Answered step by step

Verified Expert Solution

Question

1 Approved Answer

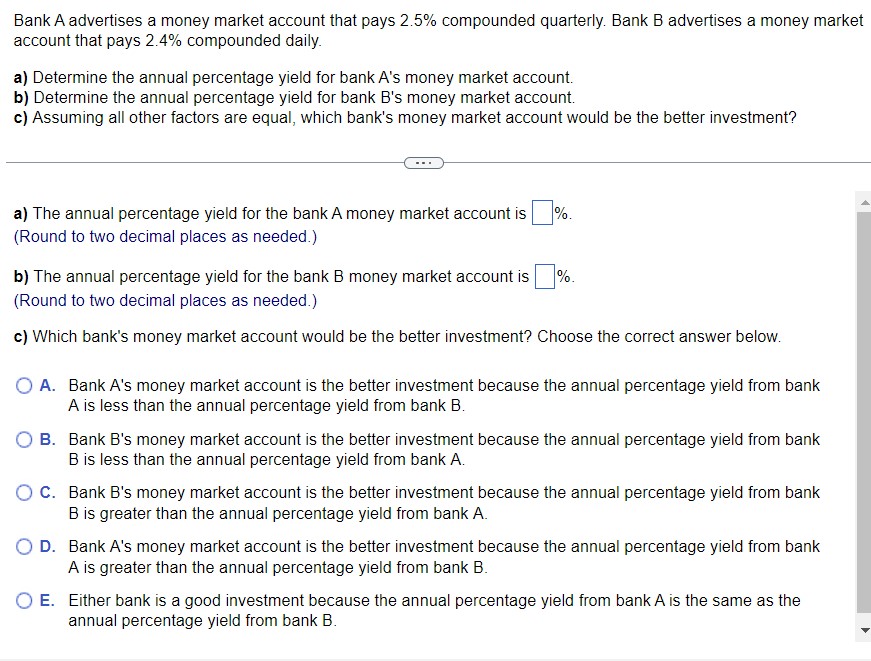

Bank A advertises a money market account that pays 2.5% compounded quarterly. Bank B advertises a money market account that pays 2.4% compounded daily. a)

Bank A advertises a money market account that pays 2.5% compounded quarterly. Bank B advertises a money market account that pays 2.4% compounded daily. a) Determine the annual percentage yield for bank A's money market account. b) Determine the annual percentage yield for bank B's money market account. c) Assuming all other factors are equal, which bank's money market account would be the better investment? a) The annual percentage yield for the bank A money market account is %. (Round to two decimal places as needed.) b) The annual percentage yield for the bank B money market account is %. (Round to two decimal places as needed.) c) Which bank's money market account would be the better investment? Choose the correct answer below. A. Bank A's money market account is the better investment because the annual percentage yield from bank A is less than the annual percentage yield from bank B. B. Bank B's money market account is the better investment because the annual percentage yield from bank B is less than the annual percentage yield from bank A. C. Bank B's money market account is the better investment because the annual percentage yield from bank B is greater than the annual percentage yield from bank A. D. Bank A's money market account is the better investment because the annual percentage yield from bank A is greater than the annual percentage yield from bank B. E. Either bank is a good investment because the annual percentage yield from bank A is the same as the annual percentage yield from bank B

Bank A advertises a money market account that pays 2.5% compounded quarterly. Bank B advertises a money market account that pays 2.4% compounded daily. a) Determine the annual percentage yield for bank A's money market account. b) Determine the annual percentage yield for bank B's money market account. c) Assuming all other factors are equal, which bank's money market account would be the better investment? a) The annual percentage yield for the bank A money market account is %. (Round to two decimal places as needed.) b) The annual percentage yield for the bank B money market account is %. (Round to two decimal places as needed.) c) Which bank's money market account would be the better investment? Choose the correct answer below. A. Bank A's money market account is the better investment because the annual percentage yield from bank A is less than the annual percentage yield from bank B. B. Bank B's money market account is the better investment because the annual percentage yield from bank B is less than the annual percentage yield from bank A. C. Bank B's money market account is the better investment because the annual percentage yield from bank B is greater than the annual percentage yield from bank A. D. Bank A's money market account is the better investment because the annual percentage yield from bank A is greater than the annual percentage yield from bank B. E. Either bank is a good investment because the annual percentage yield from bank A is the same as the annual percentage yield from bank B Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started