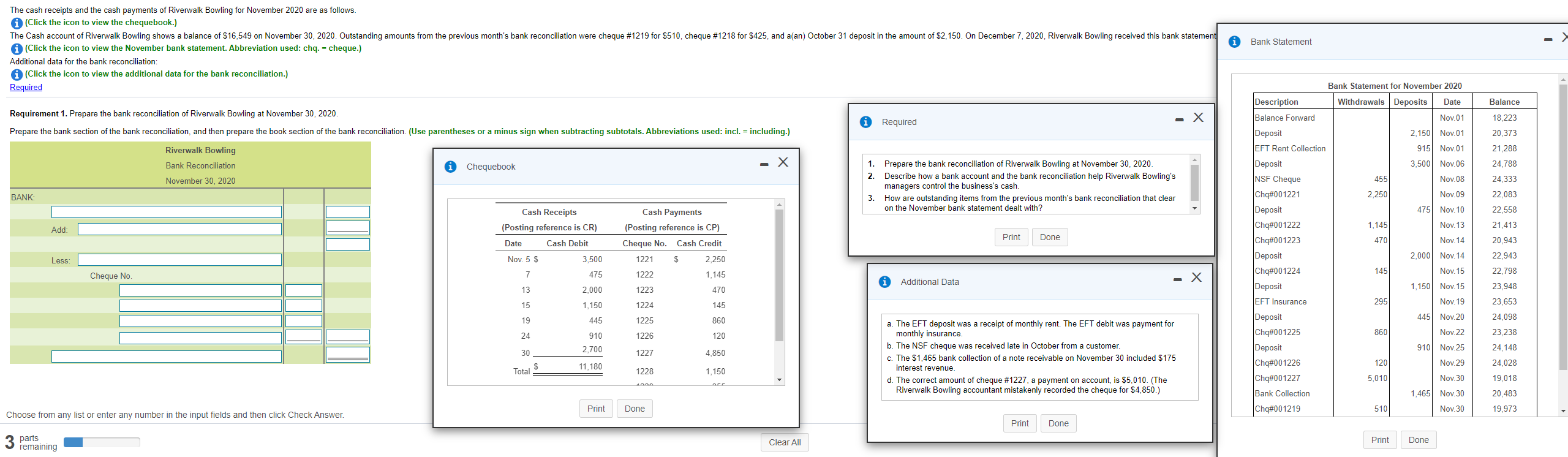

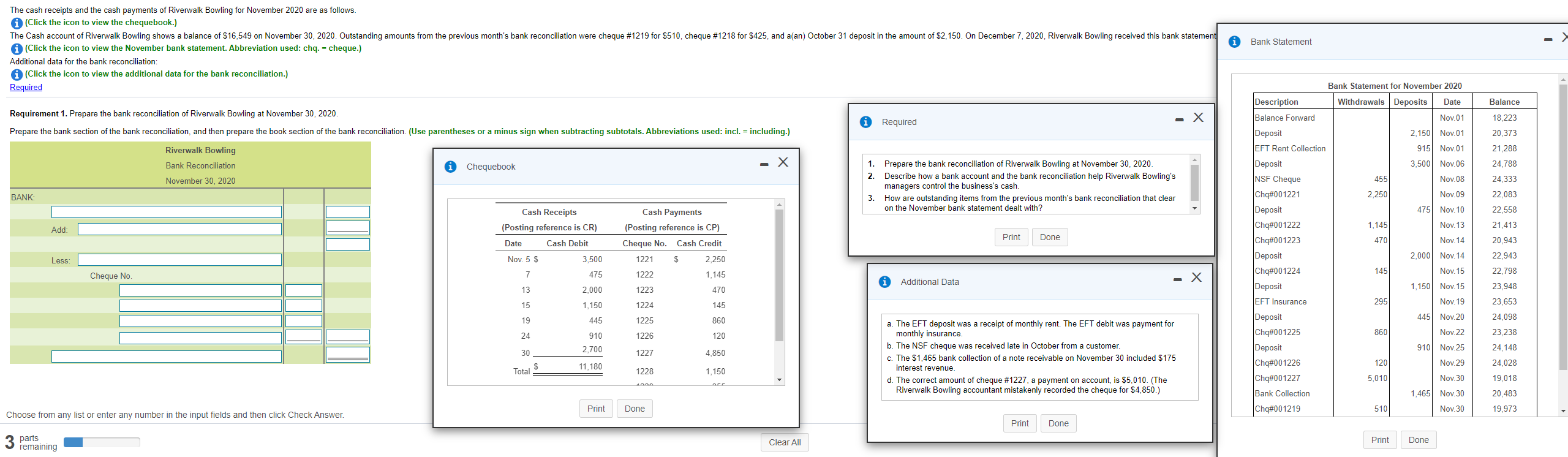

Bank Statement The cash receipts and the cash payments of Riverwalk Bowling for November 2020 are as follows. (Click the icon to view the chequebook.) The Cash account of Riverwalk Bowling shows a balance of $16,549 on November 30, 2020. Outstanding amounts from the previous month's bank reconciliation were cheque #1219 for $510, cheque #1218 for $425, and a(an) October 31 deposit in the amount of $2,150. On December 7, 2020, Riverwalk Bowling received this bank statement (Click the icon to view the November bank statement. Abbreviation used: chq. = cheque.) Additional data for the bank reconciliation: (Click the icon to view the additional data for the bank reconciliation.) Required Bank Statement for November 2020 Withdrawals Deposits Date Balance Required Requirement 1. Prepare the bank reconciliation of Riverwalk Bowling at November 30, 2020. Prepare the bank section of the bank reconciliation, and then prepare the book section of the bank reconciliation. (Use parentheses or a minus sign when subtracting subtotals. Abbreviations used: incl. = including.) - X Nov.01 18,223 20,373 2,150 Nov.01 915 Nov.01 21,288 Riverwalk Bowling Bank Reconciliation x 3,500 Nov.06 Chequebook 24,788 November 30, 2020 455 Nov.08 24.333 1. Prepare the bank reconciliation of Riverwalk Bowling at November 30, 2020 2. Describe how a bank account and the bank reconciliation help Riverwalk Bowling's managers control the business's cash. 3. How are outstanding items from the previous month's bank reconciliation that clear on the November bank statement dealt with? BANK: 2.250 Nov.09 22,083 22,558 475 Nov. 10 Nov. 13 Cash Receipts (Posting reference is CR) Date Cash Debit 1,145 Add: 21,413 Print Done 470 Nov. 14 Cash Payments (Posting reference is CP) Cheque No. Cash Credit 1221 $ 2,250 1222 1,145 1223 470 20,943 22.943 Less: Nov. 5 $ Description Balance Forward Deposit EFT Rent Collection Deposit NSF Cheque Chq#001221 Deposit Chq#001222 Cha#001223 Deposit Cha#001224 Deposit EFT Insurance Deposit Cha#001225 Deposit Cha#001226 Cha#001227 Bank Collection Cha#001219 3,500 2,000 Nov. 14 145 7 Nov. 15 Cheque No. 22,798 475 2,000 Additional Data 13 1,150 Nov. 15 15 1,150 1224 145 295 Nov. 19 23,948 23,653 24,098 23,238 19 445 1225 860 445 Nov 20 24 1226 860 Nov 22 120 910 2.700 910 Nov.25 24.148 30 1227 4,850 a. The EFT deposit was a receipt of monthly rent. The EFT debit was payment for monthly insurance b. The NSF cheque was received late in October from a customer. c. The $1,465 bank collection of a note receivable on November 30 included $175 interest revenue. d. The correct amount of cheque #1227, a payment on account, is $5,010. (The Riverwalk Bowling accountant mistakenly recorded the cheque for $4,850.) 