Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bank of America New York has inked a contract for the purchase of plastic card from a manufacturer in Germany for euro 2,750,000. The purchase

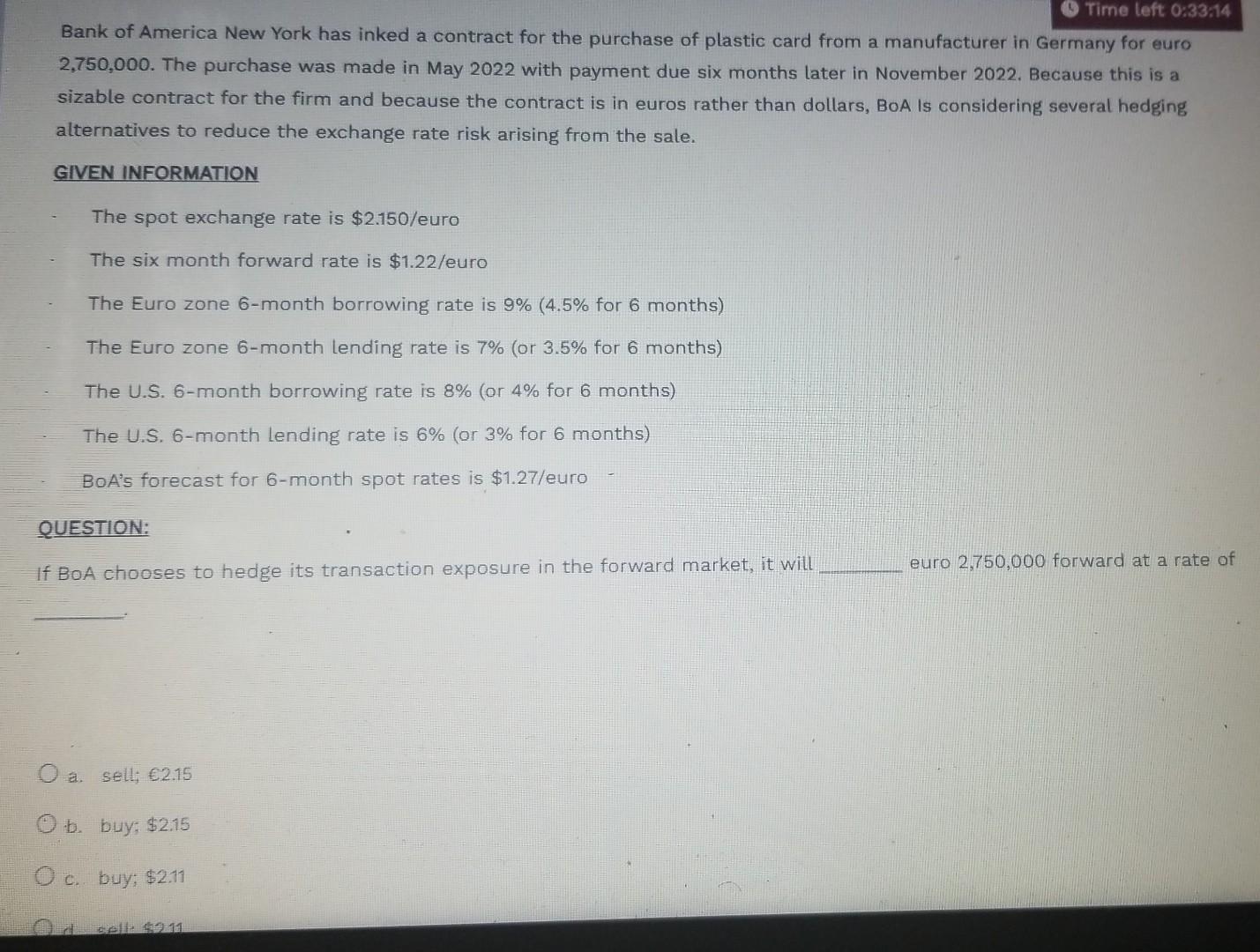

Bank of America New York has inked a contract for the purchase of plastic card from a manufacturer in Germany for euro 2,750,000. The purchase was made in May 2022 with payment due six months later in November 2022. Because this is a sizable contract for the firm and because the contract is in euros rather than dollars, BoA Is considering several hedging alternatives to reduce the exchange rate risk arising from the sale. GIVEN INFORMATION The spot exchange rate is $2.150 /euro The six month forward rate is $1.22 /euro The Euro zone 6-month borrowing rate is 9%(4.5% for 6 months) The Euro zone 6-month lending rate is 7% (or 3.5% for 6 months) The U.S. 6-month borrowing rate is 8% (or 4% for 6 months) The U.S. 6-month lending rate is 6% (or 3% for 6 months) BoA's forecast for 6-month spot rates is $1.27/ euro - QUESTION: If BoA chooses to hedge its transaction exposure in the forward market, it will euro 2,750,000 forward at a rate of a. sell; 2.15 b. buy; $2.15 c. buy; $2.11 Bank of America New York has inked a contract for the purchase of plastic card from a manufacturer in Germany for euro 2,750,000. The purchase was made in May 2022 with payment due six months later in November 2022. Because this is a sizable contract for the firm and because the contract is in euros rather than dollars, BoA Is considering several hedging alternatives to reduce the exchange rate risk arising from the sale. GIVEN INFORMATION The spot exchange rate is $2.150 /euro The six month forward rate is $1.22 /euro The Euro zone 6-month borrowing rate is 9%(4.5% for 6 months) The Euro zone 6-month lending rate is 7% (or 3.5% for 6 months) The U.S. 6-month borrowing rate is 8% (or 4% for 6 months) The U.S. 6-month lending rate is 6% (or 3% for 6 months) BoA's forecast for 6-month spot rates is $1.27/ euro - QUESTION: If BoA chooses to hedge its transaction exposure in the forward market, it will euro 2,750,000 forward at a rate of a. sell; 2.15 b. buy; $2.15 c. buy; $2.11

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started