Answered step by step

Verified Expert Solution

Question

1 Approved Answer

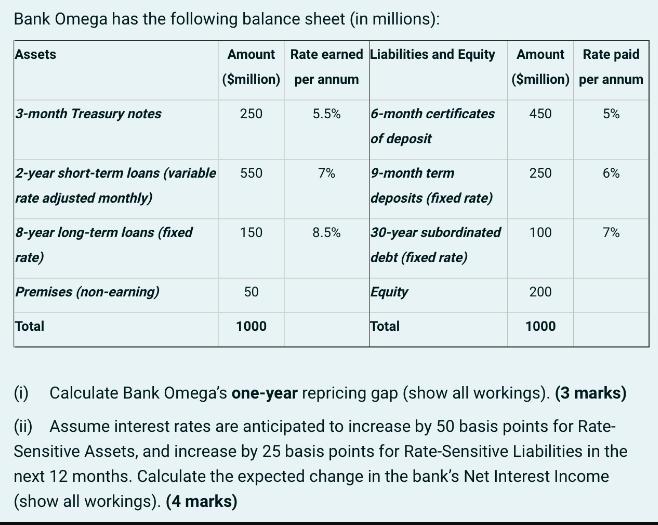

Bank Omega has the following balance sheet (in millions): Assets Amount Rate earned Liabilities and Equity Amount Rate paid ($million) per annum ($million) per

Bank Omega has the following balance sheet (in millions): Assets Amount Rate earned Liabilities and Equity Amount Rate paid ($million) per annum ($million) per annum 3-month Treasury notes 250 5.5% 6-month certificates of deposit 450 5% 2-year short-term loans (variable 550 7% 9-month term 250 6% rate adjusted monthly) deposits (fixed rate) 8-year long-term loans (fixed rate) 150 8.5% 30-year subordinated 100 7% debt (fixed rate) Premises (non-earning) 50 Equity 200 Total 1000 Total 1000 (i) Calculate Bank Omega's one-year repricing gap (show all workings). (3 marks) (ii) Assume interest rates are anticipated to increase by 50 basis points for Rate- Sensitive Assets, and increase by 25 basis points for Rate-Sensitive Liabilities in the next 12 months. Calculate the expected change in the bank's Net Interest Income (show all workings). (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

i To calculate Bank Omegas oneyear repricing gap we need to determine the repricing intervals for bo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started