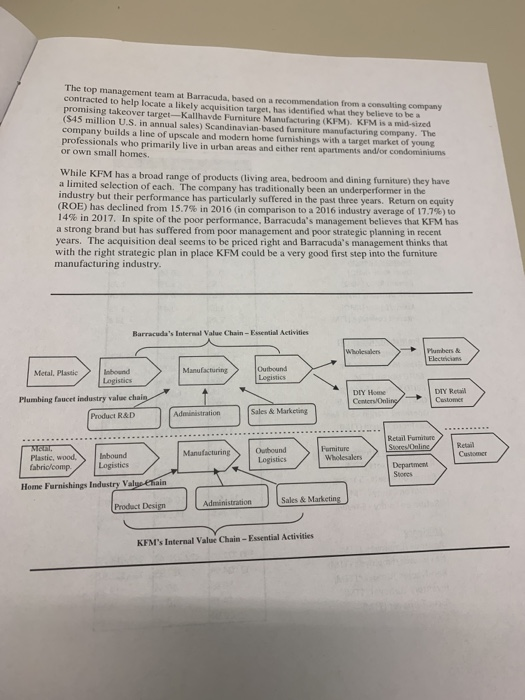

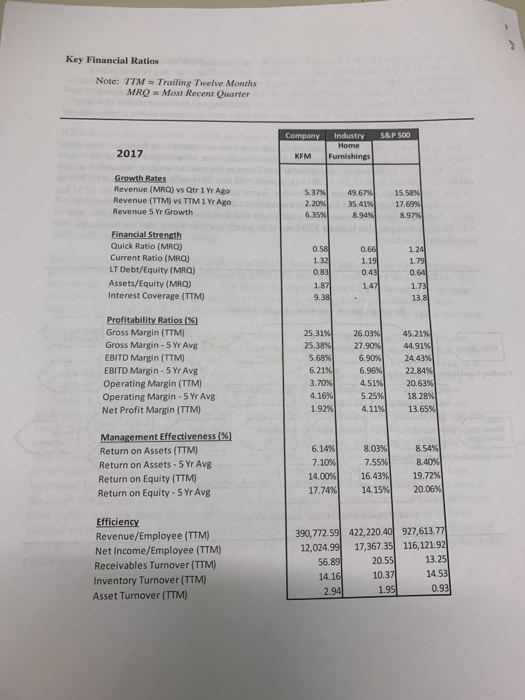

Barracuda, Inc. Considers Acquisition of KFM Barracuda, Inc. has diversified beyond its early base as a lamp fixture hardware and plumbing fixture products that it sells to professionals (i.e. plum manufacturer into multiple electricians) and through the large volume do-it-yourself (DIY) stores like The Home Lowe's. , the While Barracuda's successful growth has been achieved primarily through acquisition company tends to let the acquired businesses run independently. It has done so by looking t fragmented industries to acquire small firms with efficient operations and good management teams. It then grows these businesses through a combination of internal cash flow and debt, and directs new sales to the professional and DIY channels Barracuda has been particularly successful in the faucet segment, which it practically reinvented though such technological innovations as the washerless faucet and marketing innovations like branding and good-better-best merchandising. The company primarily employs a broad differentiation business-level strategy Barracuda has leveraged its merchandising across its businesses and, coupled with the explosive growth of the DIY channel, is spectacularly profitable with a net profit after tax (NPAT) of 18% and average ROE ofjust above 30%. The firm's management is looking to broaden its revenue base and has identified the home furnishings business as sharing many characteristics with faucets, prior to Barracuda's entry into faucets. It plans to enter this industry through acquisitions. The landscape of the U.S. home furnishings manufacturing industry consists of many players, none with controlling share, and serious issues of overcapacity. There are presently 2,500 home furnishings firms, and only 600 of those have over 15 employees. Average NPAT is between 4 and 5%, which also reflects the fact that few firms have good managers, while the industry is still primarily comprised of single-business family-run firms, which manufacture furnitune domestically, imports are increasing at a fairly rapid rate. Some of the European imports are leaders in contemporary design. Relatively large established firms are also diversifying into the home furnishings industry via acquisition. Supplier firms to the home furnishings industry are in relatively concentrated industries (like lumber, steel, and textiles), and therefore typically offer little accommodations to the small furniture manufacturers. Retailers, the intermediate customer of the home furnishings industry, are becoming increasingly concentrated and the few large, successful furniture companies actually have their own stores or have dedicated showrooms in the larger department stores. Customers have many products to choose from, at many different price points, and few home furnishing products beyond those of the larger companies have established brands. Also, customers can swiich easily among high and low-priced furniture and poning any furniture other discretionary expenditures (spanning plasma TVs to the choice of post purchase entirely) The top management team at Barracuda, based on a recommendation from a consalting company contracted to help locate a likely acquisition target, has identified what they believe to be a promising takeover target-Kallhavde Furniture Manufacturing (KPM), KFM is a mid-sized ($45 million U.S. in annual sales) Scandinavian-based furniture manufacturing company. The company builds a line of upscale and modern home furnishings with a target market of young professionals who primarily live in urban areas and either rent apartments and/or condominiums or own small homes has a broad range of products (living area, bedroom and dining furniture) they have a limited selec industry but their performance has particularly suffered in the past three years. Return on equity (ROE) 14% in 2017' In spite of the poor performance. Barracuda's management believes that KFM has a strong brand but has suffered from poor management and poor strategic planning in recent years. The acquisition deal seems to be priced right and Barracuda's