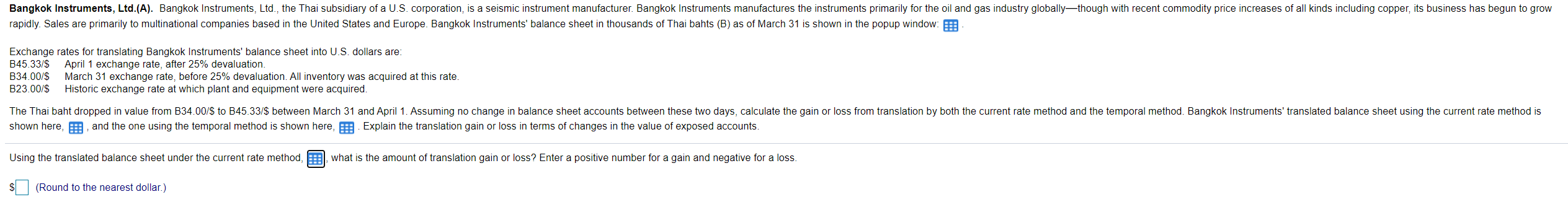

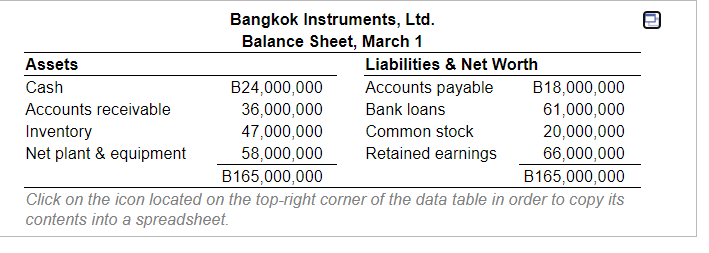

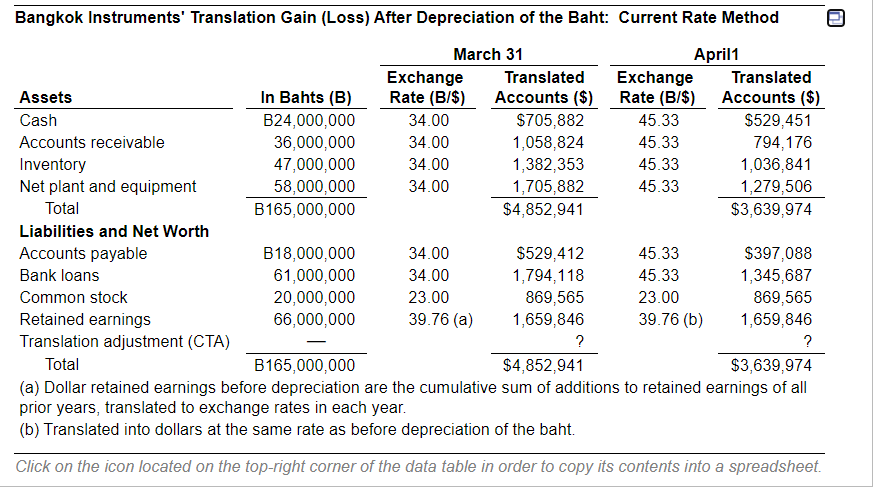

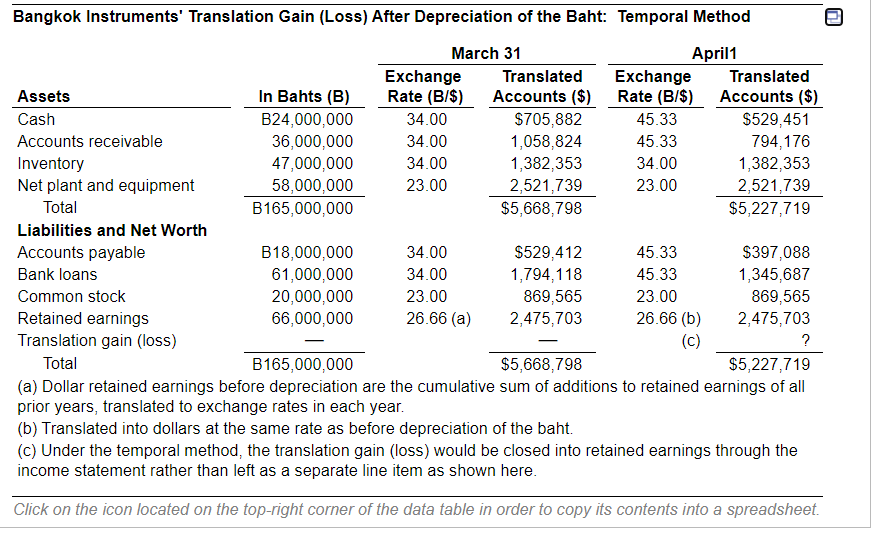

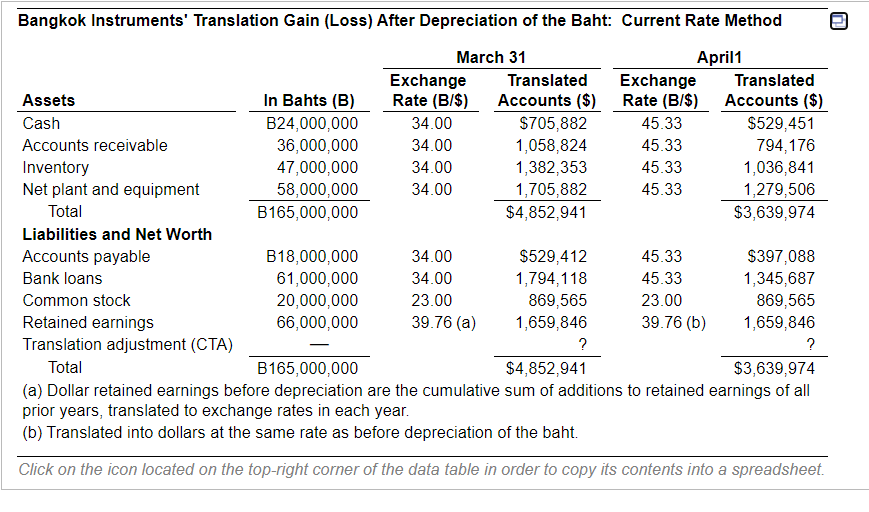

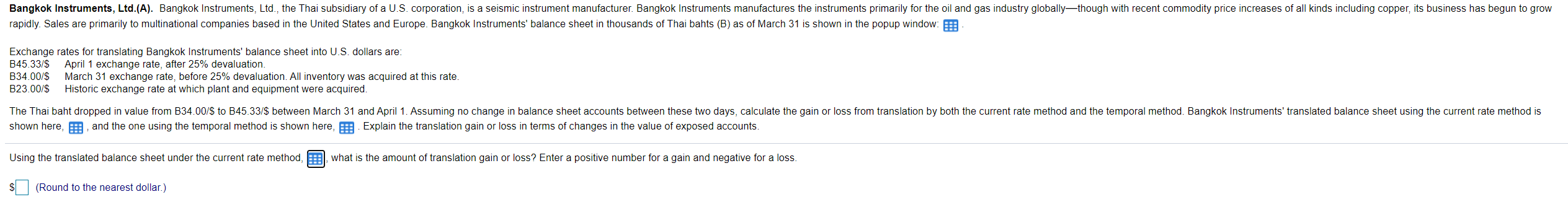

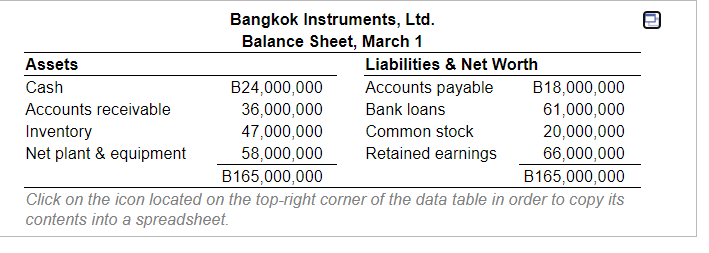

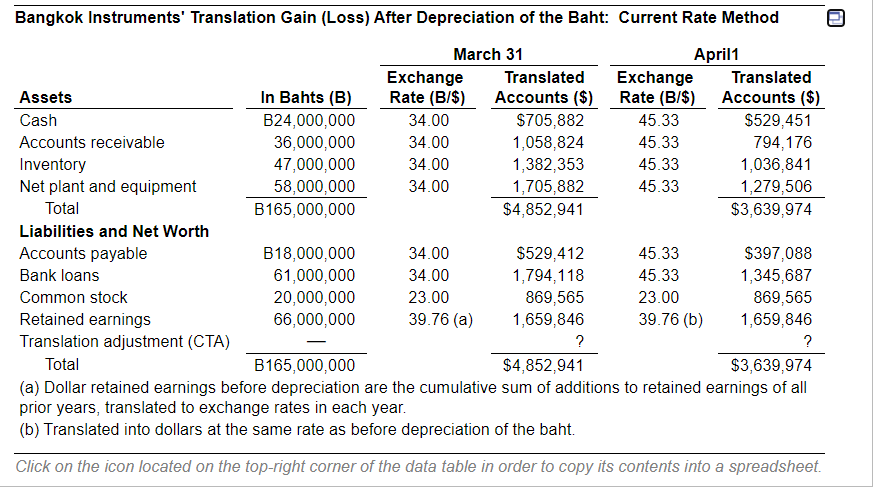

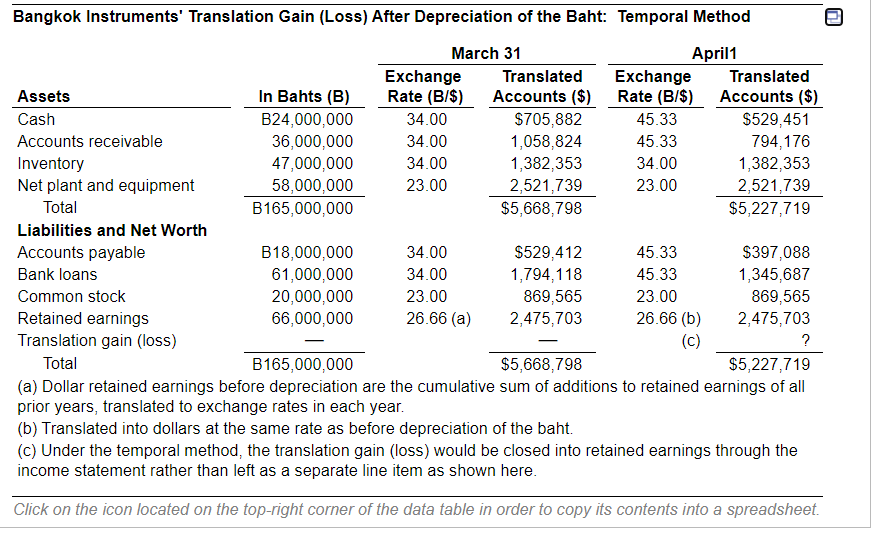

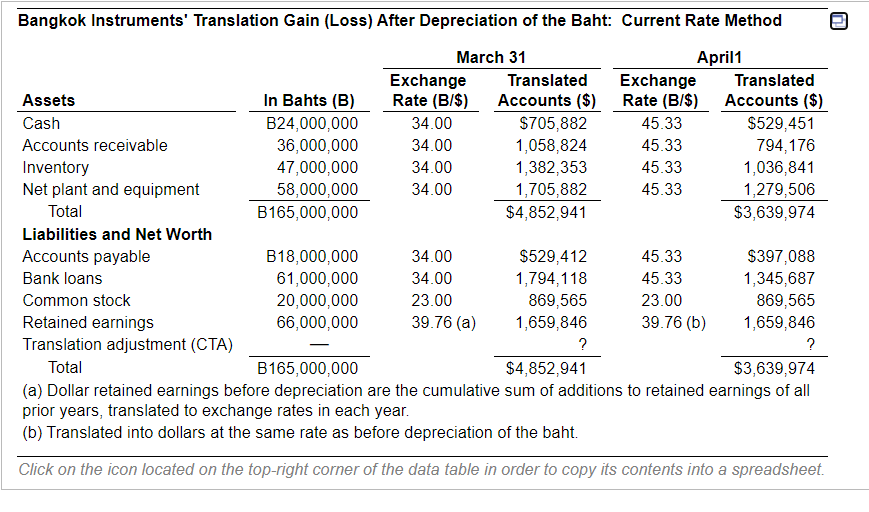

Bangkok Instruments, Ltd.(A). Bangkok Instruments, Ltd., the Thai subsidiary of a U.S. corporation, is a seismic instrument manufacturer. Bangkok Instruments manufactures the instruments primarily for the oil and gas industry globallythough with recent commodity price increases of all kinds including copper, its business has begun to grow rapidly. Sales are primarily to multinational companies based in the United States and Europe. Bangkok Instruments' balance sheet in thousands of Thai bahts (B) as of March 31 is shown in the popup window: Exchange rates for translating Bangkok Instruments' balance sheet into U.S. dollars are: B45.33/$ April 1 exchange rate, after 25% devaluation. B34.00/$ March 31 exchange rate, before 25% devaluation. All inventory was acquired at this rate. B23.00/$ Historic exchange rate at which plant and equipment were acquired. The Thai baht dropped in value from B34.00/$ to B45.33/$ between March 31 and April 1. Assuming no change in balance sheet accounts between these two days, calculate the gain or loss from translation by both the current rate method and the temporal method. Bangkok Instruments' translated balance sheet using the current rate method is shown here, E, and the one using the temporal method is shown here, Explain the translation gain or loss in terms of changes in the value of exposed accounts. Using the translated balance sheet under the current rate method, what is the amount of translation gain or loss? Enter a positive number for a gain and negative for a loss. $ (Round to the nearest dollar.) U