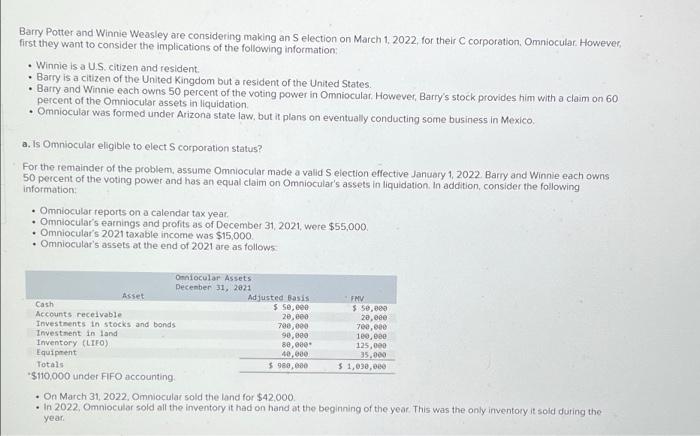

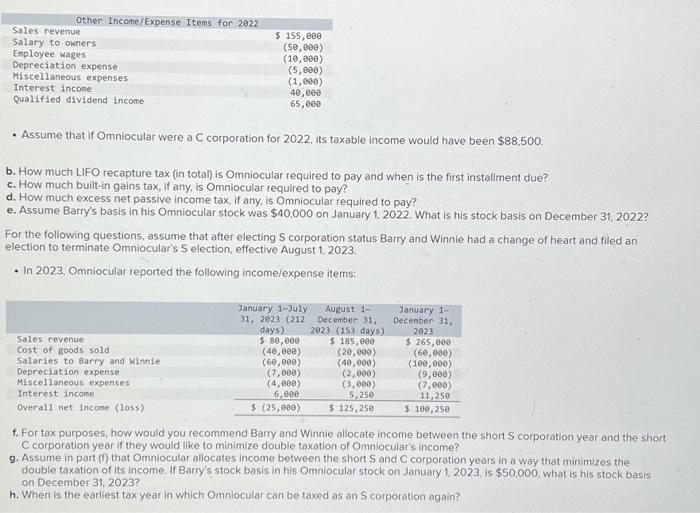

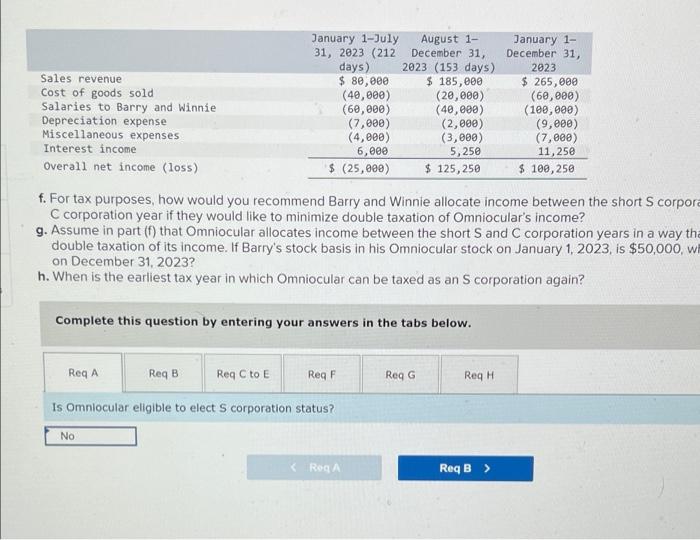

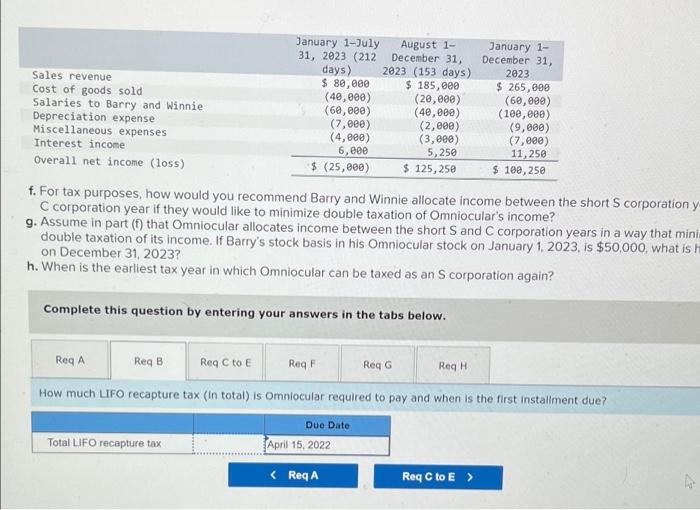

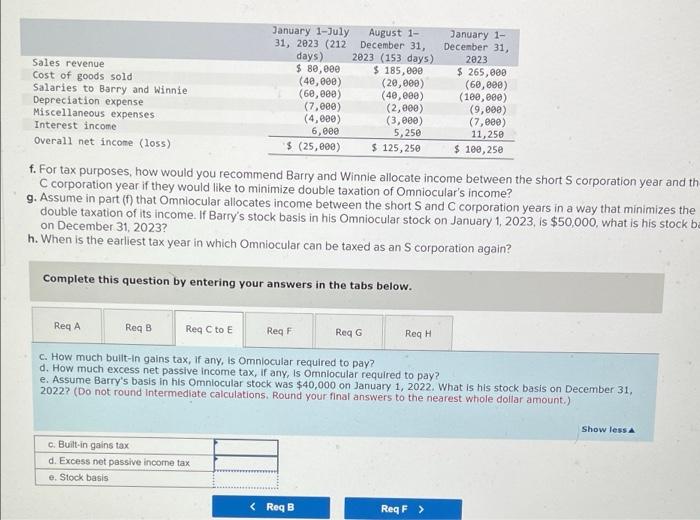

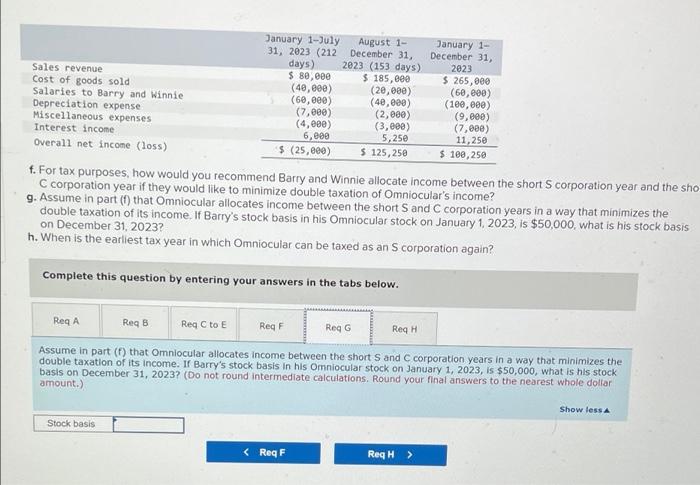

Barry Potter and Winnie Weasley are considering making an Selection on March 1, 2022 for their corporation. Omniocular. However, first they want to consider the implications of the following information Winnie is a U.S. citizen and resident Barry is a citizen of the United Kingdom but a resident of the United States. Barry and Winnie each owns 50 percent of the voting power in Omniocular. However, Barry's stock provides him with a claim on 60 percent of the Omniocular assets in liquidation Omniocular was formed under Arizona state law, but it plans on eventually conducting some business in Mexico a. Is Omniocular eligible to electS corporation status? For the remainder of the problem, assume Omniocular made a valid Selection effective January 1, 2022 Barry and Winnie each owns 50 percent of the voting power and has an equal claim on Omniocular's assets in liquidation. In addition, consider the following information: Omniocular reports on a calendar tax yeat. Omniocular's earnings and profits as of December 31, 2021, were $55,000 Omniocular's 2021 taxable income was $15,000 Omniocular's assets at the end of 2021 are as follows FNV Onniocular Assets December 31, 2021 Asset Adjusted basis Cash $ 50,000 $ 50,00 Accounts receivable ze een 20,000 Investments in stocks and bonds 700,000 700,000 Investment in land 90,000 180, eee Inventory (LEO) 80,000 125,000 Equipment 40,000 35.000 Totals $ 980,000 $ 1,030,000 $110,000 under FIFO accounting . On March 31, 2022. Omniocular sold the land for $42.000 In 2022, Omniocular sold all the inventory it had on hand at the beginning of the year. This was the only inventory it sold during the year Other Income/Expense Items for 2022 Sales revenue Salary to owners Employee wages Depreciation expense Miscellaneous expenses Interest income Qualified dividend income $ 155,000 (50,000) (10,000) (5,000) (1,000) 40,000 65, eee Assume that if Omniocular were a C corporation for 2022. its taxable income would have been $88,500 b. How much LIFO recapture tax (in total) is Omniocular required to pay and when is the first installment