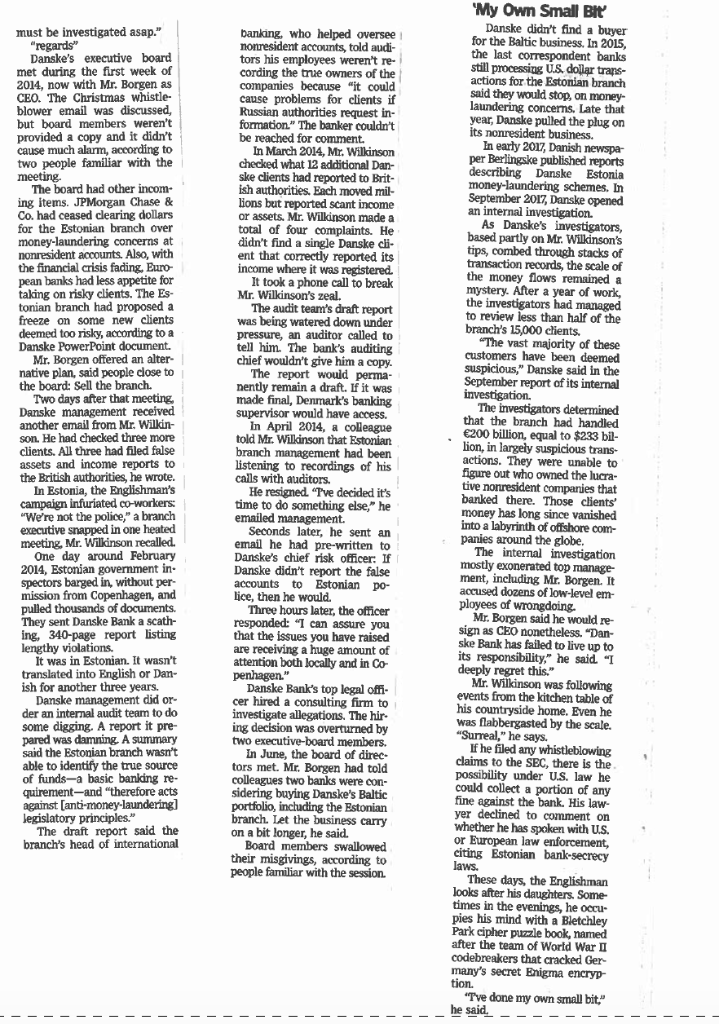

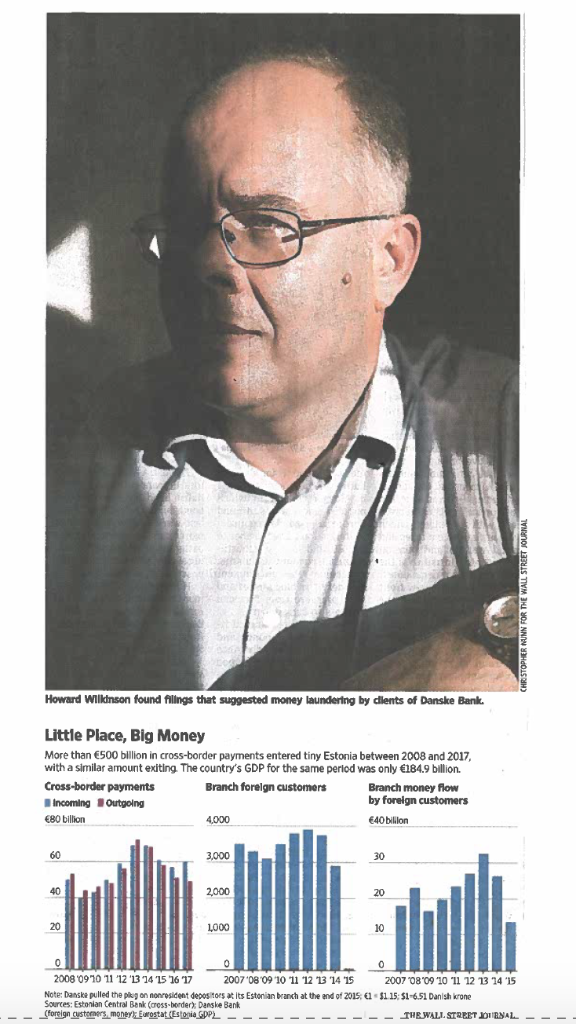

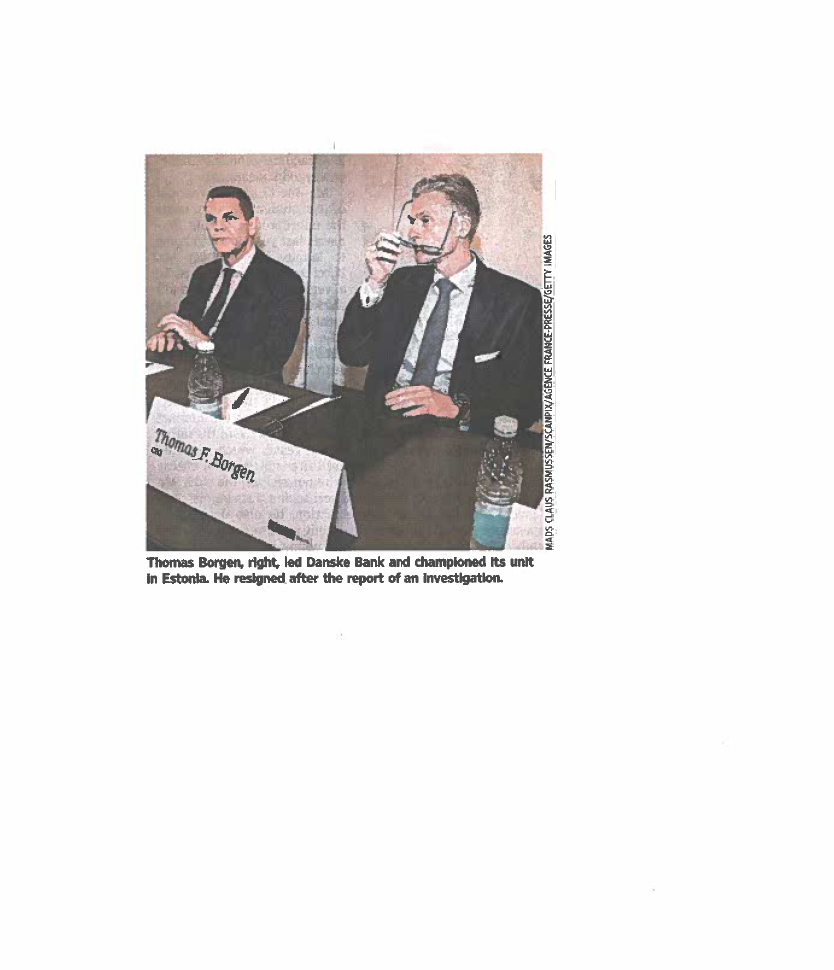

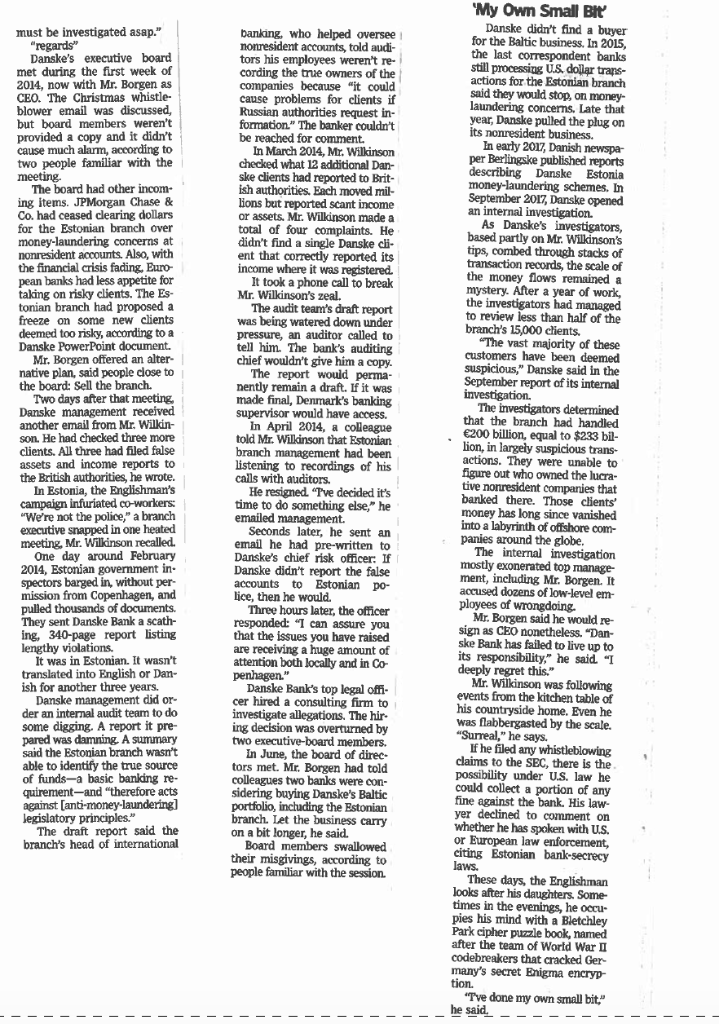

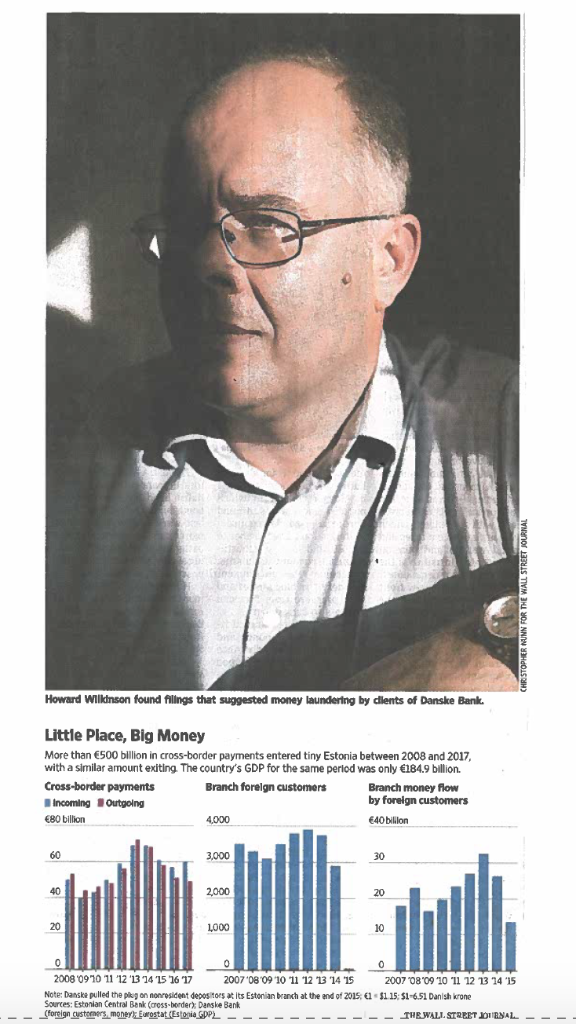

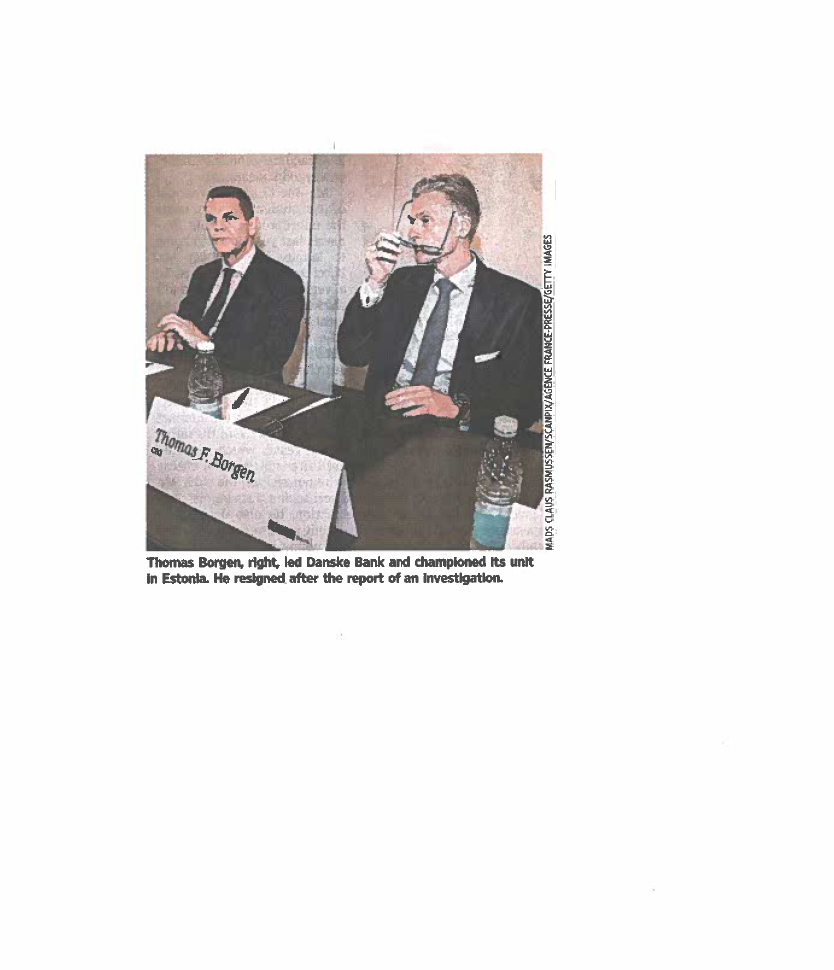

Banker With a Hunch Exposed $200 Billion Scandal of internal bank documents, in- d menos and with dn Danske Bank trader in Estonia dug into filings, tried to alert bosses 24-18 PA years, and how a midlevel ca- reer banker, fixated on detail, fi- $230 billion had flowed from Russia and other former Soviet states through its tiny branch in Estonia. A large part of this was probably illicit money, the bank TALLINN, Estonia-It took a El payment to uncover one of the By Bradley Hope, "We want to make it abso- lutely clear that this case in no way reflects the bank we want to be, Danske said in a writter trader at a Danish bank's branch It is a money-laundering scandal on a grand scale, broaching one of the West's rawest sub- in Estonia, noticed that a London business, which moved more than $1 million through the branch almost daily, had filed a report with the "We will do everything it takes to ensure that we never find ourselves in the same situation jects, its tense relationship with Russia. The U.K. government claiming it had no income or money involved is equal to more than all the dal has tarred the reputation of Denmark,a parent, and wiped out nearly half the stock- corporate profits in Russia in a year. The scan- country ranked among the world's most trans- assets. Downloading the report cost Mr. W The discrepancy didn't immediately strike him as malicious. Later, he began tugging on the thread. And five years after Mr. Wilkinson raised the alarm, his old employet, Danske market value of Denmark's largest bank, which knew about the problems for years before they Please turn to page A8 Danske in late 2006 said it Bank, last month announced that more tharn Bank and absorb its million customers. The deal included a subsidiary in Estonia based in a six-story former factory with became public. Its star CEO has before the Soviets repurposed it for tank parts. After commu- nism's collapse, a bank moved the cost incurred by some of its banks to survive the global fi- During a 2006 visit, Russian monitored money from coun- tries with weak rule of law. Reg- Andrei Kozlov, who was con- which had changed hands a cou- ple of times, was servicing cus- tion and the Treasury Depart- ment and Securities and Ex later, he was gunned down as he left a soccer match. A Russian court ruled it was a contract ske's September release of a re- man displeased with his laun- for the possibility of a huge fine. The bank says it still doesn't the bank came two months graduate who had traveled the led on the corner of the fourth bonds, called "flow business." through the remote branch over From his home in the English said he had no idea of the scale when he first began poking into his bank's dealings. He de- scribed himself as disillusioned. "If you wanted to launder money all you need to do is find an obscure branch in a bank Some European banks were in "And nobody is going to ask you internal memo would later ex- on the third floor serving a cus- never dealt with before, termed coming money out of their ac- counts within days of its arrival, for the Baltic business. In 2015, still processing US dollar traps- actions for the Estonian branch said they would stop, on money- met during the first week of 2014, now with Mr. Borgen as