Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Barnes & Noble manufactures 3 products (product A, B, and C) using the same production process. The costs incurred up to the split-off point are

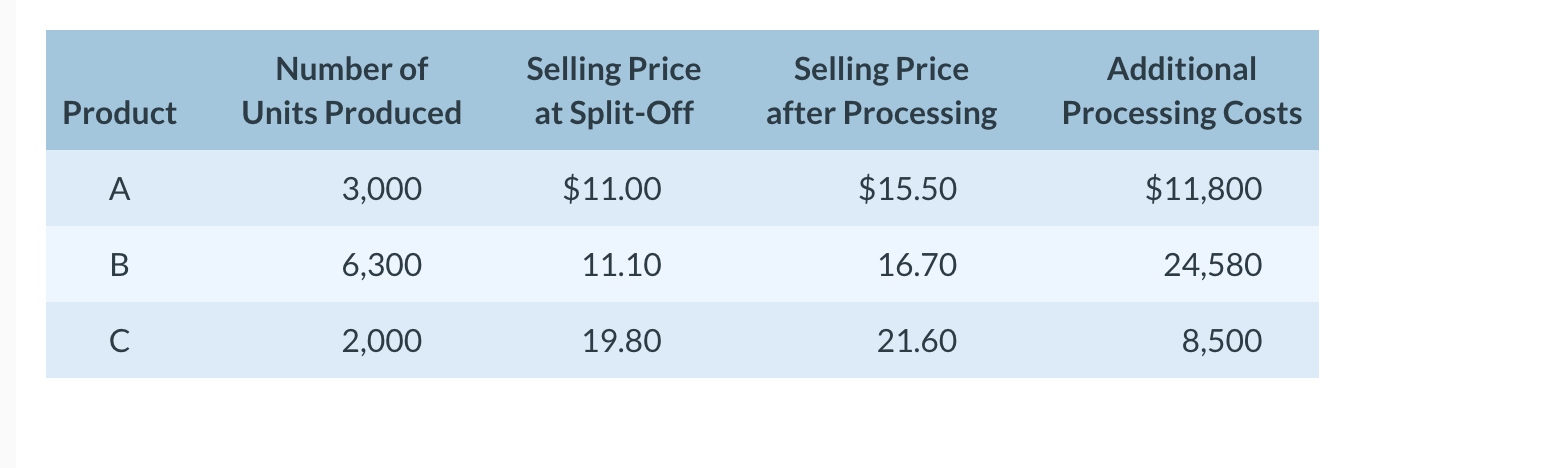

Barnes & Noble manufactures 3 products (product A, B, and C) using the same production process. The costs incurred up to the split-off point are $181,000. These costs are allocated to the products on the basis of their sales value at the split-off point. The number of units produced, the selling prices per unit of the 3 products at the split-off point and after further processing, and the additional processing costs are as follows:

