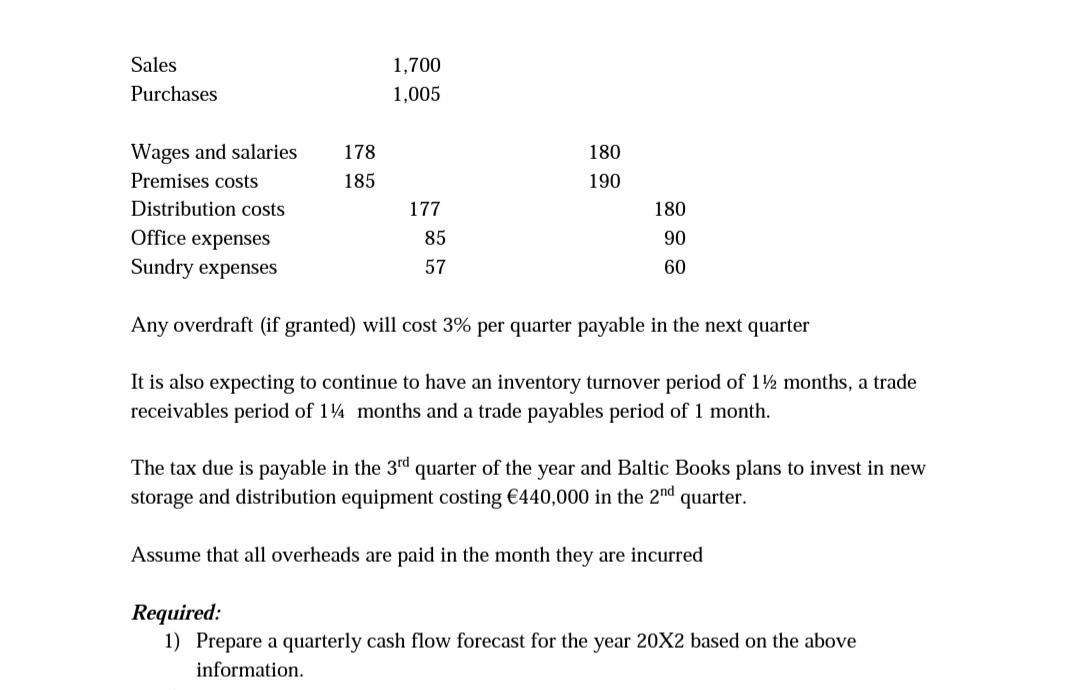

Baltic Books buys and sells books through its chain of shops in the Baltic region. Due to the Covid pandemic, most of its shops have been unable to open so they have had to change the business plan to selling online and allowing their customers to purchase on credit. Their latest accounts are as follows: INCOME STATEMENT FOR YEAR ENDED 31ST DECEMBER 20X1 Sales Less purchases Gross profit Less overheads: Wages and salaries Premises costs Distribution costs Office expenses Sundry expenses Non-current assets Current assets Inventory Trade receivables Cash at bank Less current liabilities Trade payables Taxation Net current assets Operating profit before taxation Taxation Net profit after taxation BALANCE SHEET AS AT 31ST DECEMBER 20X1 501 700 24 000 000 000 334 6 642 741 687 344 226 1,225 340 000 6,680 4,008 2,672 Last 4 20X1 000 2,640 32 6 26 000 2,450 885 3,335 Equity Baltic Books is expecting to continue its successful expansion of online sales and is forecasting 5% growth each quarter over the previous quarter. Naturally, purchases are expected to increase at the same rate. 3,335 The relevant figures for the last quarter of 20X1 and the 20X2 budget for other overheads per quarter are: Budget 20X2 000 Sales Purchases Wages and salaries Premises costs Distribution costs Office expenses Sundry expenses 178 185 1,700 1,005 177 85 57 180 190 180 90 60 Any overdraft (if granted) will cost 3% per quarter payable in the next quarter It is also expecting to continue to have an inventory turnover period of 1 months, a trade receivables period of 144 months and a trade payables period of 1 month. The tax due is payable in the 3rd quarter of the year and Baltic Books plans to invest in new storage and distribution equipment costing 440,000 in the 2nd quarter. Assume that all overheads are paid in the month they are incurred Required: 1) Prepare a quarterly cash flow forecast for the year 20X2 based on the above information.

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started