Question

Banking ks Orientation & Ch1 Question 25, RTDA: Exercise 1 HW Score: 94.52%,24.58 of 26 points Part 5 of 5 Points: 0.91 of 2 Keal-Ime

Banking\ ks Orientation & Ch1\ Question 25, RTDA: Exercise 1\ HW Score:

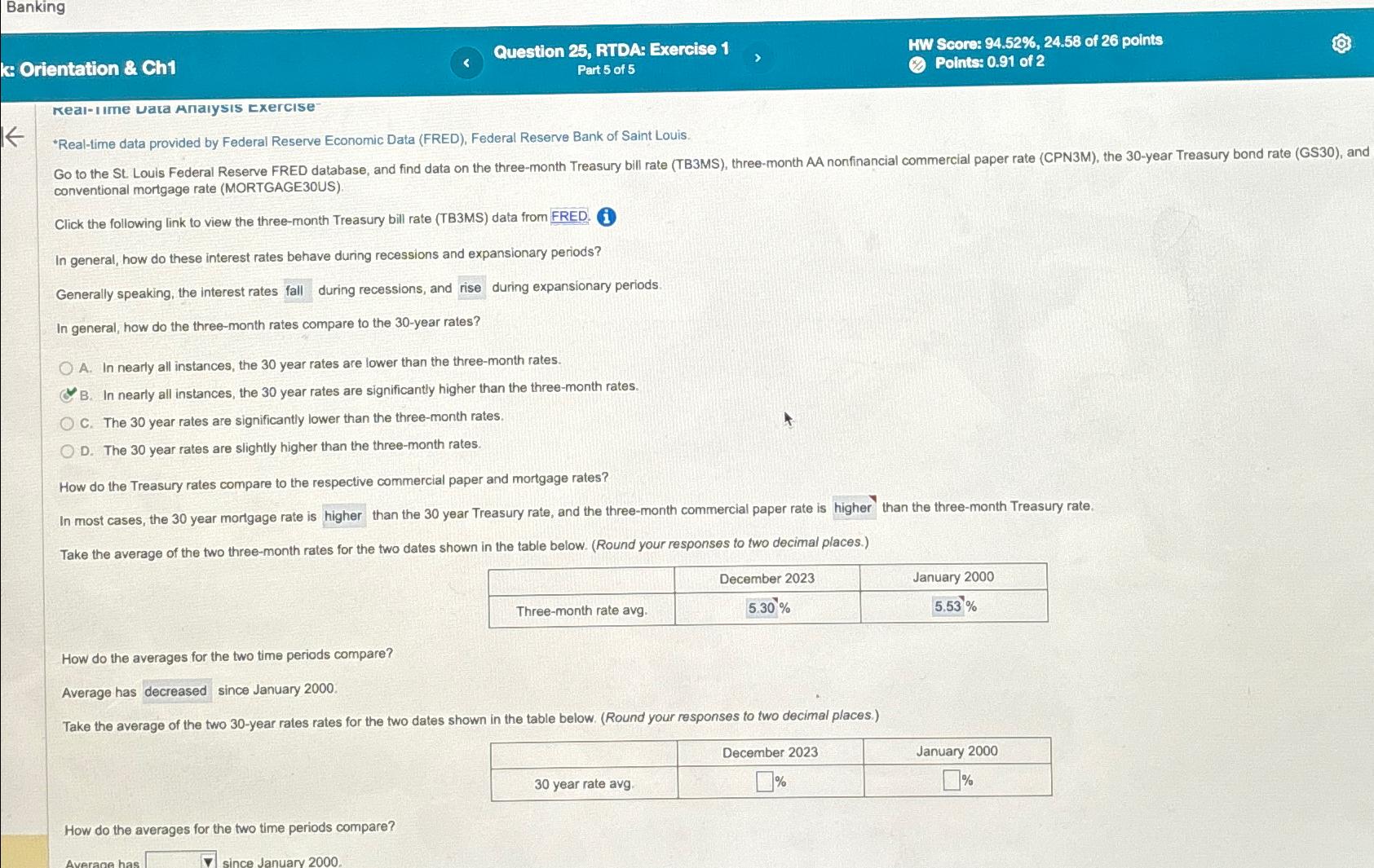

94.52%,24.58of 26 points\ Part 5 of 5\ Points: 0.91 of 2\ Keal-Ime vata Anaiyss cxercise\ *Real-time data provided by Federal Reserve Economic Data (FRED), Federal Reserve Bank of Saint Louis. conventional mortgage rate (MORTGAGE30US).\ Click the following link to view the three-month Treasury bill rate (TB3MS) data from FRED. (i)\ In general, how do these interest rates behave during recessions and expansionary periods?\ Generally speaking, the interest rates during recessions, and rise during expansionary periods.\ In general, how do the three-month rates compare to the 30-year rates?\ A. In nearly all instances, the 30 year rates are lower than the three-month rates.\ B. In nearly all instances, the 30 year rates are significantly higher than the three-month rates.\ C. The 30 year rates are significantly lower than the three-month rates.\ D. The 30 year rates are slightly higher than the three-month rates.\ How do the Treasury rates compare to the respective commercial paper and mortgage rates?\ In most cases, the 30 year mortgage rate is higher than the 30 year Treasury rate, and the three-month commercial paper rate is higher than the three-month Treasury rate.\ Take the average of the two three-month rates for the two dates shown in the table below. (Round your responses to two decimal places.)\ \\\\table[[,December 2023,January 2000],[Three-month rate avg.,

5.30%,

5.53%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started