Question

Barbero Building Products Company reported a $478,000 short-term note payable on it December 31, 2022, trial balance. The note is due on March23, 2023. OnFebruary

Barbero Building Products Company reported a $478,000 short-term note payable on it December 31, 2022, trial balance. The note is due on March23, 2023. OnFebruary 2, 2023, Barbero extended the term of the loan for $300,000 of the balance, changing the due date to March 23,2024. Barbero finalized the loan extension on February 2, 2023, and it is not subject to any modifications. Barbero released financial statements on February16, 2023. How should Barbero classify the $478,000 note payable on the December31, 2022, balance sheet? Provide any necessary journal entries.

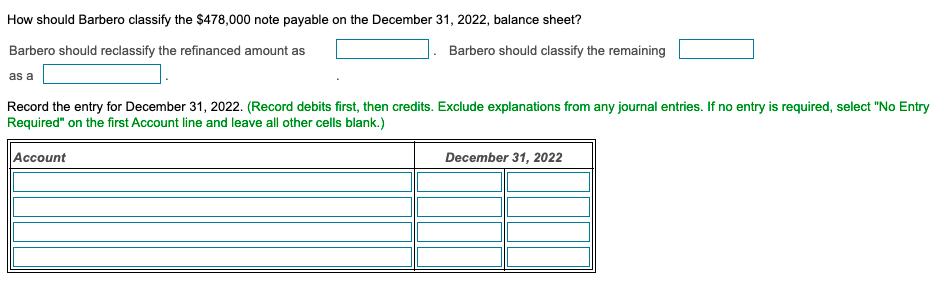

How should Barbero classify the $478,000 note payable on the December 31, 2022, balance sheet? Barbero should reclassify the refinanced amount as as a Barbero should classify the remaining Record the entry for December 31, 2022. (Record debits first, then credits. Exclude explanations from any journal entries. If no entry is required, select "No Entry Required" on the first Account line and leave all other cells blank.) Account December 31, 2022

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Barbero ought to re classify the re supported quant...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started