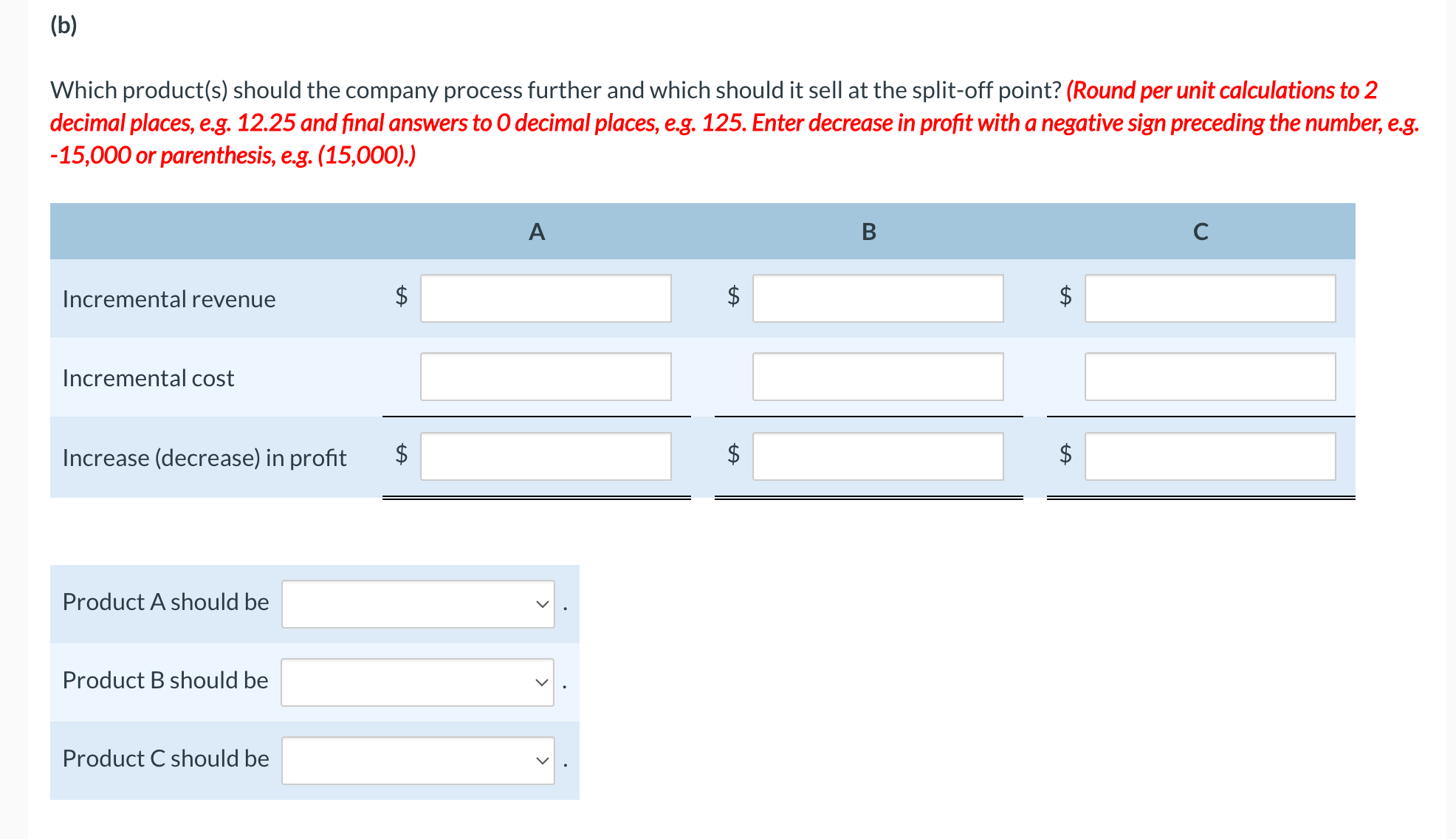

\begin{tabular}{ccccc|} Product & \begin{tabular}{c} Number of \\ Units Produced \end{tabular} & \begin{tabular}{c} Selling Price \\ at Split-Off \end{tabular} & \begin{tabular}{c} Selling Price \\ after Processing \end{tabular} & \begin{tabular}{c} Additional \\ Processing Costs \end{tabular} \\ \hline A & 3,000 & $11.00 & $15.50 & $11,800 \\ B & 6,300 & 11.10 & 16.70 & 24,580 \\ C & 2,000 & 19.80 & 21.60 & 8,500 \\ \hline \end{tabular} Which product(s) should the company process further and which should it sell at the split-off point? (Round per unit calculations to 2 decimal places, e.g. 12.25 and final answers to 0 decimal places, e.g. 125. Enter decrease in profit with a negative sign preceding the number, e.g. 15,000 or parenthesis, e.g. (15,000).) Product A should be Product B should be Product C should be

\begin{tabular}{ccccc|} Product & \begin{tabular}{c} Number of \\ Units Produced \end{tabular} & \begin{tabular}{c} Selling Price \\ at Split-Off \end{tabular} & \begin{tabular}{c} Selling Price \\ after Processing \end{tabular} & \begin{tabular}{c} Additional \\ Processing Costs \end{tabular} \\ \hline A & 3,000 & $11.00 & $15.50 & $11,800 \\ B & 6,300 & 11.10 & 16.70 & 24,580 \\ C & 2,000 & 19.80 & 21.60 & 8,500 \\ \hline \end{tabular} Which product(s) should the company process further and which should it sell at the split-off point? (Round per unit calculations to 2 decimal places, e.g. 12.25 and final answers to 0 decimal places, e.g. 125. Enter decrease in profit with a negative sign preceding the number, e.g. 15,000 or parenthesis, e.g. (15,000).) Product A should be Product B should be Product C should be Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started