Answered step by step

Verified Expert Solution

Question

1 Approved Answer

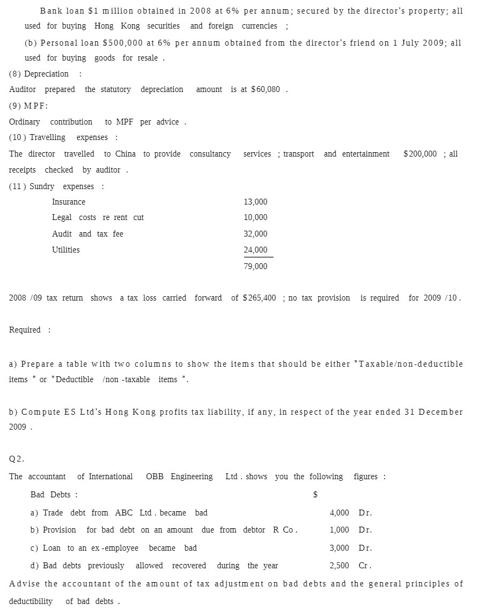

Bank loan $1 million obtained in 2008 at 6% per annum; secured by the director's property; all used for buying Hong Kong securities and

Bank loan $1 million obtained in 2008 at 6% per annum; secured by the director's property; all used for buying Hong Kong securities and foreign currencies: (b) Personal loan $500,000 at 6% per annum obtained from the director's friend on 1 July 2009; all used for buying goods for resale. (8) Depreciation Auditor prepared the statutory depreciation amount is at $60,000 (9) MPF: Ordinary contribution to MPF per advice. (10) Travelling expenses The director travelled to China to provide consultancy services transport and entertainment $200,000; all receipts checked by auditor (11) Sundry expenses: Insurance Legal costs re rent cut Audit and tax fee Utilities 2008/09 tax return shows a tax loss carried forward of $265,400 no tax provision is required for 2009/10. Required: 13,000 10,000 32,000 24,000 79,000 a) Prepare a table with two columns to show the items that should be either "Taxable/non-deductible items or "Deductible /non-taxable items. b) Compute ES Ltd's Hong Kong profits tax liability, if any, In respect of the year ended 31 December 2009 Q2. The accountant of International OBB Engineering Ltd shows you the following figures: $ Bad Debts a) Trade debt from ABC Ltd. became bad b) Provision for bad debt on an amount due from debtor R. Co. 4,000 Dr. 1,000 Dr. 3,000 Dr. 2,500 Cr. c) Loan to an ex-employee became bad d) Bad debts previously allowed recovered during the year Advise the accountant of the amount of tax adjustment on bad debts and the general principles of deductibility of bad debts.

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Q1 Compute ES Ltds Hong Kong profits tax liability if any in respect of the year ended 31 December 2009 To compute ES Ltds Hong Kong profits tax liability we need to first calculate its assessable pro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started