CEO. The Christmas whistle- cording the true owners of the formation" The banker couldn't provided a copy and it didn't cause much alarm, according to In earty 2017, Danish newspa- In March 2014, Mr. Wilkinson checked what 12 additional Dan- ske clients had reported to Brit ish authorities. Each moved mil- money-laundering schemes. In The board had other incom- Co. had ceased clearing dollars for the Estonian branch over or assets. Mr. Wilkinson made a based partly on Mr. Wikinson's tips, combed through stacks of transaction records, the scale of ent that correctly reported its the financial crisis facing Euro- pean banks had less appetite for taking on risky clients. The Es- The audit team's draft report was being watered down under to review less than half of the deemed too risky, according toa "The vast majority of these tell him. The bank's auditing chief wouldn't give him a copy. Mr. Borgen offered an alter- native plan, said people close to suspicious," Danske said in the September report of its internal the board: Sell the branch. Two days after that meeting, made final, Denmark's banking that the branch had handled 200 billion, equal to $233 bil- lion, in largely suspicious trans- actions. They were unable to figure out who owned the lucra- another email from Mr. Wilkin- son, He had checked three more clients. All three had filed false assets and income reports to the British authorities, he wrote in April 2014, a colleague told Mr. Wilkinson that Estonian branch management had been He resigned Tve decided it's time to do something else," he We're not the police," a branch into a labyrinth of offishore com- email he had pre-written to Danske's chief risk officer: If Danske didn't report the false 2014, Estonian govermment in spectors barged in, without per- mission from Copenhagen, and accused dozens of low-level em Three hours later, the officer responded: "I can assure you that the issues you have raised Mr. Borgen said he would re- sign as CE0 nonetheless. "Dan- ske Bank has failed to live up to They sent Danske Bank a scath- It was in Estonian. It wasn't ish for another three years. der an internal audit team to do attention both locally and in Co Danske Bank's top legal offi- cer hired a consulting firm to events from the kitchen table of his countryside home. Even he was flabbergasted by the scale. some digging. A report it pre- ing decision was overturned by If he filed any whistleblowing. claims to the SEC, there is the possibility under US. law he said the Estonian branch wasm't In June, the board of direc- tors met. Mr. Borgen had told colleagues two banks were con able to identify the true source fine against the bank. His law- whether he has spoken with US. The draft report said the branch's head of international people familiar with the session. looks after his daughters. Some times in the evenings, he ocrur pies his mind with a Bletchley Park cipher puzzle book, named after the team of World War Tve done my own small bit ing to open a U.S. branch In late quite pissed off" said Raul 2012, Denmark's FSA issued a Malmstein, then-chairman of statement of support to the Fed- Estonia's FSA. era Reserve saying that Danske Mr. Wilkinson's daughters followed correct anti-money- had finished opening their pres- la In 2010, Danske CEO Peter ket transactions related to those customers. "Good, easy money," the high level of Russian trans- s magazine had contacted the bank about the His first hint of unease came five years into the job, as