Answered step by step

Verified Expert Solution

Question

1 Approved Answer

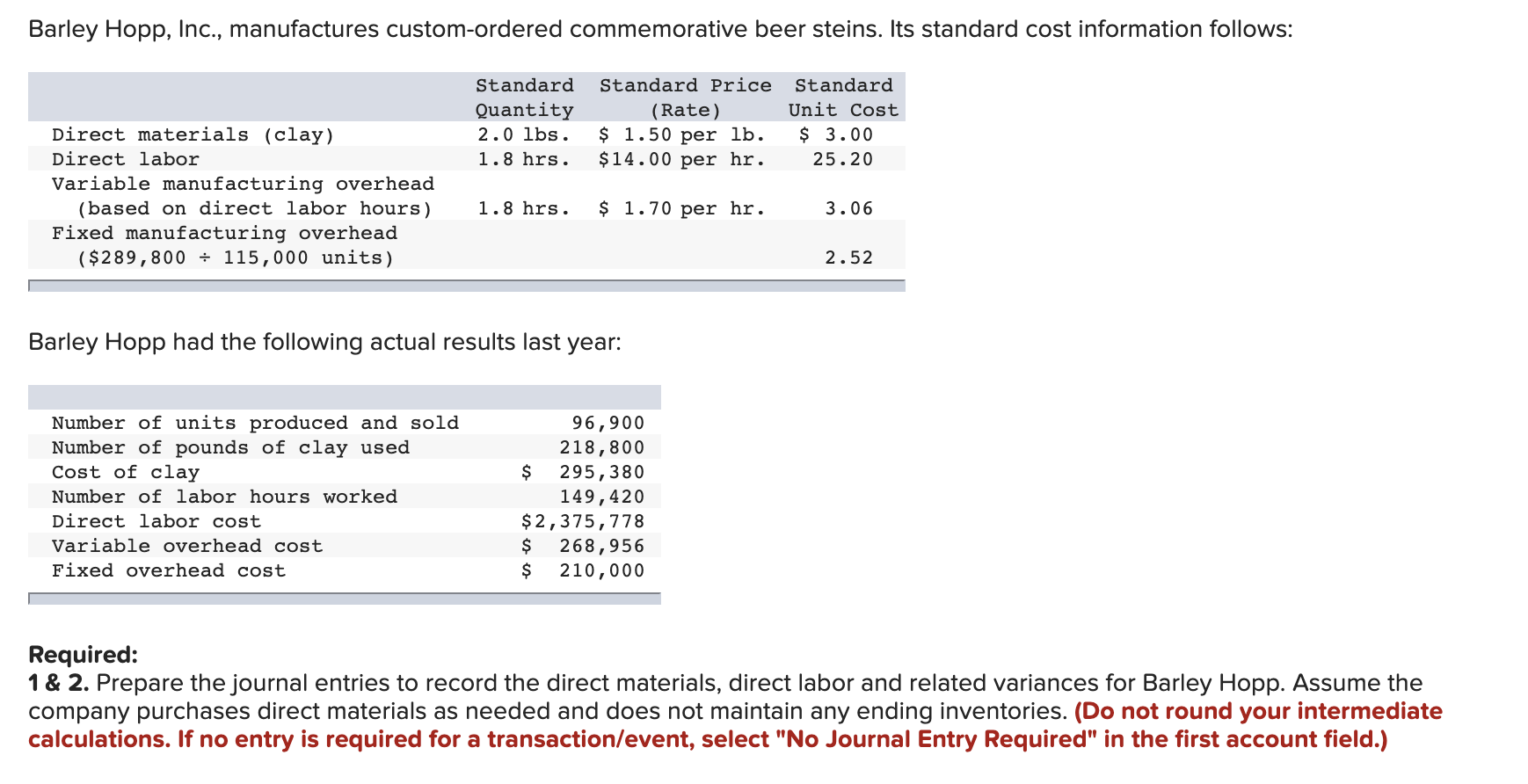

Barley Hopp, Inc., manufactures custom-ordered commemorative beer steins. Its standard cost information follows: Standard Standard Price Standard Quantity Unit Cost (Rate) $ 1.50 per