due? c. How much built-in gains tax, if any, is Omniocular required to pay? d. How much excess net passive Income tax, if any, is Omniocular required to pay? e. Assume Barry's basis in his Omniocular stock was $40,000 on January 1 2022. What is his stock basis on December 31, 2022? For the following questions, assume that after electing S corporation status Barry and Winnie had a change of heart and filed an election to terminate Omniocular's Selection, effective August 1, 2023. In 2023. Omniocular reported the following income/expense items Sales revenue Cost of goods sold Salaries to Barry and Winnie Depreciation expense Miscellaneous expenses Interest income Overall net income (loss) January 1-July August 1- 31, 2023 (212 December 31, days) 2023 (153 days) $ 80, eee $ 185,000 (40,000) (20.000) (60,000) (40,000) (7,000) (2,880) (4.00) (3,000) 6,000 5,25e $ (25,000) $ 125,250 January 1- December 31, 2023 $ 265,000 (60,000) (100,000) (9,000) (7,000) 11,250 $ 100,250 f. For tax purposes, how would you recommend Barry and Winnie allocate income between the short corp tion year and the short C corporation year if they would like to minimize double taxation of Omniocular's income? g. Assume in part (1) that Omniocular allocates income between the shorts and corporation years in a way that minimizes the double taxation of its Income. If Barry's stock basis in his Omnlocular stock on January 1, 2023, is $50,000, what is his stock basis on December 31, 2023? h. When is the earliest tax year in which Omniocular can be taxed as an Scorporation again? Sales revenue Cost of goods sold Salaries to Barry and Winnie Depreciation expense Miscellaneous expenses Interest income Overall net income (loss) January 1-July August 1- 31, 2023 (212 December 31, days) 2023 (153 days) $ 80,000 $ 185,000 (40,000) (20,000) (60,000) (40,000) (7,000) (2,000) (4,000) (3,000) 6,000 5,250 $ 125,000) $ 125,250 January 1- December 31, 2023 $ 265,000 (60,000) (100,000) (9 , ) . (7,000) 11,25e $ 100,250 f. For tax purposes, how would you recommend Barry and Winnle allocate income between the short corpora C corporation year if they would like to minimize double taxation of Omniocular's income? g. Assume in part (f) that Omniocular allocates income between the shorts and C corporation years in a way tha double taxation of its income. If