Answered step by step

Verified Expert Solution

Question

1 Approved Answer

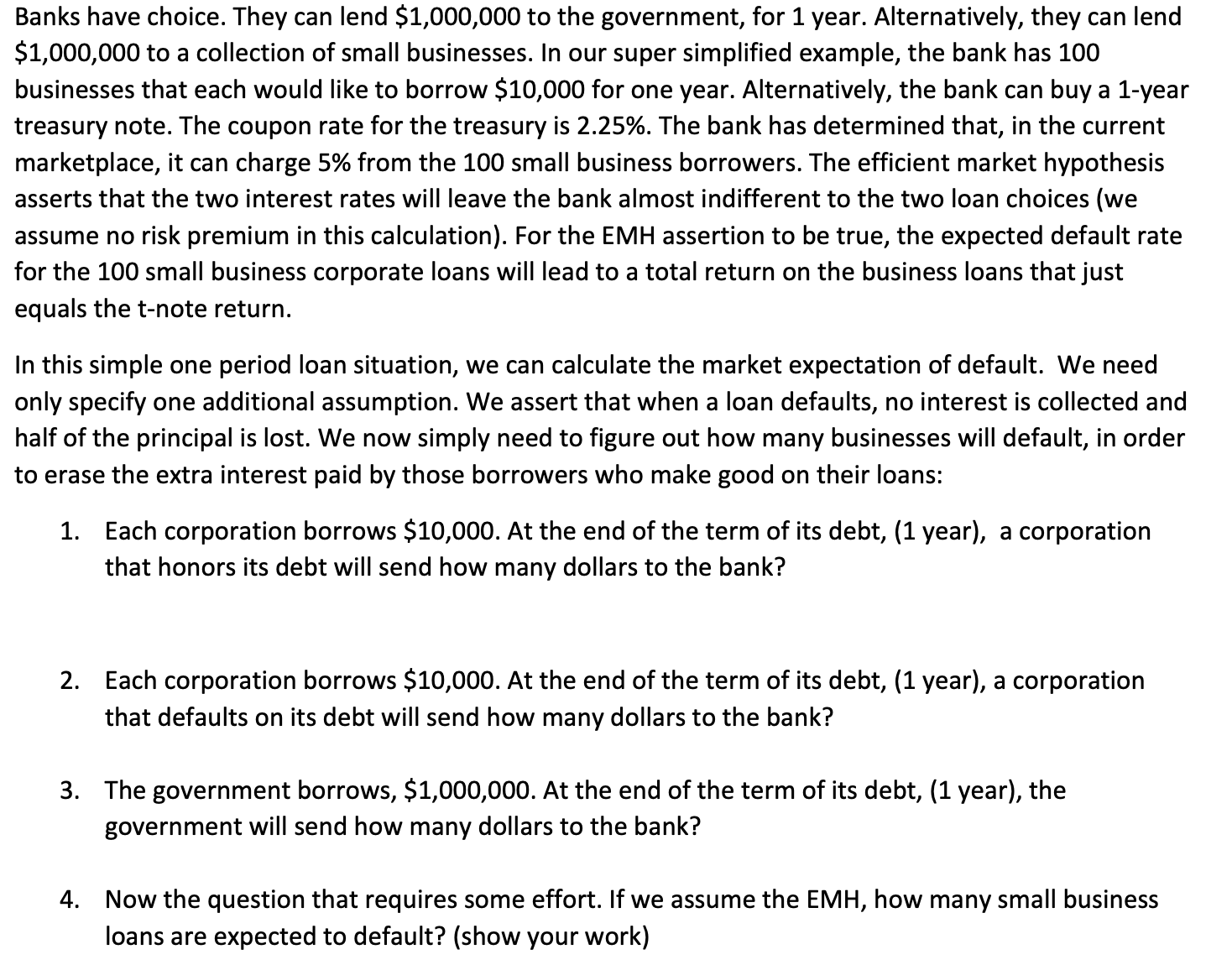

Banks have choice. They can lend $ 1 , 0 0 0 , 0 0 0 to the government, for 1 year. Alternatively, they can

Banks have choice. They can lend $ to the government, for year. Alternatively, they can lend

$ to a collection of small businesses. In our super simplified example, the bank has

businesses that each would like to borrow $ for one year. Alternatively, the bank can buy a year

treasury note. The coupon rate for the treasury is The bank has determined that, in the current

marketplace, it can charge from the small business borrowers. The efficient market hypothesis

asserts that the two interest rates will leave the bank almost indifferent to the two loan choices we

assume no risk premium in this calculation For the EMH assertion to be true, the expected default rate

for the small business corporate loans will lead to a total return on the business loans that just

equals the note return.

In this simple one period loan situation, we can calculate the market expectation of default. We need

only specify one additional assumption. We assert that when a loan defaults, no interest is collected and

half of the principal is lost. We now simply need to figure out how many businesses will default, in order

to erase the extra interest paid by those borrowers who make good on their loans:

Each corporation borrows $ At the end of the term of its debt, year a corporation

that honors its debt will send how many dollars to the bank?

Each corporation borrows $ At the end of the term of its debt, year a corporation

that defaults on its debt will send how many dollars to the bank?

The government borrows, $ At the end of the term of its debt, year the

government will send how many dollars to the bank?

Now the question that requires some effort. If we assume the EMH, how many small business

loans are expected to default? show your work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started