Question

Bank Alpha has given out a pool of mortgages with principal amount of $13 million. These mortgages have an average maturity of 22 years

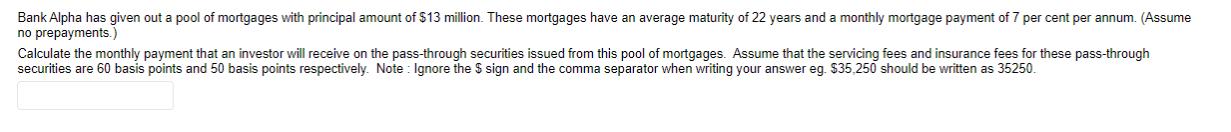

Bank Alpha has given out a pool of mortgages with principal amount of $13 million. These mortgages have an average maturity of 22 years and a monthly mortgage payment of 7 per cent per annum. (Assume no prepayments.) Calculate the monthly payment that an investor will receive on the pass-through securities issued from this pool of mortgages. Assume that the servicing fees and insurance fees for these pass-through securities are 60 basis points and 50 basis points respectively. Note: Ignore the $ sign and the comma separator when writing your answer eg. $35,250 should be written as 35250.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the monthly payment that an investor will receive on the passthrough securities issued ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Kin Lo, George Fisher

Volume 1, 1st Edition

132612119, 978-0132612111

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App