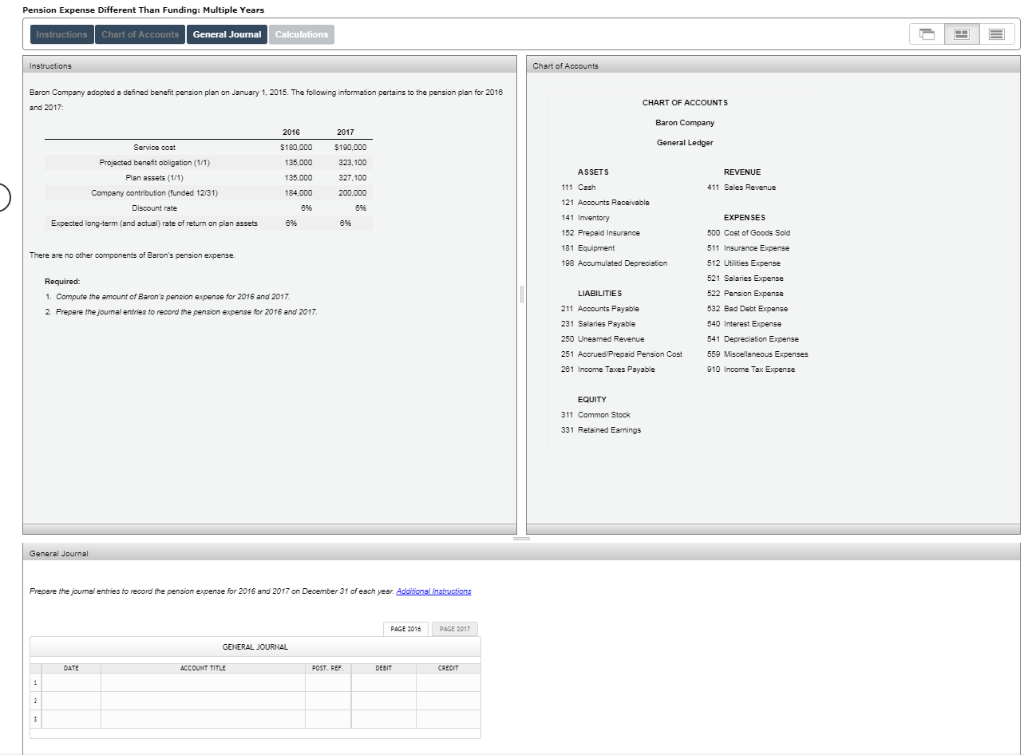

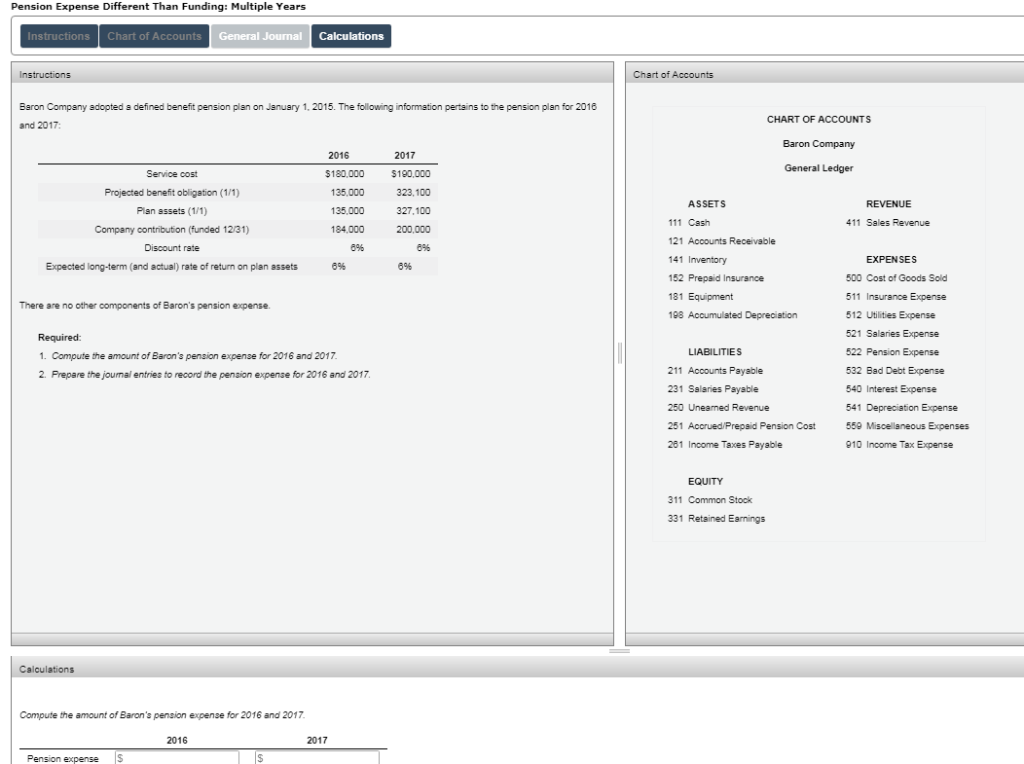

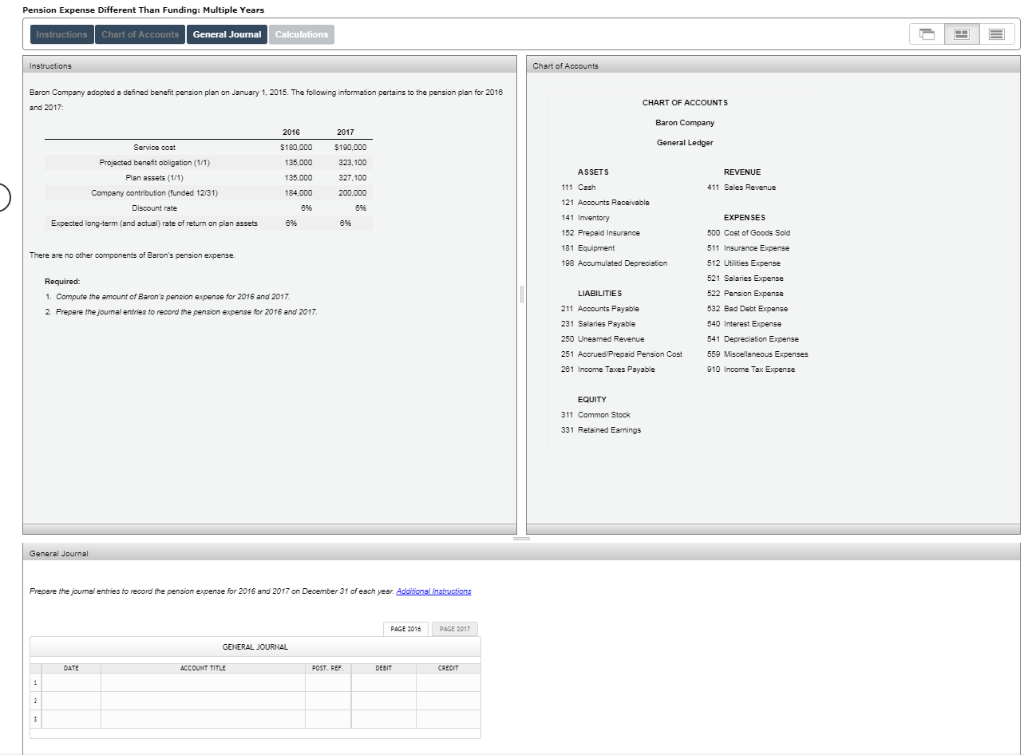

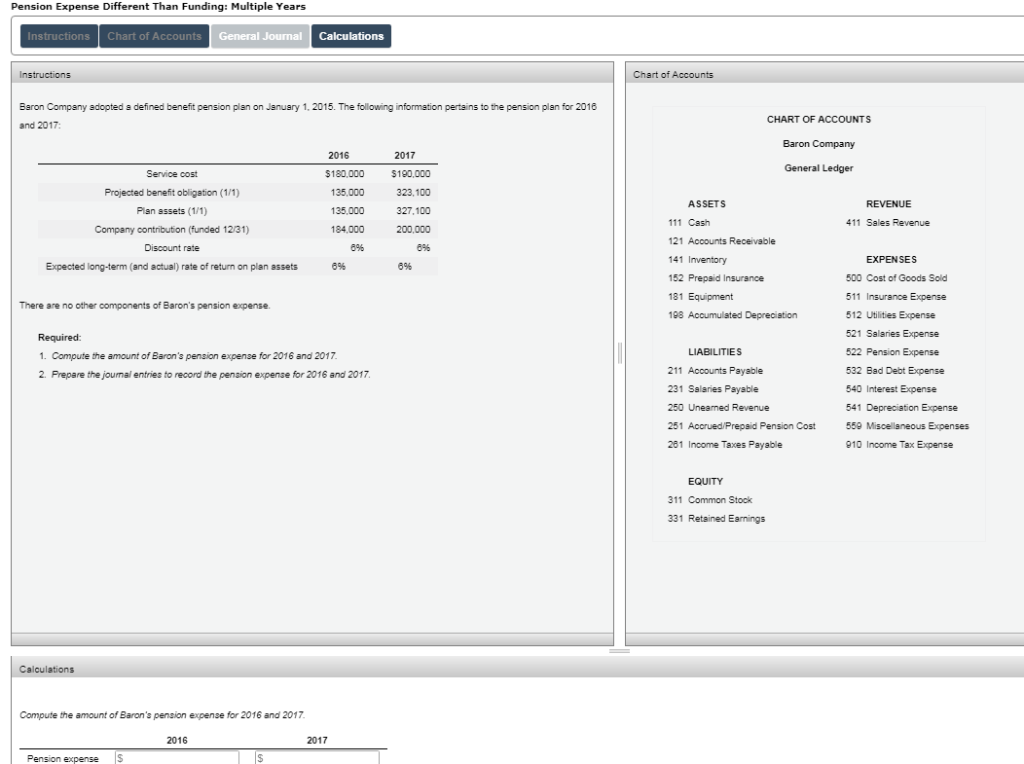

Baron Company adopted a defined benefit pension plan on January 1, 2015. The following information pertains to the pension plan for 2016 and 2017:

| | 2016 | 2017 |

| Service cost | $180,000 | $190,000 |

| Projected benefit obligation (1/1) | 135,000 | 323,100 |

| Plan assets (1/1) | 135,000 | 327,100 |

| Company contribution (funded 12/31) | 184,000 | 200,000 |

| Discount rate | 6% | 6% |

| Expected long-term (and actual) rate of return on plan assets | 6% | 6% |

There are no other components of Barons pension expense.

Required:

| 1. | Compute the amount of Barons pension expense for 2016 and 2017. |

| 2. | Prepare the journal entries to record the pension expense for 2016 and 2017. |

Pension Expense Different Than Funding: Multiple Years Chart of Accounts General Journal Chart of Accounts Baron Company adopted a defined benefit pension plan on January 1, 2015. The following information pertains to the pension plan for 2018 CHART OF ACCOUNTS and 2017 Baron Company 2016 2017 General Ledger Service cost $180,000 $190,000 Projectad baneit obligation (1/1) 135,000 23,100 ASSETS