Bangkok Instruments, Ltd. Balance Sheet, March 1 Assets Liabilities & Net Worth Cash B24,000,000 Accounts payable B18,000,000 Accounts receivable 36,000,000 Bank loans 61,000,000 Inventory 47,000,000 Common stock 20,000,000 Net plant & equipment 58,000,000 Retained earnings 66,000,000 B165,000,000 B165,000,000 Click on the icon located on the top-right corner of the data table in order to copy its contents into a spreadsheet. Bangkok Instruments' Translation Gain (Loss) After Depreciation of the Baht: Current Rate Method March 31 April1 Exchange Translated Exchange Translated Assets In Bahts (B) Rate (B/$) Accounts ($) Rate (B/$) Accounts ($) Cash B24,000,000 34.00 $705,882 45.33 $529,451 Accounts receivable 36,000,000 34.00 1,058,824 45.33 794,176 Inventory 47,000,000 34.00 1,382,353 45.33 1,036,841 Net plant and equipment 58,000,000 34.00 1,705,882 45.33 1,279,506 Total B165,000,000 $4,852,941 $3,639,974 Liabilities and Net Worth Accounts payable B18,000,000 34.00 $529,412 45.33 $397,088 Bank loans 61,000,000 34.00 1,794,118 45.33 1,345,687 Common stock 20,000,000 23.00 869,565 23.00 869,565 Retained earnings 66,000,000 39.76 (a) 1,659,846 39.76 (b) 1,659,846 Translation adjustment (CTA) ? ? Total B165,000,000 $4,852,941 $3,639,974 (a) Dollar retained earnings before depreciation are the cumulative sum of additions to retained earnings of all prior years, translated to exchange rates in each year. (b) Translated into dollars at the same rate as before depreciation of the baht. Click on the icon located on the top-right corner of the data table in order to copy its contents into a spreadsheet. Bangkok Instruments' Translation Gain (Loss) After Depreciation of the Baht: Temporal Method U March 31 April1 Exchange Translated Exchange Translated Assets In Bahts (B) Rate (B/$) Accounts ($) Rate (B/$) Accounts ($) Cash B24,000,000 34.00 $705,882 45.33 $529,451 Accounts receivable 36,000,000 34.00 1,058,824 45.33 794,176 Inventory 47,000,000 34.00 1,382,353 