his colleagues rushed to take their 2012 holidays. A young junior account manager asked ents on Christmas 2013 when, in nian branch in a North Korean Danske's anti-money-launder the holiday calm, a thought bur- ing chief later emailed col- ied deeply away came to mind. leagues about issues at the Es Had Lantana-the London busi- tonian branch, saying: "The ness that moved millions Danish FSA has helped the Bank through the Estonian bank while in a critical situation. They are listing its assets as zero-prop- now very worried that any situ erly amended its filing to UK authorities, as he'd been told 18 land. Months later, Mr. Straarup Was he com- fortable with the exposure to nonresident clients? Mr. Borgen, according to a person who at tended the meeting, said he hadn't come across any cause for help wrapping up The client-listed in the UK. as Lantana Trade LLP was reg- istered next door to a suburban ation may arise." London hardware store, accord Danske and the Federal Remonths before? serve declined to comment when asked about the exchange. ing to documents. They show it moved $480 million through the Estonian branch in five months. When Mr. Wilkinson down- loaded the business's records, Mr. Straarup declined In 2013, Mr. Borgen, the char- Dear Sirs: The bank smatic chief of international ment, and Mr. Borgen didn't re- spond to requests for comment. Russia's central bank kept a banking, became Danske's CEO. may...have committed blackist of hundreds of thou person close to the board said a Criminal offense' an He was producing these enor employee wrote sands of individuals barred from Russia's banking sector on suspicion of financial crimes. Many of them were popping up as clients of the Danske branch next door in Es tonia, the Russian central bank At a meeting that year of the company data: "0.00. with top officials from acrossThe day after Christmas, Mr the Continent present, a shout- Wilkinson spent another pound ing match erupted, said people to download Lantana's amended familiar with the session. The filing. On the third page, Lan- Estonians yelled that criminal tana said that as of as of May Russian money was washing 31, 2012, its bank accounts held through their country, and Den- 15689, equal to about $20,500 mark was doing little to stop it. Bank records showed it had "In simple terms, we were close to $1 million on deposit comp weeks later, adding that Danske had asked Lantana to submit a new, correct version to Compa- nies House. He forgot about it. the ing Supervision Estonia's FSA had just two 2013, a senior bank official said laundering reviews. The maxi- mum fine for money launder ing equaled a few hours' profits at the branch. And Eu- ropean Union directives dis- couraged Estonian inspectors from entering the bank build- was no longer a with Danske that day. Mr. Wilkinson said. He added that another official told him one of Lantana's owners was a relative of Madimir Putin, which for one with Mr. Wilkinson's colleagues prob- ably knew, he guessed. "At that question is how big is the prob- their Danish regulatory coun- terparts. Denmark's FSA over "It sat in the back of my head that there was something that wasn't quite right," Mr. Wilkinsaw it because it was a branch The next morning, Mr. Wi- kinson emaied four Danske offi cials with the subject "Whistle- blowing disclosure knowingly dealing with criminals in Esto- rather than a subsidiary. spite their limited jurisdiction and resources, raised red flags, mailing about six letters to