management thinks that with the right strategic plan in place KFM could be a very good first step into the furniture tion of each. The company has traditionally been an underperformer in the has declined frorn l 5.7% in 2016 (in comparison to a 2016 industry average of 17.7%) to manufacturing industry Barracuda's Internal Value Chain- Essential Activities WholesalersMumbers & Outbound Logistics Manufacturing nbound Metal. Plastie DTY Retail Plumbing faucet industry value cha Sales & Marketing Product R&D Retail Fuituail Funiture Outbound Logistics Manufacturing Cussoener Plastic, wood, fabric/comp Wholesalers Logisties Stores Home Furnishings Industry Valpeain Sales & Marketing Administration Prodact KFM's Internal Value Chain-Essential Activities Key Financial Ratios Note: TTM = Trailing Twelve Months MRO Most Recent Quarter Company Industry S&P 500 2017 KFM Furnishings Growth Rates Revenue (MRQ) vs Qtr 1 Yr Ago Revenue (TTM) Vs TTM 1 Yr Ago Revenue 5 Yr Growth 537% 49. 67% 35.41%| 8.94% 2.20%| 17.69% 8.97% Quick Ratio (MRQ) Current Ratio (MRQ) LT Debt/Equity (MRQ) Assets/Equity (MRQ) Interest Coverage (TTM) 1.4 9.3 13. Profitability Ratios(%) Gross Margin (TTM) 25.31% 25.38% 26.03%| 27,90% 45.21% 4491% 24.43% 22.84% 20.63% 18.28% 13.65% Gross Margin- 5 Yr Avg EBITD Margin (TTM) 6.21% EBITD Margin-5Yr Avg Operating Margin (TTM) 6.96% 451%) 416% 1.92% Operating Margin-5Yr Avg 4.11%| Net Profit Margin (TTM) ManagementEffectiveness (%) Return on Assets (TTM) Return on Assets-5 Yr Avg Return on Equity (TTM) Return on Equity-5 Yr Avg 614% 7.10% 14.00% 17.74%| 8.03% 840% 19.72% 20.06% 16.43% 14.15% Efficiency 30,772.59 422,220.40 927,613.77 12,024.99 17,367.35 116,121.92 Revenue/Employee (TTM) Net Income/Employee (TTM) 13. 14.53 20. 10.3 56. Receivables Turnover (TTM) Inventory Turnover (TTM) 1.95 Asset Turnover (TTM) 52. Is the furniture industry an attractive industry for Barracuda to invest? Why or why no Support your analysis using information from the case and external analysis frameworks, including Porter's Five Forces Analysis, as discussed in this course. 15 points) (Question counts Barracuda, Inc. Considers Acquisition of KFM Barracuda, Inc. has diversified beyond its early base as a lamp fixture hardware and plumbing fixture products that it sells to professionals (i.e. plum manufacturer into multiple electricians) and through the large volume do-it-yourself (DIY) stores like The Home Lowe's. , the While Barracuda's successful growth has been achieved primarily through acquisition company tends to let the acquired businesses run independently. It has done so by looking t fragmented industries to acquire small firms with efficient operations and good management teams. It then grows these businesses through a combination of internal cash flow and debt, and directs new sales to the professional and DIY channels Barracuda has been particularly successful in the faucet segment, which it practically reinvented though such technological innovations as the washerless faucet and marketing innovations like branding and good-better-best merchandising. The company primarily employs a broad differentiation business-level strategy Barracuda has leveraged its merchandising across its businesses and, coupled with the explosive growth of the DIY channel, is spectacularly profitable with a net profit after tax (NPAT) of 18% and average ROE ofjust above 30%. The firm's management is looking to broaden its revenue base and has identified the home furnishings business as sharing many characteristics with faucets, prior to Barracuda's entry into faucets. It plans to enter this industry through acquisitions. The landscape of the U.S. home furnishings manufacturing industry consists of many players, none with controlling share, and serious issues of overcapacity. There are presently 2,500 home furnishings firms, and only 600 of those have over 15 employees. Average NPAT is between 4 and 5%, which also reflects the fact that few firms have good managers, while the industry is still primarily comprised of single-business family-run firms, which manufacture furnitune domestically, imports are increasing at a