Answered step by step

Verified Expert Solution

Question

1 Approved Answer

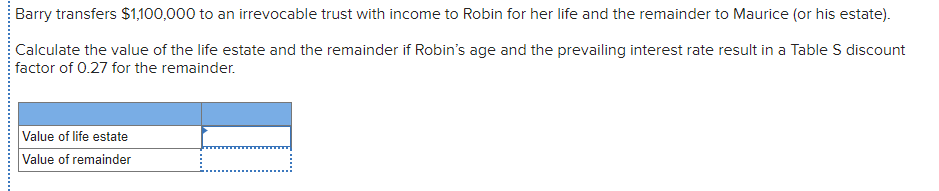

Barry transfers $1,100,000 to an irrevocable trust with income to Robin for her life and the remainder to Maurice (or his estate). Calculate the value

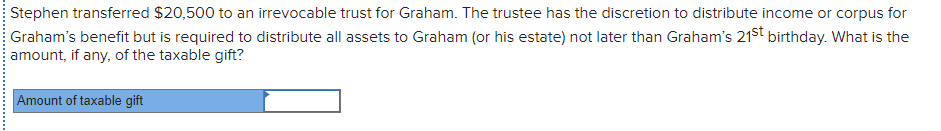

Barry transfers $1,100,000 to an irrevocable trust with income to Robin for her life and the remainder to Maurice (or his estate). Calculate the value of the life estate and the remainder if Robin's age and the prevailing interest rate result in a Table S discount factor of 0.27 for the remainder. Value of life estate Value of remainder Stephen transferred $20,500 to an irrevocable trust for Graham. The trustee has the discretion to distribute income or corpus for Graham's benefit but is required to distribute all assets to Graham (or his estate) not later than Graham's 21st birthday. What is the amount, if any, of the taxable gift? Amount of taxable gift

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started