Barry's stock basis in his Omniocular stock on January 1, 2023, is $50,000, w on December 31, 2023? h. When is the earliest tax year in which Omniocular can be taxed as an Scorporation again? Complete this question by entering your answers in the tabs below. ReqA Reg B Reg C to E Reg F Reg G Reg H Is Omniocular eligible to elect S corporation status? No KROGA ReqB > Sales revenue Cost of goods sold Salaries to Barry and Winnie Depreciation expense Miscellaneous expenses Interest income overall net income (loss) January 1-July August 1- 31, 2023 (212 December 31, days) 2023 (153 days) $ 80,000 $ 185,000 (40,000) (2 , ) (6 , ) (40,000) ( 7 , ) (2,000) (4,000) (3,000) 6, eee 5,250 $ (25,000) $ 125, 250 January 12 December 31, 2023 $ 265,000 (60,000) (1ee, eee) (9,600 (7,000) 11,250 $ 100,250 f. For tax purposes, how would you recommend Barry and Winnie allocate income between the short s corporation y C corporation year if they would like to minimize double taxation of Omniocular's income? g. Assume in part (f) that Omniocular allocates income between the shorts and C corporation years in a way that mini double taxation of its income. If Barry's stock basis in his Omniocular stock on January 1, 2023, is $50,000, what is h on December 31, 2023? h. When is the earliest tax year in which Omniocular can be taxed as an S corporation again? Complete this question by entering your answers in the tabs below. ReqA Req B Reg Cto E ReqF Req Reg H How much LIFO recapture tax (In total) is Omnlocular required to pay and when is the first installment due? Total LIFO recapture tax Due Date April 15, 2022 January 1-July August 1- January 1- 31, 2023 (212 December 31, December 31, days) 2023 (153 days) 2023 Sales revenue $ 80,000 $ 185,699 $ 265,000 Cost of goods sold ( 4 , ) ( 2 , ) (60,800) Salaries to Barry and Winnie (60,000) (40,000) (180,000) Depreciation expense (7,080) (2,800) (9,000) Miscellaneous expenses (4,980) (3,000) (7,880) Interest income 6,000 5,250 11,250 Overall net income (loss) $ 25,000) $ 125,250 $ 100,250 f. For tax purposes, how would you recommend Barry and Winnie allocate income between the shorts corporation year and th C corporation year if they would like to minimize double taxation of Omniocular's income? 