Den- mark's FSA between 2007 and 2014. The complaints became caustic as years went by Teeuns ne rise of atnn e wr se Alpha Male' Dear Sirs" he wrote. "The bank may itself have committed a criminal offence.... There has been a near total process fail- Danske's returns from Esto- tall, gray-haired banker several rungs above Mr. Wilkinson, who One Estonian FSA letter "is Mr Danske's executives would in- vestigate, make changes, and branch before the board. ever read. and I have read om Thomas Borgen, then in bankingharsh letters," a Danske for Danske, impressed othersance oucer emailed a colleague Denmark's FSA says it raised handshake. Two days later, a with his ramrod posture and soothing intonation, colleagues cerns with Danske Bank and was assured that the bank regularly sent people to check the branch terse response on his phone to Wilkinson: "Thanks for draw- male in the roa The Estonian branch's profits were a point of pride during a European business slump. "This was his baby," the adviser said. room, and they no problems. Howard Wlkinson found fillings that suggested money laundering by cllents of Danske Bank. Little Place, Big Money More than 500 billion in cross-border payments entered tiny Estonia between 2008 and 2017, with a similar amount exiting The country's GDP for the same period was only 184.9 billion. Cross-border payments IncomingOutgoling 80 billion Branch foreign customers Branch money flow by foreign customers 4000 40 billon 60 3,000 30 40 2000 20 20 1000 10 0070809 10 11 12 13 14 15 2008 '0970 11 .12 .13 24 15 36 17 2007'080910'll12T3 14.15 Note: Danske pulled the pkgon nonresident depositors at its Estonian branch at the end of 2015; 11115:51-651 Danish krone Sources: Estonian Central Benk (aross borderx Danske Bank THE WALL STREET JOTTBNAL Thomas Borgen, right, led Danske Bank and champloned Its unlt in Estonria He resigned after the report of an investlgation. Danske Bank Exercise International Finance Directions: Visit the Transparency International (TI) website. Familiarize yourself with the organization's mission and then determine where Denmark and Estonia rank in TI's latest ranking Visit the Danske Bank website danskebank.com and familiarize yourself with the bank's code of conduct and corporate governance policies. Next please read the article about the money laundering scandal at Danske Bank and then respond to the following 1. In light of TI's rankings, why do you suppose this scandal occurred? 2. Identify at least three facts that support the view that the Danske Bank board of directors failed the shareholders. 3. Did former CEO Peter Straarup fail the shareholders? Explain. If you had been in his position, what would you have done? How does this series of events inform the reader about Danske Bank's culture? Explain. How should it have operated? 4. 5. If you had been in Mr. Wilkinson's position, what would you have done? What would you have done differently? Explain 6. Why do you suppose Mr. Borgen proposed selling the Estonian branch rather than correcting roblems identified there? 7. Why do you suppose the bank's internal investigation exculpated senior management and attempted to blame lower level employees for the conduct at the Estonian branch? 8. How did government regulators, particularly at the European Union, level enable the conduct at the Estonian branch? 