REVENUE Pian assets (1/1) 35.000 327.100 111 Cash 411 Sales Revenue 200.000 Compeny contribution (funded 12/31) 184.000 21 Accounts Recaivablie Discount rate 5% 0% 41 Inventory EXPENSES Expected long-term (and actual) rate of return on plan asets 6% 9% 152 Prepsid Insurence 500 Cost of Goods Soid 181 Equipment 511 Insurance Expense There are no other components of Baron's pension expense. 512 Utilities Expense 521 Salaries Expense Required: LIABILITIES 522 Pansion Expensa 1 Compute the amount of Baron' penaion expene for 2016 and 2017 211 Accounts Payable 32 Bad Dabt Expanse 2 Prepare the joumal entries to record the penaion expense for 2016 and 2017, 40 Interest Expense 231 Selaries Payable 250 Uneamed Reverue 541 Depreciation Expense 251 Accrued Prepaid Pension Cost 559 Mscellaneous Expenses 281 Income Taxes Payable 910 Income Tax Expense EQUITY 311 Common Stock 331 Retsined Earmings General Journal Prepare the journal entries to record the penaion expense for 2016 and 2017 on December 3f ofeach year Addioustions PAGE 2016 PAGE 201 GENERAL JOURNAL DATE ACCOUNT TITLE POST, RE DEsit Pension Expense Different Than Funding: Multiple Years Instructions Chart of Accounts General Journal Calculations Chart of Accounts Instructions Baron Company adopted a defined