Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Barcelona, S.A., a Spanish manufacturer of sailboats and sailing equipment. You are evaluating a proposal for Barcelona to build sailboats for a foreign competitor

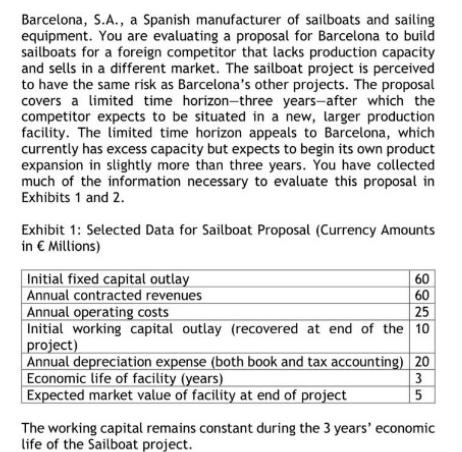

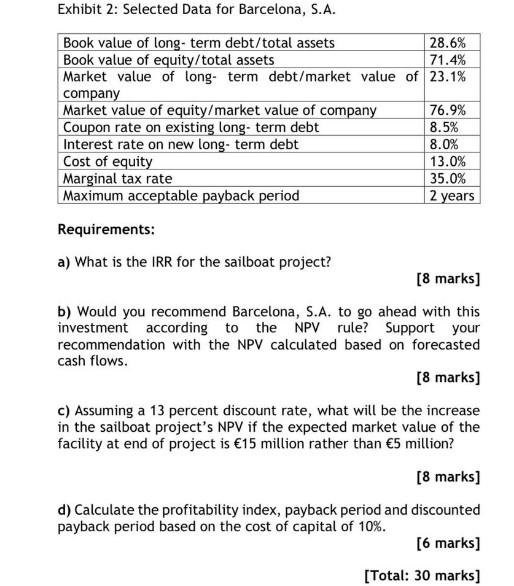

Barcelona, S.A., a Spanish manufacturer of sailboats and sailing equipment. You are evaluating a proposal for Barcelona to build sailboats for a foreign competitor that lacks production capacity and sells in a different market. The sailboat project is perceived to have the same risk as Barcelona's other projects. The proposal covers a limited time horizon-three years-after which the competitor expects to be situated in a new, larger production facility. The limited time horizon appeals to Barcelona, which currently has excess capacity but expects to begin its own product expansion in slightly more than three years. You have collected much of the information necessary to evaluate this proposal in Exhibits 1 and 2. Exhibit 1: Selected Data for Sailboat Proposal (Currency Amounts in Millions) Initial fixed capital outlay Annual contracted revenues Annual operating costs 60 60 25 Initial working capital outlay (recovered at end of the 10 project) Annual depreciation expense (both book and tax accounting) 20 Economic life of facility (years) Expected market value of facility at end of project 3 5 The working capital remains constant during the 3 years' economic life of the Sailboat project. Exhibit 2: Selected Data for Barcelona, S.A. Book value of long-term debt/total assets Book value of equity/total assets 28.6% 71.4% Market value of long- term debt/market value of 23.1% company Market value of equity/market value of company Coupon rate on existing long-term debt Interest rate on new long-term debt 76.9% 8.5% 8.0% Cost of equity Marginal tax rate 13.0% 35.0% Maximum acceptable payback period 2 years Requirements: a) What is the IRR for the sailboat project? [8 marks] b) Would you recommend Barcelona, S.A. to go ahead with this investment according to the NPV rule? Support your recommendation with the NPV calculated based on forecasted cash flows. [8 marks] c) Assuming a 13 percent discount rate, what will be the increase in the sailboat project's NPV if the expected market value of the facility at end of project is 15 million rather than 5 million? [8 marks] d) Calculate the profitability index, payback period and discounted payback period based on the cost of capital of 10%. [6 marks] [Total: 30 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started