9. In light of the scandal, do you think Danske Bank is at risk for losing its independence and being subject to failure or take over? 10. In light of the events described in the article, explain why share repurchase programs can be risky and often destroy shareholder value. Banker With a Hunch Exposed $200 Billion Scandal of internal bank documents, in- d menos and with dn Danske Bank trader in Estonia dug into filings, tried to alert bosses 24-18 PA years, and how a midlevel ca- reer banker, fixated on detail, fi- $230 billion had flowed from Russia and other former Soviet states through its tiny branch in Estonia. A large part of this was probably illicit money, the bank TALLINN, Estonia-It took a El payment to uncover one of the By Bradley Hope, "We want to make it abso- lutely clear that this case in no way reflects the bank we want to be, Danske said in a writter trader at a Danish bank's branch It is a money-laundering scandal on a grand scale, broaching one of the West's rawest sub- in Estonia, noticed that a London business, which moved more than $1 million through the branch almost daily, had filed a report with the "We will do everything it takes to ensure that we never find ourselves in the same situation jects, its tense relationship with Russia. The U.K. government claiming it had no income or money involved is equal to more than all the dal has tarred the reputation of Denmark,a parent, and wiped out nearly half the stock- corporate profits in Russia in a year. The scan- country ranked among the world's most trans- assets. Downloading the report cost Mr. W The discrepancy didn't immediately strike him as malicious. Later, he began tugging on the thread. And five years after Mr. Wilkinson raised the alarm, his old employet, Danske market value of Denmark's largest bank, which knew about the problems for years before they Please turn to page A8 Danske in late 2006 said it Bank, last month announced that more tharn Bank and absorb its million customers. The deal included a subsidiary in Estonia based in a six-story former factory with became public. Its star CEO has before the Soviets repurposed it for tank parts. After commu- nism's collapse, a bank moved the cost incurred by some of its banks to survive the global fi- During a 2006 visit, Russian monitored money from coun- tries with weak rule of law. Reg- Andrei Kozlov, who was con- which had changed hands a cou- ple of times, was servicing cus- tion and the Treasury Depart- ment and Securities and Ex later, he was gunned down as he left a soccer match. A Russian court ruled it was a contract ske's September release of a re- man displeased with his laun- for the possibility of a huge fine. The bank says it still doesn't the bank came two months graduate who had traveled the led on the corner of the fourth bonds, called "flow business." through the remote branch over From his home in the English said he had no idea of the scale when he first began poking into his bank's dealings. He de- scribed himself as disillusioned. "If you wanted to launder money all you need to do is find an obscure branch in a bank Some European banks were in "And nobody is going to ask you internal memo would later ex- on the third floor serving a cus- never dealt with before, termed coming money out of their ac- counts within days of its arrival, for the Baltic business. In 2015, still processing US dollar traps- actions for the Estonian branch said they would stop, on money- met during the first week of 2014, now with Mr. Borgen as CEO. The Christmas whistle- cording the true owners of the formation" The banker couldn't provided a copy and it didn't cause