benefit pension plan on January 1, 2015. The following information pertains to the pension plan for 2016 CHART OF ACCOUNTS and 2017 Baron Company 2016 2017 General Ledger Service cost $180,000 190,000 Projected benefit obligation (1/1) 135.000 323,100 REVENUE ASSETS Plan sssets (1/1) 135.000 327.100 111 Cash 411 Sales Revenue 184.000 Company contribution (funded 12/31) 200.000 121 Accounts Receivable Discount rate 896 5% 141 Inventory EXPENSES Expected long-term (and actual) rate of return on plan assets 5% 696 152 Prepsid Insurance 500 Cost of Goods Sold 511 Insurance Expense 181 Equipment There are no other components of Baron's pension expense. 512 Utilities Expense 521 Salaries Expense Required: LIABILITIES 522 Pension Expense 1. Compute the amount of Baron's pension expense for 2016 and 2017 211 Accounts Payable 532 Bad Debt Expense 2. Prepare the journal entries to record the pension expense for 2016 and 2017. 231 Salaries Payable 540 Interest Expense 250 Uneamed Revenue 541 Depreciation Expense 251 AccruediPrepaid Pension Cost 559 Miscel laneous Expenses 281 Income Taxes Payable 910 Income Tax Expense EQUITY 311 Common Stock 331 Retained Earnings Calculations Compute the amount of Baron's pension expense for 2016 and 2017 2016 2017 Pension expenseS