Answered step by step

Verified Expert Solution

Question

1 Approved Answer

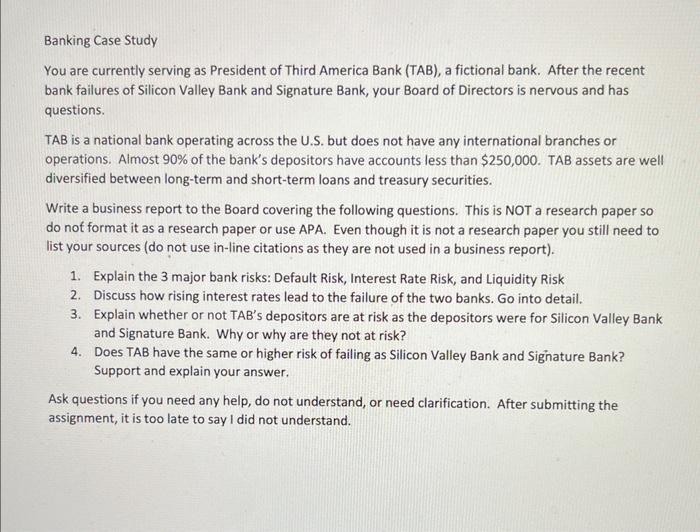

Banking Case Study You are currently serving as President of Third America Bank ( TAB ) , a fictional bank. After the recent bank failures

Banking Case Study

You are currently serving as President of Third America Bank TAB a fictional bank. After the recent

bank failures of Silicon Valley Bank and Signature Bank, your Board of Directors is nervous and has

questions.

TAB is a national bank operating across the US but does not have any international branches or

operations. Almost of the bank's depositors have accounts less than $ TAB assets are well

diversified between longterm and shortterm loans and treasury securities

Write a business report to the Board covering the following questions. This is NOT a research paper so

do not format it as a research paper or use APA. Even though it is not a research paper you still need to

list your sources do not use inline citations as they are not used in a business report

Explain the major bank risks: Default Risk, Interest Rate Risk, and Liquidity Risk

Discuss how rising interest rates lead to the failure of the two banks. Go into detail.

Explain whether or not TAB's depositors are at risk as the depositors were for Silicon Valley Bank

and Signature Bank. Why or why are they not at risk?

Does TAB have the same or higher risk of failing as Silicon Valley Bank and Signature Bank?

Support and explain your answer.

Ask questions if you need any help, do not understand, or need clarification. After submitting the

assignment, it is too late to say I did not understand.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started