much alarm, according to In earty 2017, Danish newspa- In March 2014, Mr. Wilkinson checked what 12 additional Dan- ske clients had reported to Brit ish authorities. Each moved mil- money-laundering schemes. In The board had other incom- Co. had ceased clearing dollars for the Estonian branch over or assets. Mr. Wilkinson made a based partly on Mr. Wikinson's tips, combed through stacks of transaction records, the scale of ent that correctly reported its the financial crisis facing Euro- pean banks had less appetite for taking on risky clients. The Es- The audit team's draft report was being watered down under to review less than half of the deemed too risky, according toa "The vast majority of these tell him. The bank's auditing chief wouldn't give him a copy. Mr. Borgen offered an alter- native plan, said people close to suspicious," Danske said in the September report of its internal the board: Sell the branch. Two days after that meeting, made final, Denmark's banking that the branch had handled 200 billion, equal to $233 bil- lion, in largely suspicious trans- actions. They were unable to figure out who owned the lucra- another email from Mr. Wilkin- son, He had checked three more clients. All three had filed false assets and income reports to the British authorities, he wrote in April 2014, a colleague told Mr. Wilkinson that Estonian branch management had been He resigned Tve decided it's time to do something else," he We're not the police," a branch into a labyrinth of offishore com- email he had pre-written to Danske's chief risk officer: If Danske didn't report the false 2014, Estonian govermment in spectors barged in, without per- mission from Copenhagen, and accused dozens of low-level em Three hours later, the officer responded: "I can assure you that the issues you have raised Mr. Borgen said he would re- sign as CE0 nonetheless. "Dan- ske Bank has failed to live up to They sent Danske Bank a scath- It was in Estonian. It wasn't ish for another three years. der an internal audit team to do attention both locally and in Co Danske Bank's top legal offi- cer hired a consulting firm to events from the kitchen table of his countryside home. Even he was flabbergasted by the scale. some digging. A report it pre- ing decision was overturned by If he filed any whistleblowing. claims to the SEC, there is the possibility under US. law he said the Estonian branch wasm't In June, the board of direc- tors met. Mr. Borgen had told colleagues two banks were con able to identify the true source fine against the bank. His law- whether he has spoken with US. The draft report said the branch's head of international people familiar with the session. looks after his daughters. Some times in the evenings, he ocrur pies his mind with a Bletchley Park cipher puzzle book, named after the team of World War Tve done my own small bit ing to open a U.S. branch In late quite pissed off" said Raul 2012, Denmark's FSA issued a Malmstein, then-chairman of statement of support to the Fed- Estonia's FSA. era Reserve saying that Danske Mr. Wilkinson's daughters followed correct anti-money- had finished opening their pres- la In 2010, Danske CEO Peter ket transactions related to those customers. "Good, easy money," the high level of Russian trans- s magazine had contacted the bank about the His first hint of unease came five years into the job, as his colleagues rushed to take their 2012 holidays. A young junior account manager asked ents on Christmas 2013 when, in nian