Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Barbara is a true accountant: she not only likes knowing where every dollar is going, she is obsessed with it. So she is happy

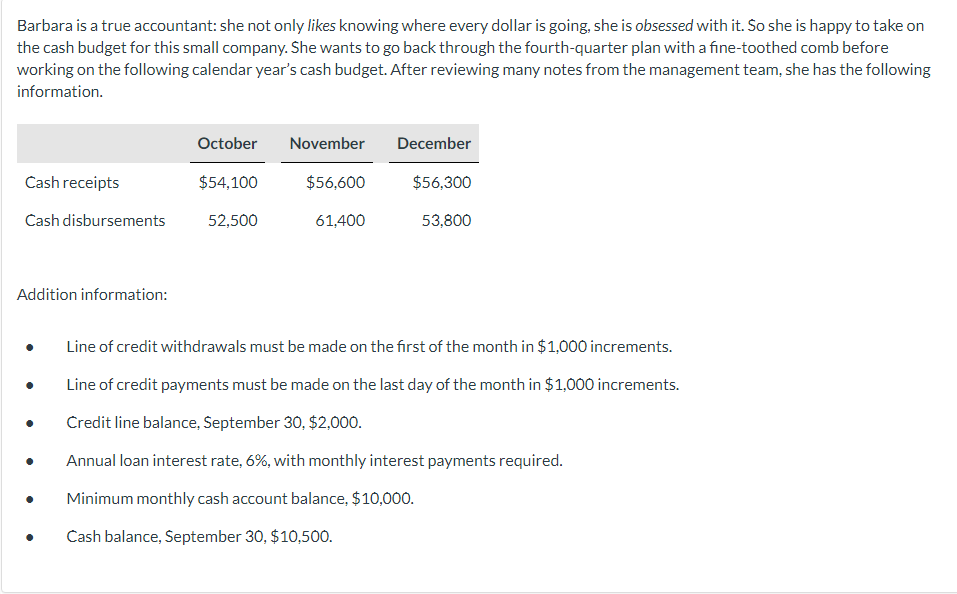

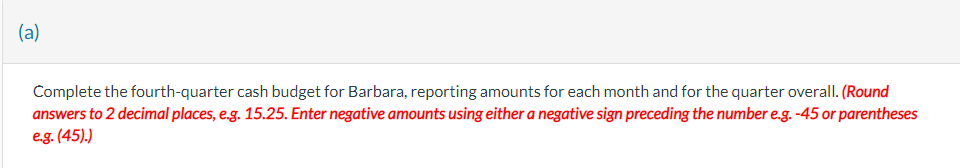

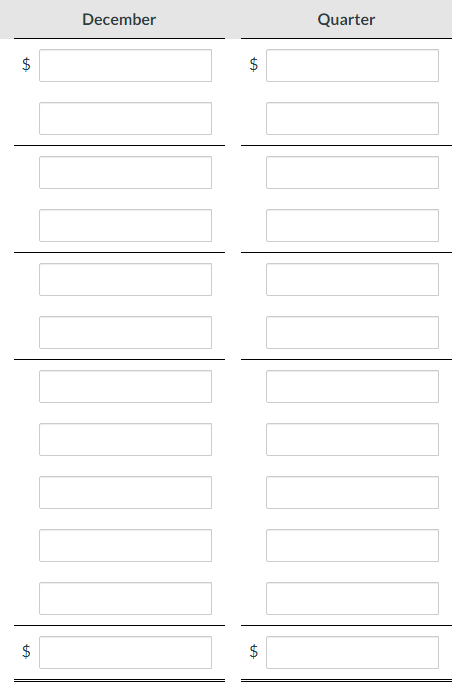

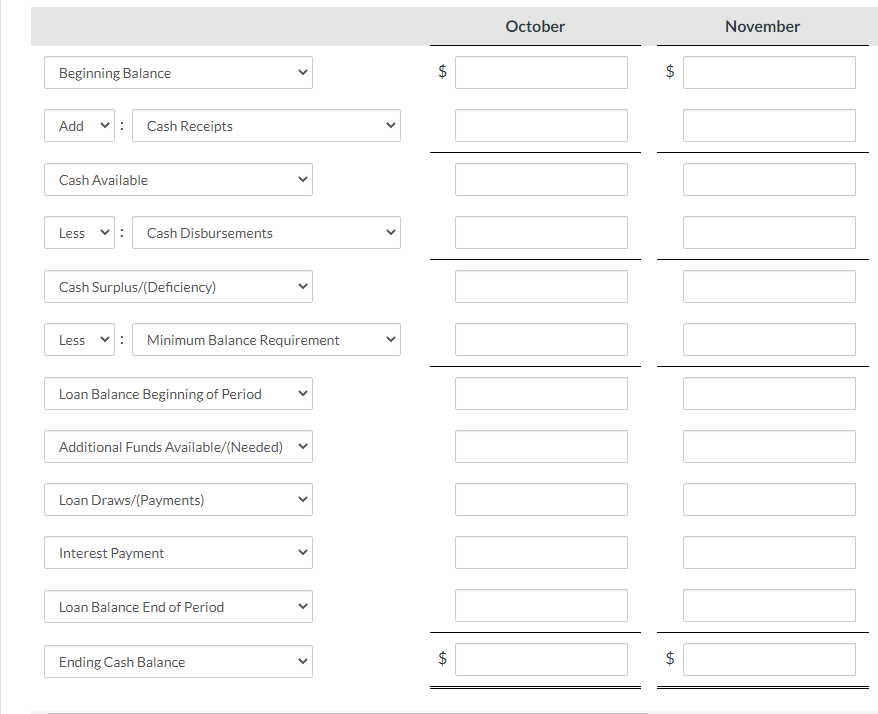

Barbara is a true accountant: she not only likes knowing where every dollar is going, she is obsessed with it. So she is happy to take on the cash budget for this small company. She wants to go back through the fourth-quarter plan with a fine-toothed comb before working on the following calendar year's cash budget. After reviewing many notes from the management team, she has the following information. October November December Cash receipts $54,100 $56,600 $56,300 Cash disbursements 52,500 61,400 53,800 Addition information: Line of credit withdrawals must be made on the first of the month in $1,000 increments. Line of credit payments must be made on the last day of the month in $1,000 increments. Credit line balance, September 30, $2,000. Annual loan interest rate, 6%, with monthly interest payments required. Minimum monthly cash account balance, $10,000. Cash balance, September 30, $10,500. (a) Complete the fourth-quarter cash budget for Barbara, reporting amounts for each month and for the quarter overall. (Round answers to 2 decimal places, e.g. 15.25. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) +A $ December $ CA +A Quarter +A $ Beginning Balance Add : Cash Receipts Cash Available Less Cash Disbursements Cash Surplus/(Deficiency) Less Minimum Balance Requirement Loan Balance Beginning of Period Additional Funds Available/(Needed) Loan Draws/(Payments) Interest Payment Loan Balance End of Period Ending Cash Balance > > LA $ October $ CA November LA $ $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started