fairly rapid rate. Some of the European imports are leaders in contemporary design. Relatively large established firms are also diversifying into the home furnishings industry via acquisition. Supplier firms to the home furnishings industry are in relatively concentrated industries (like lumber, steel, and textiles), and therefore typically offer little accommodations to the small furniture manufacturers. Retailers, the intermediate customer of the home furnishings industry, are becoming increasingly concentrated and the few large, successful furniture companies actually have their own stores or have dedicated showrooms in the larger department stores. Customers have many products to choose from, at many different price points, and few home furnishing products beyond those of the larger companies have established brands. Also, customers can swiich easily among high and low-priced furniture and poning any furniture other discretionary expenditures (spanning plasma TVs to the choice of post purchase entirely) The top management team at Barracuda, based on a recommendation from a consalting company contracted to help locate a likely acquisition target, has identified what they believe to be a promising takeover target-Kallhavde Furniture Manufacturing (KPM), KFM is a mid-sized ($45 million U.S. in annual sales) Scandinavian-based furniture manufacturing company. The company builds a line of upscale and modern home furnishings with a target market of young professionals who primarily live in urban areas and either rent apartments and/or condominiums or own small homes has a broad range of products (living area, bedroom and dining furniture) they have a limited selec industry but their performance has particularly suffered in the past three years. Return on equity (ROE) 14% in 2017' In spite of the poor performance. Barracuda's management believes that KFM has a strong brand but has suffered from poor management and poor strategic planning in recent years. The acquisition deal seems to be priced right and Barracuda's management thinks that with the right strategic plan in place KFM could be a very good first step into the furniture tion of each. The company has traditionally been an underperformer in the has declined frorn l 5.7% in 2016 (in comparison to a 2016 industry average of 17.7%) to manufacturing industry Barracuda's Internal Value Chain- Essential Activities WholesalersMumbers & Outbound Logistics Manufacturing nbound Metal. Plastie DTY Retail Plumbing faucet industry value cha Sales & Marketing Product R&D Retail Fuituail Funiture Outbound Logistics Manufacturing Cussoener Plastic, wood, fabric/comp Wholesalers Logisties Stores Home Furnishings Industry Valpeain Sales & Marketing Administration Prodact KFM's Internal Value Chain-Essential Activities Key Financial Ratios Note: TTM = Trailing Twelve Months MRO Most Recent Quarter Company Industry S&P 500 2017 KFM Furnishings Growth Rates Revenue (MRQ) vs Qtr 1 Yr Ago Revenue (TTM) Vs TTM 1 Yr Ago Revenue 5 Yr Growth 537% 49. 67% 35.41%| 8.94% 2.20%| 17.69% 8.97% Quick Ratio (MRQ) Current Ratio (MRQ) LT Debt/Equity (MRQ) Assets/Equity (MRQ) Interest Coverage (TTM) 1.4 9.3 13. Profitability Ratios(%) Gross Margin (TTM) 25.31% 25.38% 26.03%| 27,90% 45.21% 4491% 24.43% 22.84% 20.63% 18.28% 13.65% Gross Margin- 5 Yr Avg EBITD Margin (TTM) 6.21% EBITD Margin-5Yr Avg Operating Margin (TTM) 6.96% 451%) 416% 1.92% Operating Margin-5Yr Avg 4.11%| Net Profit Margin (TTM) ManagementEffectiveness (%) Return on Assets (TTM) Return on Assets-5 Yr Avg Return on Equity (TTM) Return on Equity-5 Yr Avg 614% 7.10% 14.00% 17.74%| 8.03% 840% 19.72% 20.06% 16.43% 14.15% Efficiency 30,772.59 422,220.40 927,613.77 12,024.99 17,367.35 116,121.92 Revenue/Employee (TTM) Net Income/Employee (TTM) 13. 14.53 20. 10.3 56. Receivables Turnover (TTM) Inventory Turnover (TTM) 1.95 Asset Turnover (TTM) 52. Is the furniture industry an attractive industry for Barracuda to invest? Why or why no Support your analysis using information from the case and external analysis frameworks, including Porter's Five Forces Analysis, as discussed in this course. 15 points) (Question counts