Question

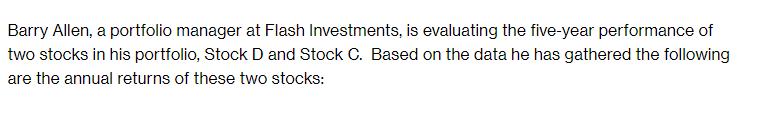

Barry Allen, a portfolio manager at Flash Investments, is evaluating the five-year performance of two stocks in his portfolio, Stock D and Stock C.

Barry Allen, a portfolio manager at Flash Investments, is evaluating the five-year performance of two stocks in his portfolio, Stock D and Stock C. Based on the data he has gathered the following are the annual returns of these two stocks: Year 2016 2017 2018 2019 2020 D 19% 12% -4% 10% 18% C -4% 20% 30% -8% 20% The geometric average return of Stock D and the variance of stock C are closest to:

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Lets calculate the portfolio variance for each case For a portfolio of 5 shares Portfolio Variance W...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Supply Chain Management A Balanced Approach

Authors: Joel D. Wisner, Keah Choon Tan, G. Keong Leong

5th edition

1337406499, 133740649X, 9781337672016 , 978-1337406499

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App