9. Assume in part (f) that Omniocular allocates income between the short and C corporation years in a way that minimizes the double taxation of its income. If Barry's stock basis in his Omniocular stock on January 1, 2023, is $50,000, what is his stock ba on December 31, 2023? h. When is the earliest tax year in which Omniocular can be taxed as an S corporation again? a Complete this question by entering your answers in the tabs below. Req A ReqB Reg C to E ReqF Req G ReqH C. How much built-in gains tax, if any, Is Omnlocular required to pay? d. How much excess net passive Income tax, if any, Is Omnlocular required to pay? e. Assume Barry's basis in his Omniocular stock was $40,000 on January 1, 2022. What is his stock basis on December 31, 2022? (Do not round Intermediate calculations. Round your final answers to the nearest whole dollar amount.) Show less c. Built-in gains tax d. Excess net passive income tax e. Stock basis January 1-July August 1- January 1- 31, 2023 (212 December 31, December 31, days) 2023 (153 days) 2023 Sales revenue $ 80,000 $ 185, eee $ 265,000 Cost of goods sold (40, eee) (20,000) (60,000) Salaries to Barry and Winnie (60,000) (40,000) (100,000) Depreciation expense (7,080) (2,000) (9,800) Miscellaneous expenses (4,eee) (3,000) (7,eee) Interest income 6,000 5,250 11,250 Overall net income (loss) $ (25, eee) $ 125,250 $ 100,250 f. For tax purposes, how would you recommend Barry and Winnie allocate income between the shorts corporation year and the sho C corporation year if they would like to minimize double taxation of Omniocular's income? g. Assume in part (f) that Omniocular allocates income between the shorts and C corporation years in a way that minimizes the double taxation of its income. If Barry's stock basis in his Omniocular stock on January 1, 2023, is $50,000, what is his stock basis on December 31, 2023? h. When is the earliest tax year in which Omniocular can be taxed as an S corporation again? Complete this question by entering your answers in the tabs below. Req A Reg B ReqC to E RegF ReqG ReqH Assume in part (1) that Omniocular allocates income between the short S and corporation years in a way that minimizes the double taxation of its income. Ir Barry's stock basis in his Omniocular stock on January 1, 2023, is $50,000, what is his stock basis on December 31, 2023? (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) Show less Stock basis