branch in a North Korean Danske's anti-money-launder the holiday calm, a thought bur- ing chief later emailed col- ied deeply away came to mind. leagues about issues at the Es Had Lantana-the London busi- tonian branch, saying: "The ness that moved millions Danish FSA has helped the Bank through the Estonian bank while in a critical situation. They are listing its assets as zero-prop- now very worried that any situ erly amended its filing to UK authorities, as he'd been told 18 land. Months later, Mr. Straarup Was he com- fortable with the exposure to nonresident clients? Mr. Borgen, according to a person who at tended the meeting, said he hadn't come across any cause for help wrapping up The client-listed in the UK. as Lantana Trade LLP was reg- istered next door to a suburban ation may arise." London hardware store, accord Danske and the Federal Remonths before? serve declined to comment when asked about the exchange. ing to documents. They show it moved $480 million through the Estonian branch in five months. When Mr. Wilkinson down- loaded the business's records, Mr. Straarup declined In 2013, Mr. Borgen, the char- Dear Sirs: The bank smatic chief of international ment, and Mr. Borgen didn't re- spond to requests for comment. Russia's central bank kept a banking, became Danske's CEO. may...have committed blackist of hundreds of thou person close to the board said a Criminal offense' an He was producing these enor employee wrote sands of individuals barred from Russia's banking sector on suspicion of financial crimes. Many of them were popping up as clients of the Danske branch next door in Es tonia, the Russian central bank At a meeting that year of the company data: "0.00. with top officials from acrossThe day after Christmas, Mr the Continent present, a shout- Wilkinson spent another pound ing match erupted, said people to download Lantana's amended familiar with the session. The filing. On the third page, Lan- Estonians yelled that criminal tana said that as of as of May Russian money was washing 31, 2012, its bank accounts held through their country, and Den- 15689, equal to about $20,500 mark was doing little to stop it. Bank records showed it had "In simple terms, we were close to $1 million on deposit comp weeks later, adding that Danske had asked Lantana to submit a new, correct version to Compa- nies House. He forgot about it. the ing Supervision Estonia's FSA had just two 2013, a senior bank official said laundering reviews. The maxi- mum fine for money launder ing equaled a few hours' profits at the branch. And Eu- ropean Union directives dis- couraged Estonian inspectors from entering the bank build- was no longer a with Danske that day. Mr. Wilkinson said. He added that another official told him one of Lantana's owners was a relative of Madimir Putin, which for one with Mr. Wilkinson's colleagues prob- ably knew, he guessed. "At that question is how big is the prob- their Danish regulatory coun- terparts. Denmark's FSA over "It sat in the back of my head that there was something that wasn't quite right," Mr. Wilkinsaw it because it was a branch The next morning, Mr. Wi- kinson emaied four Danske offi cials with the subject "Whistle- blowing disclosure knowingly dealing with criminals in Esto- rather than a subsidiary. spite their limited jurisdiction and resources, raised red flags, mailing about six letters to Den- mark's FSA between 2007 and 2014. The complaints became caustic as years went by Teeuns ne rise of atnn e wr se Alpha