Answered step by step

Verified Expert Solution

Question

1 Approved Answer

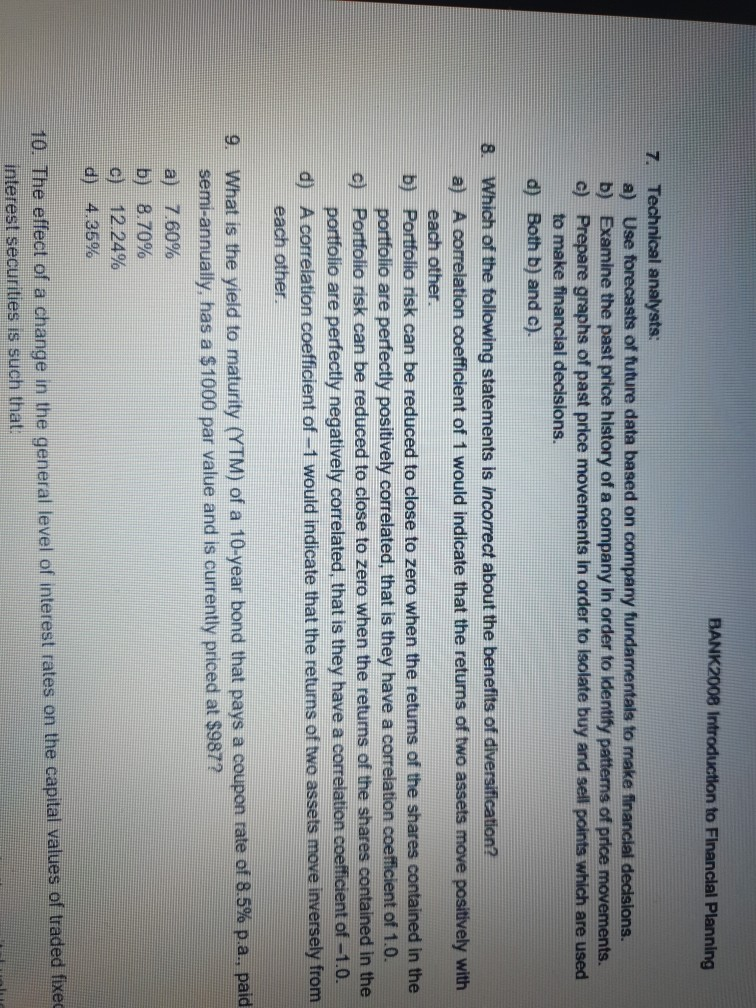

BANK2008 Introduction to Financial Planning 7. Technical analysts: a) Use forecasts of future data based on company fundamentals to make financial decisions. b) Examine the

BANK2008 Introduction to Financial Planning 7. Technical analysts: a) Use forecasts of future data based on company fundamentals to make financial decisions. b) Examine the past price history of a company in order to identify patterns of price movements. c) Prepare graphs of past price movements in order to Isolate buy and sell points which are used to make financial decisions. d) Both b) and c). 8. Which of the following statements is incorrect about the benefits of diversification? a) A correlation coefficient of 1 would indicate ims of two assets move positively with each other. b) Portfolio risk can be reduced to close to zero when the returns of the shares contained in the portfolio are perfectly positively correlated, that is they have a correlation coefficient of 1.0. c) Portfolio risk can be reduced to close to zero when the returns of the shares contained in the portfolio are perfectly negatively correlated, that is they have a correlation coefficient of -1.0. d) A correlation coefficient of - 1 would indicate that the returns of two assets move inversely from each other 9. What is the yield to maturity (YTM) of a 10-year bond that pays a coupon rate of 8.5% p.a., paid semi-annually, has a $1000 par value and is currently priced at $987? a) 7.60% b) 8.70% 12.24% d) 4.35% 10. The effect of a change in the general level of interest rates on the capital values of traded fixed interest securities is such that

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started