Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BAM Inc. has just received its sales and expense report for November, which follows. Item Sales commissions Amount $300,000 100,000 Sales staff salaries Telephone

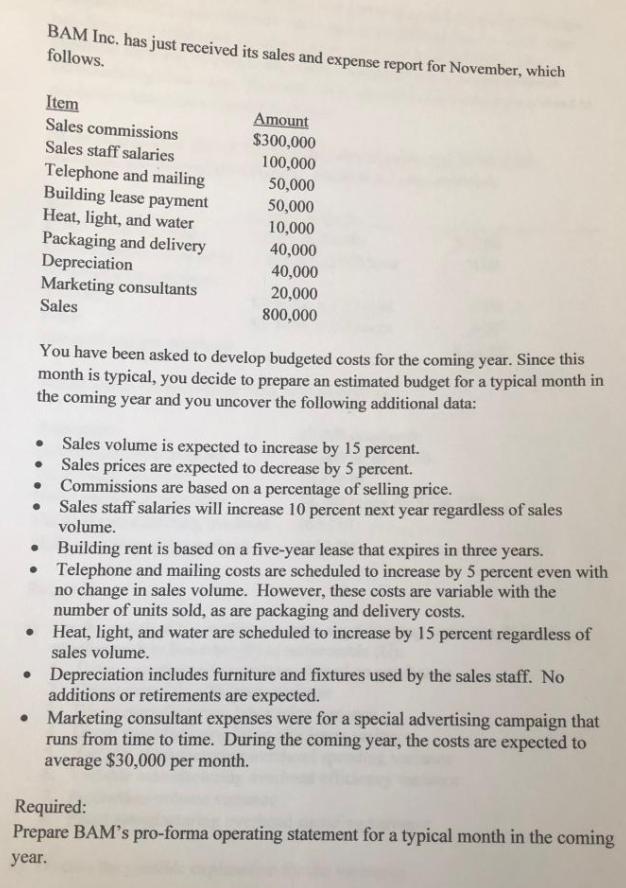

BAM Inc. has just received its sales and expense report for November, which follows. Item Sales commissions Amount $300,000 100,000 Sales staff salaries Telephone and mailing Building lease payment Heat, light, and water Packaging and delivery Depreciation Marketing consultants 50,000 50,000 10,000 40,000 40,000 20,000 Sales 800,000 You have been asked to develop budgeted costs for the coming year. Since this month is typical, you decide to prepare an estimated budget for a typical month in the coming year and you uncover the following additional data: Sales volume is expected to increase by 15 percent. Sales prices are expected to decrease by 5 percent. Commissions are based on a percentage of selling price. Sales staff salaries will increase 10 percent next year regardless of sales volume. Building rent is based on a five-year lease that expires in three years. Telephone and mailing costs are scheduled to increase by 5 percent even with no change in sales volume. However, these costs are variable with the number of units sold, as are packaging and delivery costs. Heat, light, and water are scheduled to increase by 15 percent regardless of sales volume. Depreciation includes furniture and fixtures used by the sales staff. No additions or retirements are expected. Marketing consultant expenses were for a special advertising campaign that runs from time to time. During the coming year, the costs are expected to average $30,000 per month. Required: Prepare BAM's pro-forma operating statement for a typical month in the coming year. BAM Inc. has just received its sales and expense report for November, which follows. Item Sales commissions Amount $300,000 100,000 Sales staff salaries Telephone and mailing Building lease payment Heat, light, and water Packaging and delivery Depreciation Marketing consultants 50,000 50,000 10,000 40,000 40,000 20,000 Sales 800,000 You have been asked to develop budgeted costs for the coming year. Since this month is typical, you decide to prepare an estimated budget for a typical month in the coming year and you uncover the following additional data: Sales volume is expected to increase by 15 percent. Sales prices are expected to decrease by 5 percent. Commissions are based on a percentage of selling price. Sales staff salaries will increase 10 percent next year regardless of sales volume. Building rent is based on a five-year lease that expires in three years. Telephone and mailing costs are scheduled to increase by 5 percent even with no change in sales volume. However, these costs are variable with the number of units sold, as are packaging and delivery costs. Heat, light, and water are scheduled to increase by 15 percent regardless of sales volume. Depreciation includes furniture and fixtures used by the sales staff. No additions or retirements are expected. Marketing consultant expenses were for a special advertising campaign that runs from time to time. During the coming year, the costs are expected to average $30,000 per month. Required: Prepare BAM's pro-forma operating statement for a typical month in the coming year.

Step by Step Solution

★★★★★

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Operating profit 124375 Particulars Amount Sales 800000 Sales commision ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started