34.00 1,382,353 Net plant and equipment 58,000,000 23.00 2,521,739 23.00 2,521,739 Total B165,000,000 $5,668,798 $5,227,719 Liabilities and Net Worth Accounts payable B18,000,000 34.00 $529,412 45.33 $397,088 Bank loans 61,000,000 34.00 1,794,118 45.33 1,345,687 Common stock 20,000,000 23.00 869,565 23.00 869,565 Retained earnings 66,000,000 26.66 (a) 2,475,703 26.66 (b) 2,475,703 Translation gain (loss) (c) ? Total B165,000,000 $5,668,798 $5,227,719 (a) Dollar retained earnings before depreciation are the cumulative sum of additions to retained earnings of all prior years, translated to exchange rates in each year. (b) Translated into dollars at the same rate as before depreciation of the baht. (c) Under the temporal method, the translation gain (loss) would be closed into retained earnings through the income statement rather than left as a separate line item as shown here. Click on the icon located on the top-right corner of the data table in order to copy its contents into a spreadsheet. Bangkok Instruments' Translation Gain (Loss) After Depreciation of the Baht: Current Rate Method March 31 April1 Exchange Translated Exchange Translated Assets In Bahts (B) Rate (B/$) Accounts ($) Rate (B/$) Accounts ($) Cash B24,000,000 34.00 $705,882 45.33 $529,451 Accounts receivable 36,000,000 34.00 1,058,824 45.33 794,176 Inventory 47,000,000 34.00 1,382,353 45.33 1,036,841 Net plant and equipment 58,000,000 34.00 1,705,882 45.33 1,279,506 Total B165,000,000 $4,852,941 $3,639,974 Liabilities and Net Worth Accounts payable B18,000,000 34.00 $529,412 45.33 $397,088 Bank loans 61,000,000 34.00 1,794,118 45.33 1,345,687 Common stock 20,000,000 23.00 869,565 23.00 869,565 Retained earnings 66,000,000 39.76 (a) 1,659,846 39.76 (b) 1,659,846 Translation adjustment (CTA) ? ? Total B165,000,000 $4,852,941 $3,639,974 (a) Dollar retained earnings before depreciation are the cumulative sum of additions to retained earnings of all prior years, translated to exchange rates in each year. (b) Translated into dollars at the same rate as before depreciation of the baht. Click on the icon located on the top-right corner of the data table in order to copy its contents into a spreadsheet. Bangkok Instruments, Ltd.