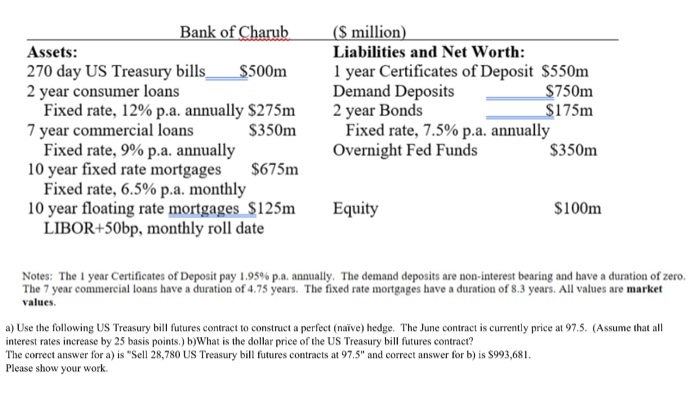

Bank of million Assets: 270 day US Treasury bills 2 year consumer loans Liabilities and Net Worth 1 year Certificates of Deposit S550m Demand Deposits 2 year Bonds 500m 750m $175m Fixed rate, 12% .a. annually $275m Fixed rate, 9% pa annually Fixed rate, 6.5% p.a. monthly LIBOR+50bp, monthly roll date Fixed rate, 7.5% pa. annually 7 year commercial loans 10 year fixed rate moages $675m 10 year floating rate mortgages S125m $350m Overnight Fed Funds $350m $100m Equity Notes: The 1 year Certificates of Deposit pay i 95% pa annually. The demand deposits are non-interest bearing and have a duration of zero. The 7 year commercial loans have a duration of 4.75 years. The fixed rate mortgages have a duration of 8.3 years. All values are market values. a) Use the following US Treasury bill futures contract to construct a perfect (naive) hedge. The June contract is currently price at 97.5. (Assume that all interest rates increase by 25 basis points.) b)What is the dollar price of the US Treasury bill futures contract? The correct answer for a) is "Sell 28,780 US Treasury bill futures contracts at 97.5" and correct answer for b) is $993,681 Please show your work. Bank of million Assets: 270 day US Treasury bills 2 year consumer loans Liabilities and Net Worth 1 year Certificates of Deposit S550m Demand Deposits 2 year Bonds 500m 750m $175m Fixed rate, 12% .a. annually $275m Fixed rate, 9% pa annually Fixed rate, 6.5% p.a. monthly LIBOR+50bp, monthly roll date Fixed rate, 7.5% pa. annually 7 year commercial loans 10 year fixed rate moages $675m 10 year floating rate mortgages S125m $350m Overnight Fed Funds $350m $100m Equity Notes: The 1 year Certificates of Deposit pay i 95% pa annually. The demand deposits are non-interest bearing and have a duration of zero. The 7 year commercial loans have a duration of 4.75 years. The fixed rate mortgages have a duration of 8.3 years. All values are market values. a) Use the following US Treasury bill futures contract to construct a perfect (naive) hedge. The June contract is currently price at 97.5. (Assume that all interest rates increase by 25 basis points.) b)What is the dollar price of the US Treasury bill futures contract? The correct answer for a) is "Sell 28,780 US Treasury bill futures contracts at 97.5" and correct answer for b) is $993,681 Please show your work