Male' Dear Sirs" he wrote. "The bank may itself have committed a criminal offence.... There has been a near total process fail- Danske's returns from Esto- tall, gray-haired banker several rungs above Mr. Wilkinson, who One Estonian FSA letter "is Mr Danske's executives would in- vestigate, make changes, and branch before the board. ever read. and I have read om Thomas Borgen, then in bankingharsh letters," a Danske for Danske, impressed othersance oucer emailed a colleague Denmark's FSA says it raised handshake. Two days later, a with his ramrod posture and soothing intonation, colleagues cerns with Danske Bank and was assured that the bank regularly sent people to check the branch terse response on his phone to Wilkinson: "Thanks for draw- male in the roa The Estonian branch's profits were a point of pride during a European business slump. "This was his baby," the adviser said. room, and they no problems. Howard Wlkinson found fillings that suggested money laundering by cllents of Danske Bank. Little Place, Big Money More than 500 billion in cross-border payments entered tiny Estonia between 2008 and 2017, with a similar amount exiting The country's GDP for the same period was only 184.9 billion. Cross-border payments IncomingOutgoling 80 billion Branch foreign customers Branch money flow by foreign customers 4000 40 billon 60 3,000 30 40 2000 20 20 1000 10 0070809 10 11 12 13 14 15 2008 '0970 11 .12 .13 24 15 36 17 2007'080910'll12T3 14.15 Note: Danske pulled the pkgon nonresident depositors at its Estonian branch at the end of 2015; 11115:51-651 Danish krone Sources: Estonian Central Benk (aross borderx Danske Bank THE WALL STREET JOTTBNAL Thomas Borgen, right, led Danske Bank and champloned Its unlt in Estonria He resigned after the report of an investlgation. Danske Bank Exercise International Finance Directions: Visit the Transparency International (TI) website. Familiarize yourself with the organization's mission and then determine where Denmark and Estonia rank in TI's latest ranking Visit the Danske Bank website danskebank.com and familiarize yourself with the bank's code of conduct and corporate governance policies. Next please read the article about the money laundering scandal at Danske Bank and then respond to the following 1. In light of TI's rankings, why do you suppose this scandal occurred? 2. Identify at least three facts that support the view that the Danske Bank board of directors failed the shareholders. 3. Did former CEO Peter Straarup fail the shareholders? Explain. If you had been in his position, what would you have done? How does this series of events inform the reader about Danske Bank's culture? Explain. How should it have operated? 4. 5. If you had been in Mr. Wilkinson's position, what would you have done? What would you have done differently? Explain 6. Why do you suppose Mr. Borgen proposed selling the Estonian branch rather than correcting roblems identified there? 7. Why do you suppose the bank's internal investigation exculpated senior management and attempted to blame lower level employees for the conduct at the Estonian branch? 8. How did government regulators, particularly at the European Union, level enable the conduct at the Estonian branch? 9. In light of the scandal, do you think Danske Bank is at risk for losing its independence and being subject to failure or take over? 10. In light of the events described in the article, explain why share repurchase programs can be risky and often destroy shareholder value