(A). Bangkok Instruments, Ltd., the Thai subsidiary of a U.S. corporation, is a seismic instrument manufacturer. Bangkok Instruments manufactures the instruments primarily for the oil and gas industry globallythough with recent commodity price increases of all kinds including copper, its business has begun to grow rapidly. Sales are primarily to multinational companies based in the United States and Europe. Bangkok Instruments' balance sheet in thousands of Thai bahts (B) as of March 31 is shown in the popup window: Exchange rates for translating Bangkok Instruments' balance sheet into U.S. dollars are: B45.33/$ April 1 exchange rate, after 25% devaluation. B34.00/$ March 31 exchange rate, before 25% devaluation. All inventory was acquired at this rate. B23.00/$ Historic exchange rate at which plant and equipment were acquired. The Thai baht dropped in value from B34.00/$ to B45.33/$ between March 31 and April 1. Assuming no change in balance sheet accounts between these two days, calculate the gain or loss from translation by both the current rate method and the temporal method. Bangkok Instruments' translated balance sheet using the current rate method is shown here, E, and the one using the temporal method is shown here, Explain the translation gain or loss in terms of changes in the value of exposed accounts. Using the translated balance sheet under the current rate method, what is the amount of translation gain or loss? Enter a positive number for a gain and negative for a loss. $ (Round to the nearest dollar.) U Bangkok Instruments, Ltd. Balance Sheet, March 1 Assets Liabilities & Net Worth Cash B24,000,000 Accounts payable B18,000,000 Accounts receivable 36,000,000 Bank loans 61,000,000 Inventory 47,000,000 Common