Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bardio Ltd. ACC201 Trying my hardest to keep up with everything, any help is much appreciated on this question! Thank you ahead of time and

Bardio Ltd. ACC201

Trying my hardest to keep up with everything, any help is much appreciated on this question! Thank you ahead of time and I do give ratings and thumbs up.

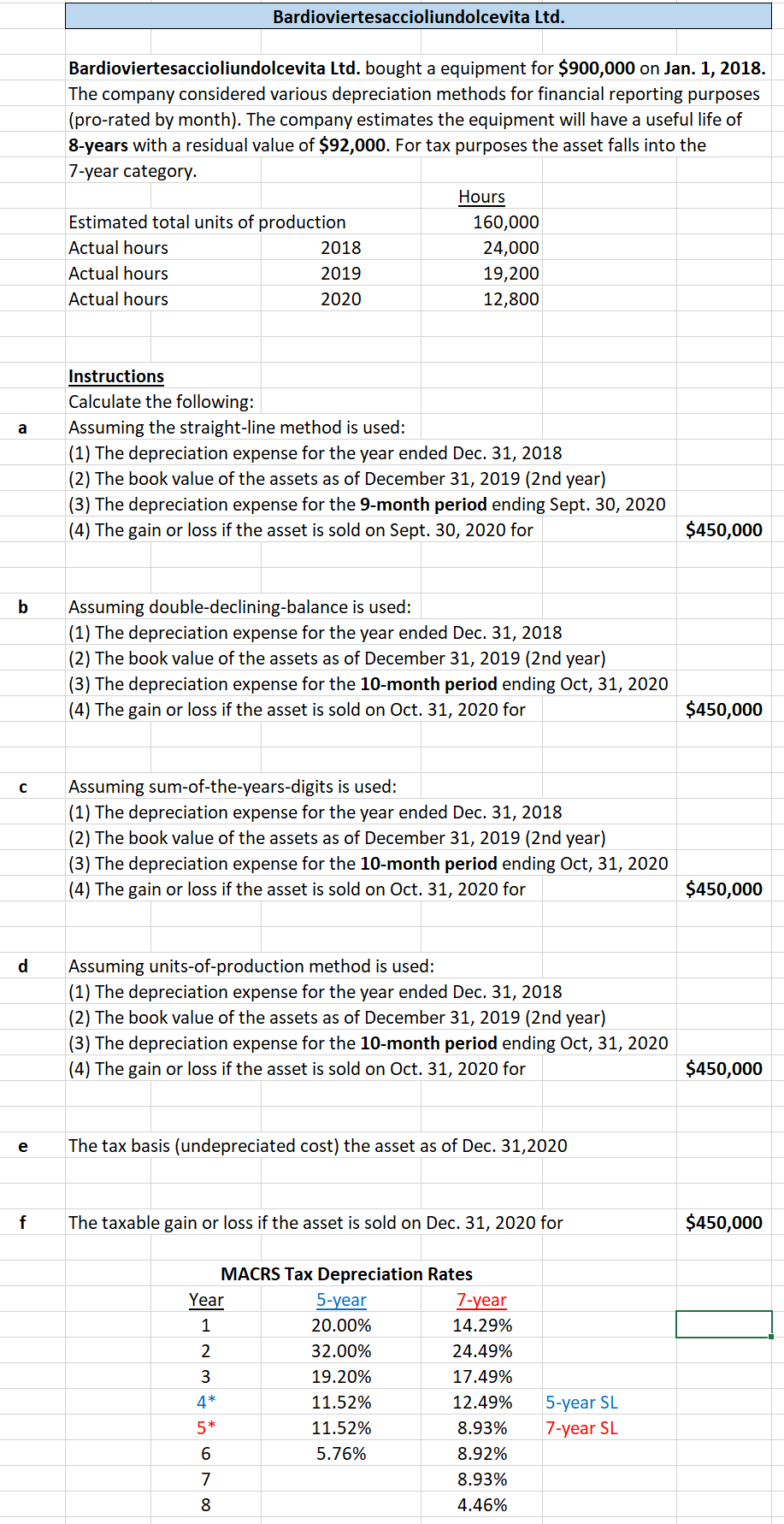

Bardioviertesaccioliundolcevita Ltd. Bardioviertesaccioliundolcevita Ltd. bought a equipment for $900,000 on Jan. 1, 2018. The company considered various depreciation methods for financial reporting purposes (pro-rated by month). The company estimates the equipment will have a useful life of 8-years with a residual value of $92,000. For tax purposes the asset falls into the 7-year category. Hours Estimated total units of production 160,000 Actual hours 2018 24,000 Actual hours 2019 19,200 Actual hours 2020 12,800 Instructions Calculate the following: Assuming the straight-line method is used: (1) The depreciation expense for the year ended Dec. 31, 2018 (2) The book value of the assets as of December 31, 2019 (2nd year) (3) The depreciation expense for the 9-month period ending Sept. 30, 2020 (4) The gain or loss if the asset is sold on Sept. 30, 2020 for $450,000 Assuming double-declining-balance is used: (1) The depreciation expense for the year ended Dec. 31, 2018 (2) The book value of the assets as of December 31, 2019 (2nd year) (3) The depreciation expense for the 10-month period ending Oct, 31, 2020 (4) The gain or loss if the asset is sold on Oct. 31, 2020 for $450,000 Assuming sum-of-the-years-digits is used: (1) The depreciation expense for the year ended Dec. 31, 2018 (2) The book value of the assets as of December 31, 2019 (2nd year) (3) The depreciation expense for the 10-month period ending Oct, 31, 2020 (4) The gain or loss if the asset is sold on Oct. 31, 2020 for $450,000 Assuming units-of-production method is used: (1) The depreciation expense for the year ended Dec. 31, 2018 (2) The book value of the assets as of December 31, 2019 (2nd year) (3) The depreciation expense for the 10-month period ending Oct, 31, 2020 (4) The gain or loss if the asset is sold on Oct. 31, 2020 for $450,000 e The tax basis (undepreciated cost) the asset as of Dec. 31,2020 f The taxable gain or loss if the asset is sold on Dec. 31, 2020 for $450,000 Year nm * to ono MACRS Tax Depreciation Rates 5-year 7-year 20.00% 14.29% 32.00% 24.49% 19.20% 17.49% 11.52% 12.49% 11.52% 8.93% 5.76% 8.92% 8.93% 4.46% 5-year SL 7-year SLStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started