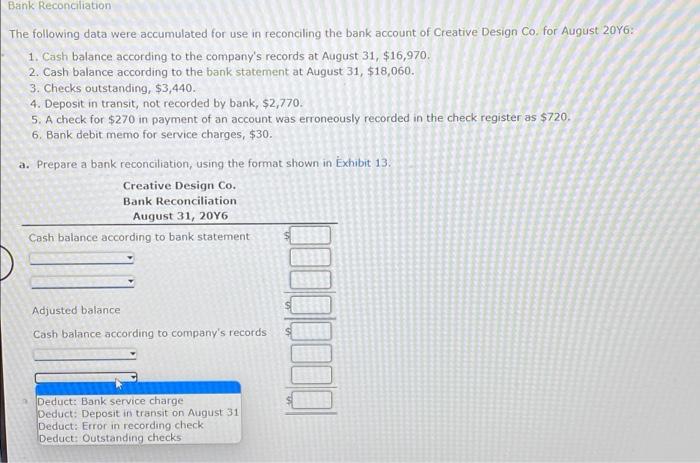

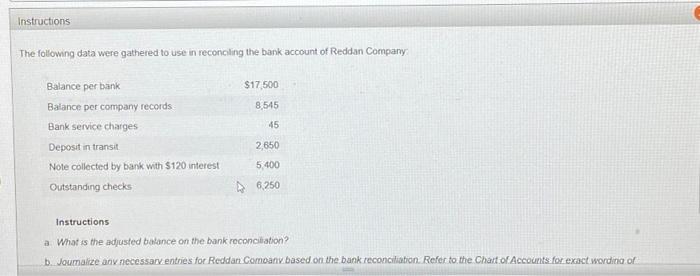

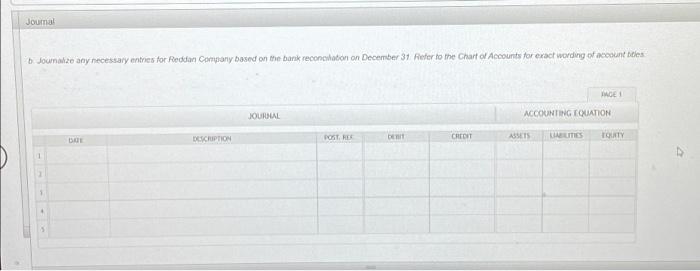

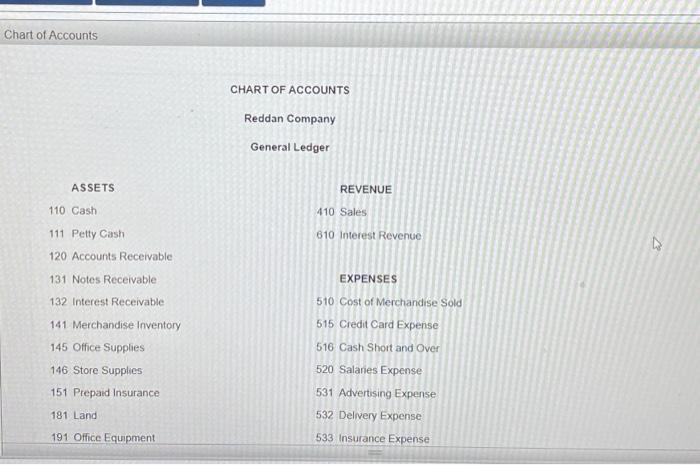

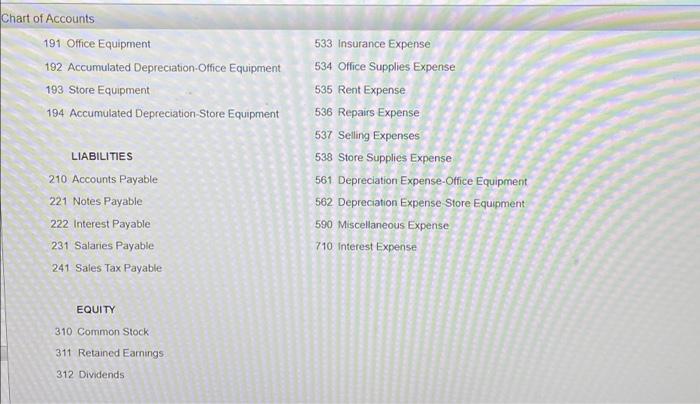

Bank Reconciliation The following data were accumulated for use in reconciling the bank account of Creative Design Co. for August 2016: 1. Cash balance according to the company's records at August 31, $16,970. 2. Cash balance according to the bank statement at August 31, $18,060. 3. Checks outstanding, $3,440. 4. Deposit in transit, not recorded by bank, $2,770. 5. A check for $270 in payment of an account was erroneously recorded in the check register as $720. 6. Bank debit memo for service charges, $30. a. Prepare a bank reconciliation, using the format shown in Exhibit 13. Creative Design Co. Bank Reconciliation August 31, 2016 Cash balance according to bank statement Adjusted balance Cash balance according to company's records Deduct: Bank service charge Deduct: Deposit in transit on August 31 Deduct: Error in recording check Deduct: Outstanding cks Instructions The following data were gathered to use in reconciling the bank account of Reddan Company $17.500 8,545 45 Balance per bank Balance per company records Bank service charges Deposit in transit Note collected by bank with $120 interest Outstanding checks 2,650 5.400 6.250 Instructions a. What is the adjusted balance on the bank reconciliation? D. Joumalize any necessary entries for Reddan Company based on the bank reconciliation Refer to the Chart of Accounts for exact wording of Joumal Journal any necessary entries for Reddon Company based on the bank reconciliation on December 31 Refer to the Chart of Accounts for exact wording of accounts GE JOURNAL ACCOUNTING EQUATION DESCRIPTION POST. ROE be CREDIT DIE ASSETS LITIES TORTY Chart of Accounts CHART OF ACCOUNTS Reddan Company General Ledger ASSETS REVENUE 110 Cash 410 Sales 610 Interest Revenue 111 Petty Cash 120 Accounts Receivable 131 Notes Receivable 132 Interest Receivable 141 Merchandise Inventory 145 Office Supplies 146 Store Supplies 151 Prepaid Insurance EXPENSES 510 Cost of Merchandise Sold 515 Credit Card Expense 516 Cash Short and Over 520 Salanes Expense 531 Advertising Expense 532 Delivery Expense 191 Land 191 Office Equipment 533 Insurance Expense Chart of Accounts 191 Office Equipment 192 Accumulated Depreciation Office Equipment 193 Store Equipment 194 Accumulated Depreciation Store Equipment 533. Insurance Expense 534 Office Supplies Expense 535 Rent Expense 536 Repairs Expense 537 Selling Expenses 538 Store Supplies Expense 561 Depreciation Expense-Office Equipment 562 Depreciation Expense Store Equipment 590 Miscellaneous Expense 710 Interest Expense LIABILITIES 210 Accounts Payable 221 Notes Payable 222 Interest Payable 231 Salaries Payable 241 Sales Tax Payable EQUITY 310 Common Stock 311 Retained Earnings 312 Dividends