stock 20,000,000 Net plant & equipment 58,000,000 Retained earnings 66,000,000 B165,000,000 B165,000,000 Click on the icon located on the top-right corner of the data table in order to copy its contents into a spreadsheet. Bangkok Instruments' Translation Gain (Loss) After Depreciation of the Baht: Current Rate Method March 31 April1 Exchange Translated Exchange Translated Assets In Bahts (B) Rate (B/$) Accounts ($) Rate (B/$) Accounts ($) Cash B24,000,000 34.00 $705,882 45.33 $529,451 Accounts receivable 36,000,000 34.00 1,058,824 45.33 794,176 Inventory 47,000,000 34.00 1,382,353 45.33 1,036,841 Net plant and equipment 58,000,000 34.00 1,705,882 45.33 1,279,506 Total B165,000,000 $4,852,941 $3,639,974 Liabilities and Net Worth Accounts payable B18,000,000 34.00 $529,412 45.33 $397,088 Bank loans 61,000,000 34.00 1,794,118 45.33 1,345,687 Common stock 20,000,000 23.00 869,565 23.00 869,565 Retained earnings 66,000,000 39.76 (a) 1,659,846 39.76 (b) 1,659,846 Translation adjustment (CTA) ? ? Total B165,000,000 $4,852,941 $3,639,974 (a) Dollar retained earnings before depreciation are the cumulative sum of additions to retained earnings of all prior years, translated to exchange rates in each year. (b) Translated into dollars at the same rate as before depreciation of the baht. Click on the icon located on the top-right corner of the data table in order to copy its contents into a spreadsheet. Bangkok Instruments' Translation Gain (Loss) After Depreciation of the Baht: Temporal Method U March 31 April1 Exchange Translated Exchange Translated Assets In Bahts (B) Rate (B/$) Accounts ($) Rate (B/$) Accounts ($) Cash B24,000,000 34.00 $705,882 45.33 $529,451 Accounts receivable 36,000,000 34.00 1,058,824 45.33 794,176 Inventory 47,000,000 34.00 1,382,353 34.00 1,382,353 Net plant and equipment 58,000,000 23.00 2,521,739 23.00 2,521,739 Total B165,000,000 $5,668,798 $5,227,719 Liabilities and Net Worth Accounts payable B18,000,000 34.00 $529,412 45.33 $397,088 