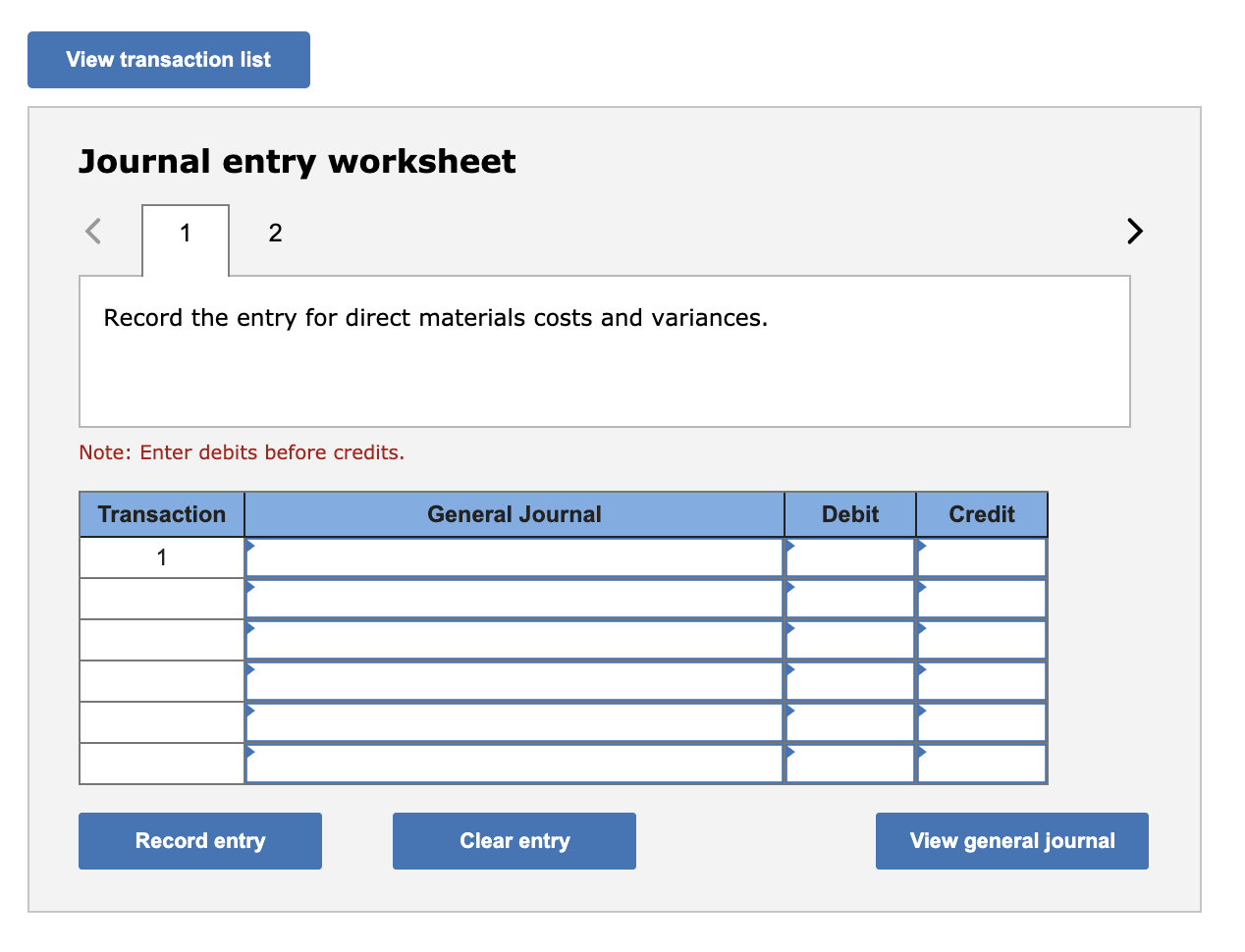

Barley Hopp, Inc., manufactures custom-ordered commemorative beer steins. Its standard cost information follows: Standard Standard Price Standard Quantity Unit Cost (Rate) $ 1.50 per lb. $14.00 per hr. Direct materials (clay) 2.0 lbs. $ 3.00 Direct labor 1.8 hrs. 25.20 Variable manufacturing overhead (based on direct labor hours) Fixed manufacturing overhead ($289,800 115,000 units) 1.8 hrs. $ 1.70 per hr. 3.06 2.52 Barley Hopp had the following actual results last year: Number of units produced and sold Number of pounds of clay used Cost of clay 96,900 218,800 $ 295,380 149,420 $2,375,778 $ Number of labor hours worked Direct labor cost Variable overhead cost 268,956 $ Fixed overhead cost 210,000 Required: 1 & 2. Prepare the journal entries to record the direct materials, direct labor and related variances for Barley Hopp. Assume the company purchases direct materials as needed and does not maintain any ending inventories. (Do not round your intermediate calculations. If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 > Record the entry for direct materials costs and variances. Note: Enter debits before credits. Transaction General Journal Debit Credit 1 Record entry Clear entry View general journal View transaction list Journal entry worksheet 1 2 > Record the entry for direct labor costs and variance. Note: Enter debits before credits. Transaction General Journal Debit Credit 2 Record entry Clear entry View general journal

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entries Date Particulars Debit Credit Materials ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started