Answered step by step

Verified Expert Solution

Question

1 Approved Answer

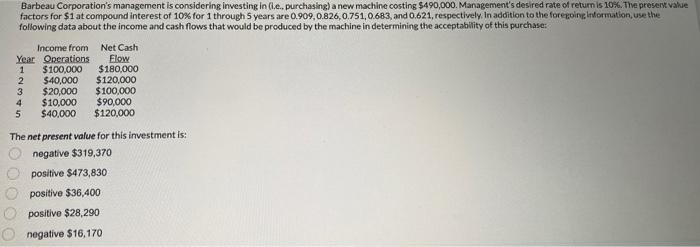

Barbeau Corporation's management is considering investing in (i.e., purchasing) a new machine costing $490,000. Management's desired rate of return is 10%. The present value factors

Barbeau Corporation's management is considering investing in (i.e., purchasing) a new machine costing $490,000. Management's desired rate of return is 10%. The present value factors for $1 at compound interest of 10% for 1 through 5 years are 0.909, 0.826, 0.751, 0.683, and 0.621, respectively. In addition to the foregoing information, use the following data about the income and cash flows that would be produced by the machine in determining the acceptability of this purchase: Income from Net Cash Flow $180,000 $40,000 $120,000 $20,000 $100,000 $10,000 $90,000 $40,000 $120,000 Year Operations 1 $100,000 2345 The net present value for this investment is: O negative $319,370 O positive $473,830 positive $36,400 positive $28,290 negative $16,170

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started