Bank loans 61,000,000 34.00 1,794,118 45.33 1,345,687 Common stock 20,000,000 23.00 869,565 23.00 869,565 Retained earnings 66,000,000 26.66 (a) 2,475,703 26.66 (b) 2,475,703 Translation gain (loss) (c) ? Total B165,000,000 $5,668,798 $5,227,719 (a) Dollar retained earnings before depreciation are the cumulative sum of additions to retained earnings of all prior years, translated to exchange rates in each year. (b) Translated into dollars at the same rate as before depreciation of the baht. (c) Under the temporal method, the translation gain (loss) would be closed into retained earnings through the income statement rather than left as a separate line item as shown here. Click on the icon located on the top-right corner of the data table in order to copy its contents into a spreadsheet. Bangkok Instruments' Translation Gain (Loss) After Depreciation of the Baht: Current Rate Method March 31 April1 Exchange Translated Exchange Translated Assets In Bahts (B) Rate (B/$) Accounts ($) Rate (B/$) Accounts ($) Cash B24,000,000 34.00 $705,882 45.33 $529,451 Accounts receivable 36,000,000 34.00 1,058,824 45.33 794,176 Inventory 47,000,000 34.00 1,382,353 45.33 1,036,841 Net plant and equipment 58,000,000 34.00 1,705,882 45.33 1,279,506 Total B165,000,000 $4,852,941 $3,639,974 Liabilities and Net Worth Accounts payable B18,000,000 34.00 $529,412 45.33 $397,088 Bank loans 61,000,000 34.00 1,794,118 45.33 1,345,687 Common stock 20,000,000 23.00 869,565 23.00 869,565 Retained earnings 66,000,000 39.76 (a) 1,659,846 39.76 (b) 1,659,846 Translation adjustment (CTA) ? ? Total B165,000,000 $4,852,941 $3,639,974 (a) Dollar retained earnings before depreciation are the cumulative sum of additions to retained earnings of all prior years, translated to exchange rates in each year. (b) Translated into dollars at the same rate as before depreciation of the baht. Click on the icon located on the top-right corner of the data table in order to copy its contents into a spreadsheet