Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Barbara Houston is a CPA with her own accounting and tax practice. One day an audit client asks her to represent him in a conference

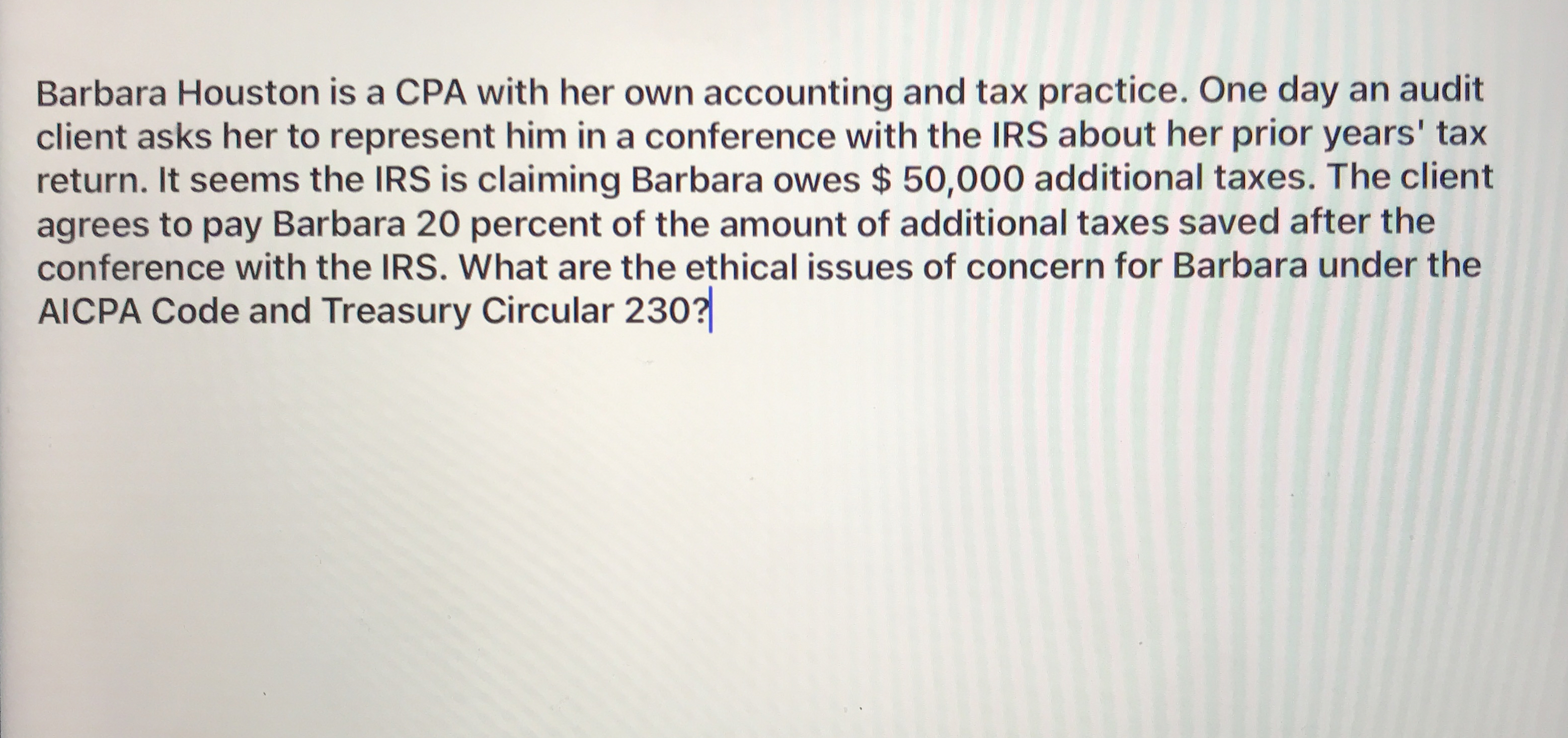

Barbara Houston is a CPA with her own accounting and tax practice. One day an audit client asks her to represent him in a conference with the IRS about her prior years' tax return. It seems the IRS is claiming Barbara owes $ additional taxes. The client agrees to pay Barbara percent of the amount of additional taxes saved after the conference with the IRS. What are the ethical issues of concern for Barbara under the AICPA Code and Treasury Circular

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started