11,180 120 Nov. 29 Total $ 1228 1,150 24,028 19,018 5,010 Nov. 30 1,465 Nov 30 Nov. 30 20,483 Print Done 5101 19,973 Choose from any list or enter any number in the input fields and then click Check Answer. Print Done 3 parts Clear All Print Done remaining Bank Statement The cash receipts and the cash payments of Riverwalk Bowling for November 2020 are as follows. (Click the icon to view the chequebook.) The Cash account of Riverwalk Bowling shows a balance of $16,549 on November 30, 2020. Outstanding amounts from the previous month's bank reconciliation were cheque #1219 for $510, cheque #1218 for $425, and a(an) October 31 deposit in the amount of $2,150. On December 7, 2020, Riverwalk Bowling received this bank statement (Click the icon to view the November bank statement. Abbreviation used: chq. = cheque.) Additional data for the bank reconciliation: (Click the icon to view the additional data for the bank reconciliation.) Required Bank Statement for November 2020 Withdrawals Deposits Date Balance Required Requirement 1. Prepare the bank reconciliation of Riverwalk Bowling at November 30, 2020. Prepare the bank section of the bank reconciliation, and then prepare the book section of the bank reconciliation. (Use parentheses or a minus sign when subtracting subtotals. Abbreviations used: incl. = including.) - X Nov.01 18,223 20,373 2,150 Nov.01 915 Nov.01 21,288 Riverwalk Bowling Bank Reconciliation x 3,500 Nov.06 Chequebook 24,788 November 30, 2020 455 Nov.08 24.333 1. Prepare the bank reconciliation of Riverwalk Bowling at November 30, 2020 2. Describe how a bank account and the bank reconciliation help Riverwalk Bowling's managers control the business's cash. 3. How are outstanding items from the previous month's bank reconciliation that clear on the November bank statement dealt with? BANK: 2.250 Nov.09 22,083 22,558 475 Nov. 10 Nov. 13 Cash Receipts (Posting reference is CR) Date Cash Debit 1,145 Add: 21,413 Print Done 470 Nov. 14 Cash Payments (Posting reference is CP) Cheque No. Cash Credit 1221 $ 2,250 1222 1,145 1223 470 20,943 22.943 Less: Nov. 5 $ Description Balance Forward Deposit EFT Rent Collection Deposit NSF Cheque Chq#001221 Deposit Chq#001222 Cha#001223 Deposit Cha#001224 Deposit EFT Insurance Deposit Cha#001225 Deposit Cha#001226 Cha#001227 Bank Collection Cha#001219 3,500 2,000 Nov. 14 145 7 Nov. 15 Cheque No. 22,798 475 2,000 Additional Data 13 1,150 Nov. 15 15 1,150 1224 145 295 Nov. 19 23,948 23,653 24,098 23,238 19 445 1225 860 445 Nov 20 24 1226 860 Nov 22 120 910 2.700 910 Nov.25 24.148 30 1227 4,850 a. The EFT deposit was a receipt of monthly rent. The EFT debit was payment for monthly insurance b. The NSF cheque was received late in October from a customer. c. The $1,465 bank collection of a note receivable on November 30 included $175 interest revenue. d. The correct amount of cheque #1227, a payment on account, is $5,010. (The Riverwalk Bowling accountant mistakenly recorded the cheque for $4,850.) 11,180 120 Nov. 29 Total $ 1228 1,150 24,028 19,018 5,010 Nov. 30 1,465 Nov 30 Nov. 30 20,483 Print Done 5101 19,973 Choose from any list or enter any number in the input fields and then click Check Answer. Print Done 3 parts Clear All Print Done remaining